The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

All the academic literature suggests that stock markets are efficient in the long term. That is, market prices will accurately reflect business values over time. Yet, markets aren’t as efficient in the short term, and stock prices can deviate from business values, sometimes significantly.

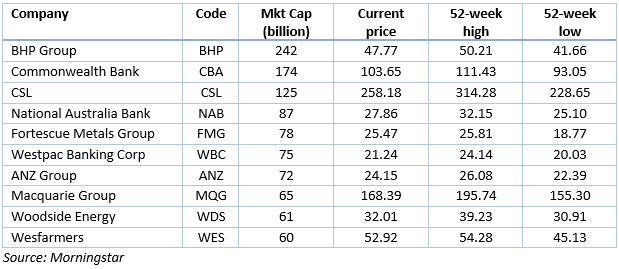

Take the top 10 companies in the ASX. These companies range in market capitalization from $60 billion to $242 billion. They’re enormous. And look how much their share prices have moved around in the past year.

Macquarie Bank

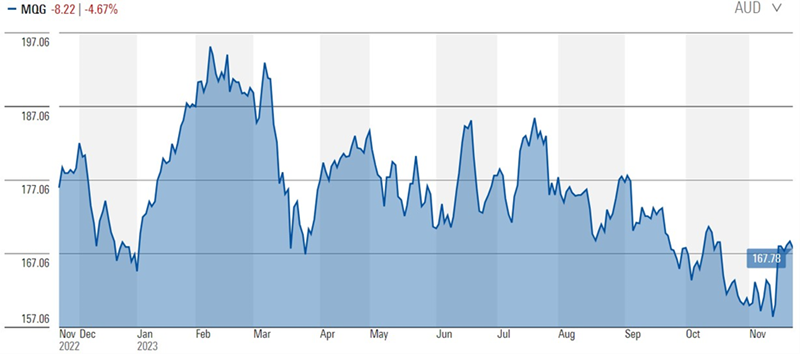

Let’s use Macquarie Bank (ASX:MQG) as an example. It’s almost regarded as Australia’s 5th bank and a home-grown success story. Macquarie’s share price is down 5% over the past year, and it’s been flat year-to-date. Fairly boring, you might say.

Those figures disguise the size of the moves throughout. From $176 last November, the stock went down to under $165 at the start of this January, before catapulting to a 52-week high of $195.74 just five weeks later. It went down to $167 in March, before rising again to $185 in July. And Macquarie got wiped out after recent results to reach of low of $155 before climbing again to its current price of $168.

What a ride.

Source: Morningstar

CSL

CSL (ASX:CSL) is another example. It’s a blue-chip healthcare stock that’s been a market darling for a long time, having delivered stellar returns for shareholders since IPO’ing. Though in the past year, its price has fluctuated wildly. It peaked near $314 in February this year, before diving to under $229 at the end of October, before bouncing back to today’s $258. Put another way, the stock went down 37% over nine months to October, and in the past three weeks, it’s gone up by 13%.

Source: Morningstar

To make this starker, CSL’s market cap reached $151 billion at its peak in February and bottomed at $110 billion at the end of October – its market value decreased by $41 billion at one stage. And CSL’s market value has increased by $15 billion since bottoming around 22 days ago.

They are crazy moves. Yes, issues have emerged with the business including continued doubts about the merits of an overseas acquisition, uncertainty around the impact of obesity drugs on its business, insider selling, and valuations which looked frothy back in February.

However, have these issues warranted a $41 billion move in nine months? Is the business worth $15 billion more than it was just three weeks ago?

Both Macquarie Bank and CSL demonstrate that market prices can move around much more than underlying business values. But is it just a matter of buying quality stocks when they reach 52-week lows? If only it were that simple - that’s where the art of investing comes in.

ResMed

Let’s look at a topical example in ResMed (ASX: RMD). Started in 1989, the company has been another home-grown success story. It’s become the global leader in sleep and respiratory care. The company specializes in positive airway pressure devices for the treatment of obstructive sleep apnoea (OSA).

OSA is a chronic illness characterized by repeated obstruction to the airway at the back of the throat during sleep. After a person with OSA falls asleep, their airway intermittently narrows and collapses causing fragmented sleep and contributing to severe health issues if left untreated.

That’s where ResMed comes into play. It makes Continuous Positive Airway Pressure (CPAP) devices that deliver a stream of pressurised air through a mask to prevent the collapse of the upper airway during sleep. ResMed and its main competitor, Philips have an estimated 80% market share in CPAP devices.

ResMed has been an amazing performer. Ove the past 15 years, it’s returned 16.4% p.a. Over 10 years, it’s been a similar story, with ResMed returning 16.3%. That’s been driven by double-digit growth in both revenue and earnings.

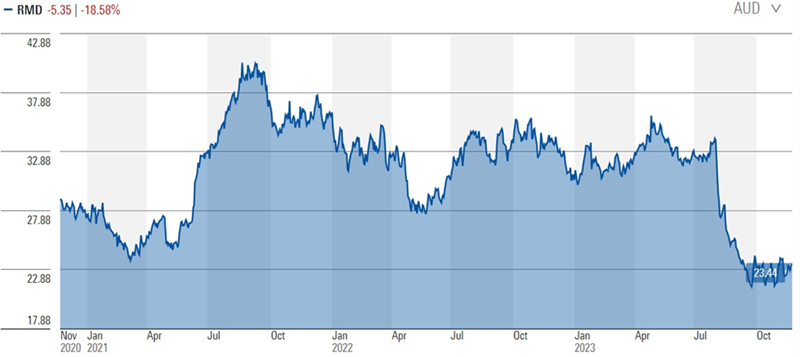

Yet the once market darling has turned pariah over the past year. The stock reached an all-time high above $40 in August last year. It subsequently fell almost 50% to a low of $21.14 in September this year, before bouncing marginally to today’s price of $23.44.

Source: Morningstar

With ResMed still hovering close to 52-week lows, the question is whether stock is now a buy or a value trap.

To answer that, it’s helpful to know why the stock has dropped so far, so fast. And it’s because of the rise of GLP-1 or obesity drugs (Ozempic, Wegovy, and Mounjaro). These drugs were initially designed to target type 2 diabetes by stimulating greater insulin production, but they’ve evolved to being helpful with weight reduction and cardiovascular indications. Given obesity is a key risk factor for OSA, there are worries that these new drugs will reduce the need for the CPAP devices of ResMed.

At one time, the market priced ResMed assuming that it was a global leader in a huge market with a long runway of growth ahead. The obesity drugs have dimmed the narrative with considerable uncertainty about future demand for CPAP devices.

Whether ResMed’s a buy or sell depends on how much these drugs could dent future demand, what impact that may have on earnings, and to what extent that’s factored into the share price. My assessment is that it’s impossible to say exactly how much CPAP demand will be impacted, and that could weigh on the stock for several years.

Yet it is possible to take a reasonable guess on future demand, and that’s what several fund managers who’ve bought into the stock have done. One of these managers, Matt Williams, Head of Australian Equities at Airlie Asset Management, told me as much on a recent episode of the Wealth of Experience podcast.

What struck me about this interview with Matt though wasn’t so much his thesis for buying ResMed, but that he’d probably seen this movie before and that may have helped with his investment decision. What I mean by that is that he has more than 30 years’ experience in funds management, and he’s seen it all: market manias and crashes, companies come and go, hundreds of competent and incompetent managers. And specific to ResMed, he’s probably seen the rise of drugs that don’t have as broader impact on adjacent markets as first assumed.

From the interview, I realised that an underappreciated edge in investing is experience. I can’t help but wonder that the average performance of active managers would be markedly better if all of them had +30 years’ experience in the market.

For the average investor, the lesson is that becoming good at investing takes time. If you don’t have the time, it may be best to outsource the job to others, perhaps to a fund manager with a successful track record over a long period of time.

Full disclosure: Airlie Funds Management is owned by Magellan, a Firstlinks sponsor.

James Gruber

In this week's edition...

One of the most common questions that investors have been asking of late is: with cash and term deposits yielding +5%, is it really worth venturing into other assets for steady income? James Gruber looks at the pros and cons of different assets - such as stocks, bonds, and hybrids - in providing yield and how they stack up against cash.

Another bank reporting season is done and dusted, and it's a mixed picture. The big negative is reduced margins due to increased deposit competition. Yet this is somewhat offset by low bad debts and healthy capital positions. Hugh Dive gives a full breakdown of the results, as well as the winners and losers.

Recently in Firstlinks, Roger Montgomery highlighted the ASX 200 is around the same price that it was 16 years ago. He blamed the poor performance mostly on our taxation system, which encourages companies to pay out most of their earnings as dividends. Ashley Owen gives a counterpoint to Roger's arguments. It's a more optimistic take on why the ASX remains a good place to invest.

It's great to have Rachel Lane back. She and Noel Whittaker have just released a second edition of their popular book, Downsizing Made Simple. We have an extract from the book that runs through the key things to research to make an informed downsizing decision.

Two weeks ago, Graham Hand broke the news of his brain tumour diagnosis. Today, he gives a diarised update of his journey since, and he pays tribute to the kind messages that he's received from hundreds of readers.

Firstlinks interviewed famous Australian-raised investor Sir Michael Hintze when his credit-focused hedge fund CQS was at the height of its powers in 2018. Since then, he's changed the firm's investment strategy and found a buyer in Canadian giant, Manulife.

The team at First Sentier Investors are calling the recent period, The Great Reset, meaning the pivot from an ultra low interest rate regime to a more normalised one. They go through what signals they're looking at to indicate that this reset is done. In the meantime, they say bonds are offering the prospect of favourable risk-adjusted returns.

Two extra articles from Morningstar for the weekend. Shani Jayamanne looks at an ASX-listed stock that remains undervalued despite jumping post results, while Susan Dziubinski reports on 3 US and 2 Australian-listed stocks that are ultracheap based on fair value estimates.

In this week's whitepaper from Neuberger Berman, investigates the 'higher-for-longer' rates outlook in the US and Europe, and the potential for slowing growth in 2024.

***

Weekend market update

On Friday in the US, shares closed mixed in a shortened session after Thanksgiving on Thursday. The S&P 500 was +0.1%, the Dow +0.3% and the Nasdaq -0.1%. It was the fourth consecutive week of gains for stocks. The yield on the 10-year US Treasury note edged higher, settling at 4.483%, ending a run of five consecutive daily declines. Gold was up 0.4% to US$2,002 per ounce and Brent Crude oil was lower by 1% to US$80.58 a barrel.

From AAP Netdesk:

The local share market on Friday finished modestly higher as a four-day ceasefire went into effect between Israel and Hamas, but the gains were not quite enough for the bourse to close in the green for the week. The benchmark S&P/ASX200 on Friday closed up 11.6 points, or 0.17%, to 7,040.8, while the broader All Ordinaries gained 9.9 points, or 0.17%, to 7,244.1. The ASX200 lost 8.6 points for the week, a 0.12% drop, with the market seemingly in search of direction with Wall Street out of action overnight for the Thanksgiving holiday.

On Friday, tech was the biggest mover, dropping 1.7% as Technology One dropped 4.9% and Wisetech Global fell 3.2% to $64.05 as the cloud logistics platform held its annual general meeting. Chief executive Richard White told shareholders that its 2023/24 outlook faced tailwinds from recent weakness in the Australian dollar, while Wisetech chairman Andrew Harrison also announced his retirement.

Whitehaven Coal added 3.4% to $7.28 as the Queensland government's coordinator general gave initial approval to Whitehaven's Winchester South coking coal project southwest of Moranbah. Whitehaven called the recommendation an important milestone, while a campaigner for the activist group Market Forces described it as an "astonishing" approval of a "climate bomb."

The utilities sector grew 1.6%, bolstered by Origin Energy. The energy retailer added 2.8% to $8.56 as its board considered a new takeover bid by a Brookfield-led consortium.

The Big Four banks were mostly higher, with CBA gaining 0.7% to $103.69, ANZ up 0.4% to $24.40 and Westpac adding 0.1% to $21.33. NAB was the outlier, dipping 0.1% to $27.97.

In the heavyweight mining sector, BHP edged 0.1% higher at $47.21, Rio Tinto added 0.2% to $126.80 and Fortescue grew 0.3% to $25.03 as it announced its name change had been completed. From Tuesday, Andrew Forrest's company will officially be known as Fortescue Ltd, rather than Fortescue Metals Group, reflecting its interest in green energy.

In consumer staples, Select Harvests fell 10.5% to $3.91 as the nut grower announced it incurred a $114.7 million loss for the 12 months ended September 30, compared to a $4.8 million profit the year before. It had been a challenging fiscal year, Select Harvest said, with cooler and wetter conditions from the third year of La Nina impacting production across nearly all growing regions. Global almond prices are also down.

Adairs climbed 1.7% to $1.49 despite the bedding and homeware retailer announcing that sales had been down 9% for the first 21 weeks of 2023/24.

Bubs fell 18.2% to a six-year low of 13.5c after the infant formula maker completed a $14 million capital raising at a deep discount to support its growth plans in the United States.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website