The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Every person has a unique inflation experience and it changes over time. Energy costs shot up in the pandemic but then fell back, 'shelter' and housing are driven by home ownership status while eating out at restaurants and cafes depends on personal budgets and preferences. Retirees might enjoy earning 5% on their term deposits while borrowers are strained by higher mortgage rates. Taylor Swift concerts around Australia are sold out with packages varying from $349.90 to $1,249.90 ("Additional transaction fees and credit/debit card processing fees may apply.") so there are some things where the cost does not seem to matter. And what's with the 90 cents on each package?

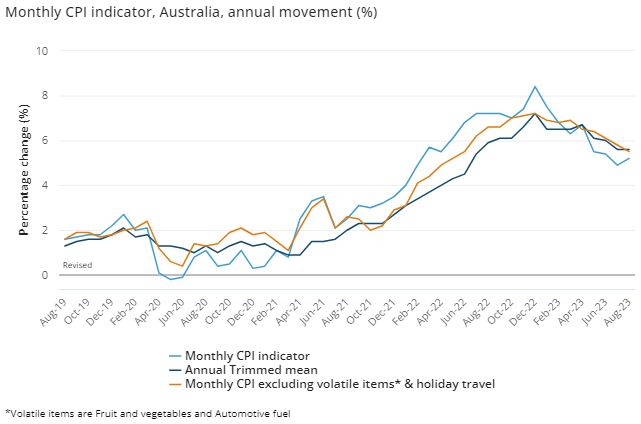

The latest official Australian Bureau of Statistics (ABS) CPI measured as the Annual Trimmed Mean (the Reserve Bank's favourite measure) is at 5.6% for August 2023, with the CPI at 5.2%, up from 4.9% in July. This ABS chart shows inflation, however measured, peaked at 7.5% to 8.5% in December 2022 and has been falling since. Nobody told the long bond rate which remains elevated and cash rate reductions are probably at least a year away.

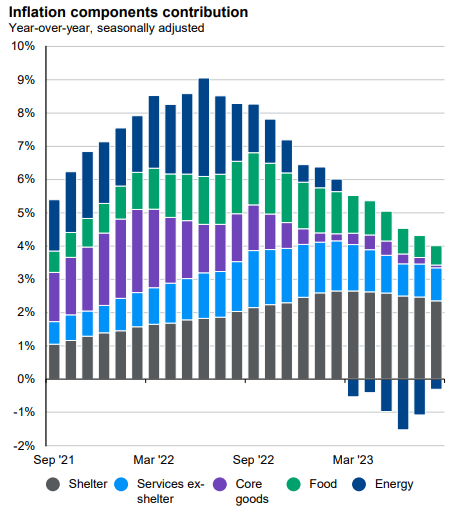

The monthly CPI (excluding volatile items) was not above 5% until May 2022, not yet 18 months ago, and yet it feels like inflation has taken a massive jump in recent years. Here are the major components, and many people would have experienced 7% to 9% or more inflation for at least a couple of years.

Source: BLS, FactSet, J.P. Morgan Asset Management.

Guide to the Markets – Australia. Data as of 30 September 2023

In our Reader Survey of a few short questions, let us know your inflation experience, both overall and anecdotally. Include some unusual or quirky examples of price increases you have noticed, and how you feel your own costs compare with these official yearly numbers. Does it feel like inflation is now under control? Full results published next week.

***

A Treasury review is underway on the new $3 million superannuation tax but with only two weeks for submissions, and the draft legislation showing no practical changes from when the policy was announced in February 2023, it feels like a sham process. Treasury has already received input for six months and done little to amend the most contentious elements. The main complaints are no longer about the need to reduce benefits for people with large amounts in super but the cumbersome and inefficient way the tax will be calculated.

It's notable, however, that the draft legislation does not refer to the $3 million threshold. Rather, it has been replaced by the term 'large superannuation balance', and the policy is now called the 'Division 296 tax law'.

"This Division reduces the concessional tax treatment of superannuation earnings for individuals with total superannuation balances greater than the large superannuation balance threshold at the end of an income year."

While many people are focussed on the lack of indexation in the $3 million amount, the way the legislation is now written opens the way for the amount to be amended easily in future.

So the most objectionable element of the legislation is taxing unrealised gains. My guess is that Treasury did not initially appreciate the can of worms opened until they realised that a person can hold super accounts in many different forms, such as retail, industry and SMSF funds. The only way to tax large super balances is at an individual level, not at a fund level as no fund knows the total balance. And taxing at an individual level based on Total Superannuation Balances includes unrealised gains.

Then the problems began. It is easy to envisage a portfolio where shares and property values rise strongly in one year and deliver a large tax bill on the unrealised gains, but without any income or asset sales. And then the next year, market values fall and there is no tax deduction for a loss.

Peter Burgess of the SMSF Association gives this example of how tax may be more in super than outside super:

"John Smith has a super balance of $3 million in accumulation phase. During the year, investment earnings totalling $80,000 are allocated to his account. Under current arrangements, the fund would pay $12,000 in tax based on the concessional tax rate of 15%. Those same assets, if held by John outside super, would incur a maximum $36,000 in tax (at the maximum 45%).

Let’s assume John’s balance in this super fund appreciated by $800,000 during this income year. There were no contributions or withdrawals for the income year so John’s Total Super Balance at the end of the income year was $3,868,000. Under the government’s proposed tax changes, John would be liable for 15% additional tax on the change in value of his balance above $3 million, resulting in an additional tax bill of $28,644, taking the total tax bill to $40,644.

Since unrealised gains are not taxed on assets held outside the fund, John would pay at least $4,644 more tax than if the assets had been held outside super."

And let's stop calling it a 30% tax. It is a new 15% Division 296 tax calculated completely differently from the usual 15% tax on superannuation, which does not incur any liability for unrealised gains.

***

Stockmarkets are going through a decent bounce back after the selloff on inflation and interest rate fears. In Australia, the S&P/ASX200 is up 6.4% over the last 12 months but that number disguises that all the gain happened at the end of 2022. Calendar 2023 is at best flat because we do not have the big tech winners from AI that the US has experienced.

Source: Morningstar Premium

The NASDAQ shows the big winners, although even here, there has not been much gain since June 2023.

Source: Morningstar Premium

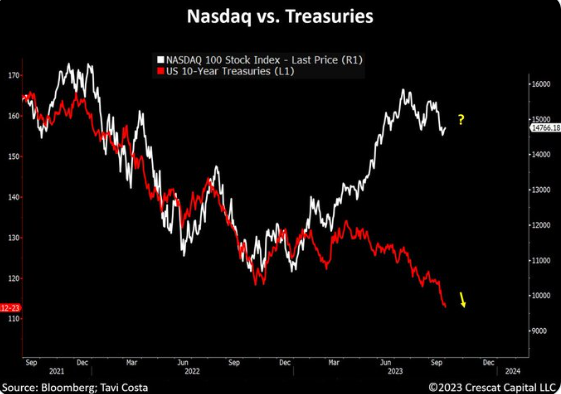

What is most surprising is the disconnect between NASDAQ and the 10-year US Treasury yield. Driven by the dream of universal AI gains, the broken link between rising rates and the NASDAQ index belies traditional market valuations. Tech companies with earnings growth in the future are usually punished as rates rise, as happened in 2022, drawing close correlations between US Treasuries and equities. Now, analysts are looking for what gives first: either US Treasury rates or stocks. Of course, with the massive US deficits to fund, rates may continue rising even if stocks fall. It's a more challenging investing climate than usual.

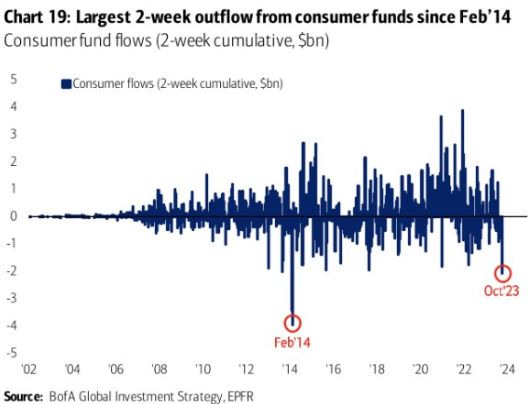

An early sign of the mood is in the Bank of America funds flows data, which show 'consumer' funds experienced their largest two-week outflows since February 2014, double any two-week period during the entire pandemic. Despite the market's strength over 2023, investors are watching for a reason to exit equities.

***

Demographer Bernard Salt recently posted an article on his LinkedIn page asking at what age we are most content. He cited that life expectancy for the average Australian has increased by 15 years since 1950, when not many people lived long in retirement. The Baby Boomers and younger now have completely different expectations, but there was a surprise response to a new question in the 2021 Census. Australians were asked if they suffer from anxiety or depression as advised by a doctor. Says Salt:

"The results showed worrying results for young women in particular and also for the very old and the lonely. But the results also showed a marked diminution in anxiety and depression across a (roughly) 13-year span from 65 to 78.

Here is the happiest, the least worrisome, the most contented stage of the lifecycle. It is a joyous sweet spot. It is a sunny upland in life’s later years. No other decade comes close to this decade for stressless joy when adult kids are finally partnered up, when grandkids arrive, when health matters aren’t dire, when there’s sufficient super for travel.

This is the happiest time in life. The most contented stage of the lifecycle. The best years of life. All this and more lies ahead for the newly retired."

While Salt explains there are of course exceptions, these years should be seen more as an opportunity for "the most carefree years of their lives across the late 60s and most of the 70s." As I've said many times, if you've got money, this is a chance to spend it on yourself and your favourite causes.

Finally, Noel Whittaker was visiting his son in California last week and he sent me this note on his 'epiphany'.

"I have long been sceptical of self-driving cars and having had Teslas for four years I think I know what I’m talking about. I have experienced my Tesla stopping on a freeway because it picked up traffic lights on the road underneath the freeway – I’ve seen it stop at red arrows even though the green light ahead was fine. I’ve seen it ignore speed signs and red lights and slow down in a major road, because some months before there had been a 40 K limit.

Today I had an epiphany. I was in Los Angeles with my son James who bought a Tesla Y four weeks ago and got three months of fully self-driving as part of the package. He lives in Westchester which is just near Los Angeles airport. We got the car to take us to Manhattan Beach and then bring us home again. I was astounded. All he had to do was enter the destination and the car drove us with no assistance from the driver. Manhattan Beach has very steep, narrow streets going down towards the water and it navigated them, including turns, effortlessly."

No doubt it will seem common a decade from now, although unlike in Australia, Teslas are falling quickly in price in the US and a Model Y is now $US3,700 cheaper than the average car with government incentives thrown in.

In my article this week, I look at why so many people who are eligible for tax-free super pensions - including half of all large fund members over 65 (excluding SMSFs) - stay in accumulation funds paying tax. Switching super to pension after the age of 65 and possibly 60 seems an obvious thing to do.

Graham Hand

Also in this week's edition...

The four major asset classes - equities, bonds, cash and property - have experienced a mixed 2023. Bonds have sunk, equities and property have bounced, while cash has offered a decent yield albeit one that still trails inflation. What's the future look like for these asset classes and where is the best place to put your money? Schroders' Sebastian Mullins offers his thoughts.

ASX reporting season focuses on how earnings compare with forecasts, yet there's little mention of how dividends perform versus expectations. A new scorecard from Martin Currie's Reece Birtles aims to rectify this to help income-focused portfolios.

The efficient-market hypothesis taught at business schools proposes that markets are efficient as they effectively and fairly price all available information. Montaka's Andrew Macken isn't convinced and gives recent examples where markets got it wildly wrong. And he thinks they may be wrong again when it comes to Artificial Intelligence and China today.

Neuberger Berman's Niall O'Sullivan has been reading the classics and is keen to apply realpolitik to markets. He says there's more pain to come from higher interest rates and now is the time to be selective, focusing on quality businesses that can sustain their margins. But it's also the time to provide capital and liquidity opportunistically when weaker companies falter.

Big changes are upending the US entertainment industry business, and as we know, almost every piece of US content finds its way here. Loftus Capital's Harry Morrow and Alex Pollak believe the end of the existing Pay TV model is near as dollars flow from traditional to streamed TV.

Two extra articles from Morningstar for the weekend. Nathan Zaia looks at three opportunities in the ASX financial services sector, while James Gruber reports on several ASX small caps with bright futures.

Lastly, in this week's White Paper, Van Eck's outlook for global and Australian markets for the rest of the year concludes that inflation should rise, gold could glow, and puts liquidity and balance sheets in focus.

***

Weekend market update

Friday the 13th spooked investors in the US as the S&P 500 gave back early gains to finish just over half a percent lower. Treasurys caught a strong bid to recoup the bulk of yesterday's selloff, with the long bond dropping eight basis points to 4.78%. Gold leaped 3% to US$1,928 per ounce and WTI crude finished nearly 6% higher to approach US$88 a barrel, as worries about Middle East fighting escalated. The VIX ended north of 19, up nearly three points on the day.

From AAP Netdesk:

The local share market on Friday snapped its six-day winning streak after a hotter-than-expected US inflation report reignited talk of interest rates staying higher for longer. The benchmark S&P/ASX200 index on Friday finished 40 points lower at 7,051, a 0.56% drop. The broader All Ordinaries fell 43.9 points, or 0.6%, to 7,243.5.

Nine of the ASX's 11 sectors finished lower with real estate and tech, which are sensitive to interest rates, both dropping 1.9%.

The heavyweight financial sector fell 0.6%, with losses for all the big retail banks. NAB dropped 0.8% to $29.32, Westpac fell 0.7% to $21.48, and CBA and ANZ both retreated 0.6%, to $100.97 and $25.71 respectively.

In the mining sector, Newcrest gained 0.8% to $26 as shareholders approved its acquisition by US-based goldmining giant Newmont in a $26 billion all-stock transaction set to become legally binding on Wednesday. Newcrest shares will be delisted from the ASX on October 26 and Newmont's New York Stock Exchange-listed shares will begin trading on the local bourse via a CDI the following day.

Elsewhere in the sector, BHP rose 0.4% to $45.01 and Fortescue added 0.7% to $21.47 while Rio Tinto dipped 0.1% to $114.74.

CSL was up 1.3% to $241.39, rebounding from a steep selloff the day prior. The blood products giant slumped 6.3% and hit a four-year low on Thursday on fears Ozempic-type drugs could better treat kidney disease than CSL's portfolio of products.

SelfWealth gained 21.4% to a four-month high of 17c after the investment platform said it had knocked back a tentative takeover offer from Stake at 17.5c per share.

Looking ahead to next week, the Reserve Bank will release minutes from its last meeting on Tuesday. And the Australian Bureau of Statistics will release September jobs data on Thursday.

From Shane Oliver, AMP:

- Global share markets were mixed over the last week. US shares rose as Fed officials sounded less hawkish before higher than expected inflation and nervousness over the war in Israel weighed later in the week, leaving them up 0.5% for the week. Japanese shares also gained 4.3% but Eurozone shares fell 0.2% and Chinese shares fell 0.7%. The positive global lead along with talk of more stimulus in China saw Australian shares rise 1.4% for the week. The less hawkish central bank commentary along with safe haven demand saw bond yields fall back. Oil prices rose 6% on the back of the war in Israel, albeit they are still down on late September highs. Metal and iron ore prices fell as did the $A, as the $US rose.

- US inflation surprised on the upside in September thanks mainly to higher fuel and shelter prices. Inflation came in stronger than expected at 0.4%mom leaving it unchanged at 3.7%yoy. Core inflation also came in slightly stronger than expected at 0.3%mom but still fell to 4.1%yoy from 4.3%yoy. Higher fuel and shelter costs accounted for the upside surprise with core ex shelter inflation falling to just 0.1%mom. However, this masked falling goods prices but a rise in core services ex shelter inflation.

- Surely any conflict in the Middle East is bad via higher oil prices? The situation in Israel is terrible and will get worse before it gets better. But there have been numerous flareups in the Israeli/Palestinian conflict without much impact at all on oil supplies or prices as Israel is not a global oil supplier. And the same goes for Lebanon and Syria if they are drawn in.

- So far investment markets appear to have concluded that Iran will not become involved and that the conflict will be limited to Israel with little impact on oil supply. If that remains the case, then expect minimal impact. If not, then expect a surge in oil prices. The US will likely want to avoid bringing Iran into the conflict until after next year’s election and Israel may not want to open another front just yet, but Iran’s backing of Hamas and its nuclear weapons’ breakout capability mean that Israel has a strong incentive to attack Iran at some point resulting in a greater threat to world oil supplies.

- Our rough estimate is that a typical Australian household is now paying $12 a week more for auto fuel than back in May. With stretched household budgets this means that $12 a week less is available for spending elsewhere.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website