The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Previously I’ve written of studies suggesting that our capacity to make financial decisions peaks around the age of 53, and declines thereafter at a rapid rate. Decisions related to borrowing and debt peak at around age 53 while investment skills peak around age 70, with the difference likely due to the varying ages at which we get experience in borrowing and investment.

The risks to our cognitive functioning seem to be increasing given the rise of dementia-related conditions. Recently, I relayed how dementia is about to overtake heart disease as the leading cause of death in Australia. Dementia, including Alzheimer’s disease, contributed to just 0.2% of deaths in 1968, yet that’s now risen to 9.1%. It’s already the leading cause of death for women due to their longer life expectancies increasing the risk of developing dementia.

The latest research on cognitive decline in financial matters

New research appears to confirm that cognitive decline is evident in financial affairs often long before any illness is officially diagnosed. A paper from the Federal Reserve Bank of New York reveals that credit scores among Americans who later develop dementia start falling well before their disease is formally identified. 12 months before diagnosis, these people were 17% more likely to be delinquent on their mortgage payments than before the onset of the disease, and 34% more likely to be delinquent on their credit card payments. The paper suggests the problems can develop early, with the probability of delinquency among credit card holders being consistently worse up to five years before diagnosis, and for mortgage holders is worse in the three years prior to diagnosis.

Another study published in the Journal of Political Economy has found that falling cognition not only impacts decision making when it comes to debt, but also investments too.

“First, we show that older people tend to underestimate their cognitive decline. We then show that those experiencing a severe decline but unaware of it are more likely to suffer wealth losses. These losses largely reflect decreases in financial wealth and are mainly experienced by wealthier people who were previously active on the stock market. Our findings support the view that financial losses among older people unaware of their cognitive decline are the result of bad financial decisions, not of rational disinvestment strategies.”

Increased susceptibility to financial scams

Cognitive decline not only effects our decision making on investment and debt matters but also makes us more vulnerable to scams and fraud. Previous studies have shown that older age and lower levels of cognitive function are two key markers for susceptibility to falling victim to financial scams (the other two markers being lower psychological wellbeing and lower literacy).

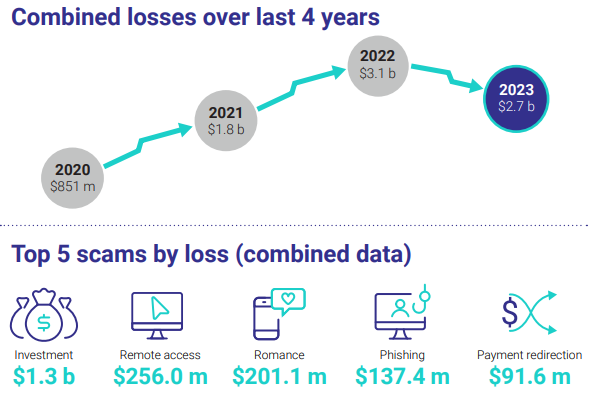

Last year, there were more than 600,000 cases of scams in Australia, with losses of more than $2.7 billion.

Source: Report of the National Anti-Scam Centre on scams activity 2023

As noted by Clime’s John Abernethy in a Firstlinks article a few weeks ago:

“From a livelihood and welfare perspective, a scammer can create havoc for an unwitting target. Whether the target loses their life savings, their superannuation, or a deposit for a house, the devastation is the same. Money that is scammed is stolen and lost. It can change lives unless there is recompense.”

Sadly, the research shows that financial fraud among the elderly often comes from those closest to the victim, including family members, caregivers and friends.

But it can also come from strangers and there are certain types of deception which are more effective than others. Email phishing that relies on reciprocation – the tendency to repay what another person has provided them – is more effective on the elderly.

There’s also evidence that as we age, we have greater difficulty detecting the “wolf in sheep’s clothing”: someone who appears trustworthy but is not acting in a trustworthy way.

The best defences against cognitive decline

Like it or not, your financial cognition will decline over time. That makes it imperative to have legal and financial guardrails in place to protect your wealth. A financial adviser can be a useful gatekeeper for elderly clients with diminishing cognitive function. Also, having a Power of Attorney is a must, along with an updated Will.

****

In my article this week, Berkshire Hathaway’s third quarter earnings update revealed Warren Buffett aggressively sold down stocks including Apple, halted company share buybacks, and built record cash reserves. These moves indicate Buffett is seeing little value in the current stock market. I look at his track record in calling market tops and whether you should follow his lead and reduce risk in your portfolio.

James Gruber

Also in this week's edition...

Donald Trump has been elected US President (again) in a decisive result. Shane Oliver looks beyond the short-term noise to the longer term implications of the election for investors and Australia.

Harry Chemay says fewer people are owning a home in retirement and those that do are carrying more debt than ever before. He believes retirement planning assumptions haven't kept pace with these latest developments and that could result in future income projections that ultimately disappoint retirees.

We hear a lot about megatrends these days and there is always scepticism about how much of their positive attributes are already reflected in share prices. Magellan's Alan Pullen and Elisa Di Marco say that scepticism may explain why most megatrends are underplayed at first. Not only that, but they may also provide clues as to why these trends tend to last longer than initial estimates. And in a twist, they suggest that not all megatrends are positive, with some being downright risky for investors in the long term.

If there is an industry Australia needs confidence in right now, it’s the residential construction sector. Yet, at a time of unprecedented need to build, construction companies are collapsing like houses of cards, leaving consumers with lost deposits and half-finished homes. Drs Bradley Hastings and Peter Swan propose some solutions to fix the growing problem.

MFS President, Carol Geremia, was recently in Australia and sat down with Firstlinks to discuss her views on the investment environment. She believes investors have significantly dialled up portfolio risk in recent decades by reducing their stock holding periods and including a greater share of equities and other risk assets. That's had a cascading effect not only on investors but investment firms and ultimately the companies they invest in. And much of it hasn't been healthy, in her view.

Arian Neiron of Van Eck offers a fantastic exploration of the history of indexing. He says equity indices have evolved over time, led by step-changes in our ability to manipulate data, yet they weren't initially meant to be investment tools.

Two extra articles from Morningstar this weekend. Mathew Hodge reveals an ASX share that just made Morningstar’s global Best Ideas list, while Greggory Warren shares his verdict on Berkshire Hathaway’s earnings.

Lastly, in this week's whitepaper, Schroders provides its latest Global Investor Insights Survey.

****

Weekend market update

In the US on Friday, stocks assumed their customary green hue, rising 0.4% on the S&P 500 to put the finishing touches on a near 5% rally for the week and briefly push the broad average above the 6,000 mark for the first time. Treasurys saw continued strength on the long end with 30-year yields dropping five basis points to 4.47%, though the two-year note rose to 4.26% from 4.21% Thursday, while WTI crude dipped back towards US$70 per barrel and gold declined to US$2,684 an ounce. Bitcoin consolidated recent gains at $76,500, and the VIX ebbed below 15.

From AAP Netdesk:

The Australian share market climbed for its third day in a row on hopes of stimulus from Beijing and a US central bank cautious when queried on the inflationary outlook under a second Trump presidency.

At close on Friday the S&P/ASX 200 index finished 68.8 points, or 0.8%, higher, at 8295.1.

The broader All Ordinaries gained 38 points, or 0.8%, to 8552.6.

Australian energy stocks were down 0.5% by the end of the day but the remaining ASX200 sectors finished higher, led by tech and a rally across property stocks.

GPT Group picked up 2% and Charter Hall Group gained 2.1%.

ANZ lifted 1.3% to $32.13 despite announcing an 8% drop in cash profit to $6.7 billion, with fierce competition for home loan customers weighing on margins at all the big banks. Shares in the remaining three banking giants also posted gains, with Westpac up 2% to $32.14, CBA lifting 1.4% to $149.32, and NAB finishing 0.8% higher at $39.65.

Across the mining heavy-weights, BHP lifted 1% to $43.40, Rio Tinto gained 1.4% to $123.31, and Fortescue drifted 0.3% higher to $19.55.

Shares in Block slid 6.1% after the digital payments company reported below-expected third-quarter revenue.

Property listing firm REA Group recovered from earlier losses to lift 0.3% after reporting underlying earnings of $243 million - a 23% increase on the year prior - and revenue growth of $413 million, up 21% on 2023.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Quarterly ETFInvestor (ETF Market Data) from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website