What has been your personal experience with inflation in recent years? Are you shocked by how expensive some items have become? Have you stopped any activity or purchase due to the increase?

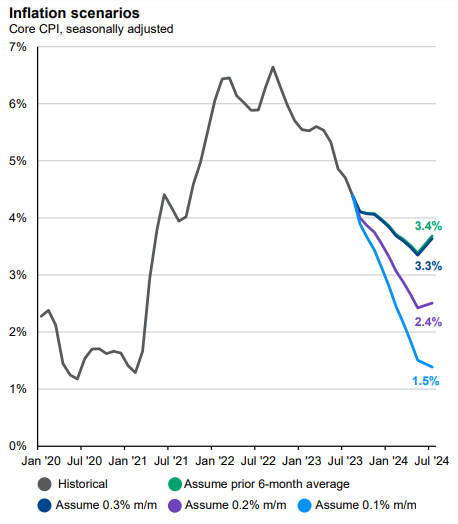

The recent peak in the Australian Consumer Price Index (CPI) was 8.4% annual in December 2022, and less than a year later, the latest annual CPI for August 2023 is 5.2%. That's a decent fall, is the inflation surge over? At a recent presentation by analysts at JP Morgan, a number of inflation scenarios were included which paint a rosy picture and justify a major exposure to long-term bonds, which would rally strongly if these scenarios play out.

Source: BLS, FactSet, J.P. Morgan Asset Management.

Guide to the Markets – Australia. Data as of 30 September 2023.

We all buy different combinations of goods and services and the impact varies. For example, the world's largest global producer and exporter of sunflower oil was Ukraine, and with supplies reduced, all cooking oils have risen in price significantly. Labour costs in hospitality and restaurants have increased and eating out is noticeably more expensive.

And how about the extra cost impact that inflation fails to measure. The shrinkflation where chocolate bars and bottles of drink are 30% smaller. The service charge automatically added to the bill. It's the little things that add up, such as:

- The restaurant that adds a 6.5% 'venue loading' to the final bill.

- The bakery with a 10% surcharge on Sundays, plus a new 'slicing fee'.

- The passing on of credit charge costs by retailers in excess of the fee charged by the bank (or are they bad at negotiating fees with their bank?).

- The car mechanics adding an 'environmental levy' at the bottom of each invoice, on top of high labour and parts costs.

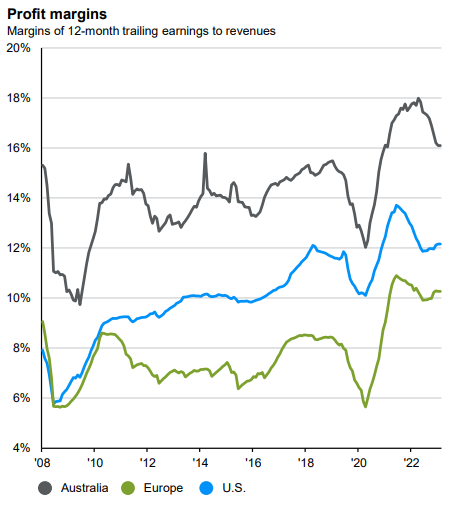

Do you believe businesses have taken advantage of the ready acceptance of an inflationary environment by consumers, allowing increased prices and charges to slip through? There is evidence that profit margins have increased since the start of the pandemic in 2020.

Source: BLS, FactSet, J.P. Morgan Asset Management.

Guide to the Markets – Australia. Data as of 30 September 2023.

What has been your experience with inflation in the last two to three years. Does it feel like a step change to higher prices, not 5% to 8% a year but 30% to 50% on many items?

You are unique in the way you consume goods and services. Take our quick survey on the impact of inflation on you. What have been the major price rises you have noticed? Give us quirky examples of the ways businesses are either covering their costs or improving their margins?

Let's look at what's happening in the real world.