The Great Lockdown will be the worst downturn since the Great Depression, says the International Monetary Fund. It warned last week that the Australian economy will slump by 6.7% in 2020, followed by a recovery in 2021. While the economy is not the stock market, there's a disconnection at the moment. The S&P500 index in the US has risen in each of the last two weeks, while 22 million Americans lost their jobs in a month. Despite the poor outlook, price/earnings ratios in both the S&P/ASX200 and the S&P500 are still above long-term averages.

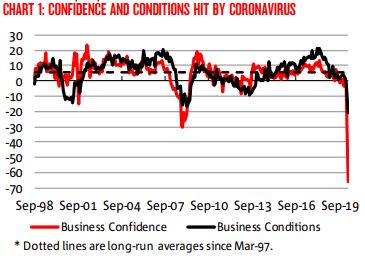

The latest NAB Business Confidence survey shows what companies are facing:

"Business confidence saw its largest decline on record and is now at its weakest level in the history of the NAB business survey ... Business conditions also declined sharply in aggregate and across the bulk of industries ... Forward orders collapsed to their lowest level on record, while capacity utilisation also saw a sharp decline. Overall, the decline in forward orders and business conditions imply a large fall in GDP in the next 6 months."

Likewise, in March 2020, the Westpac-Melbourne Institute Index of Consumer Sentiment fell by the single biggest monthly decline in the 47-year history of the survey.

It's a pivotal week for global stock analysts as the US March quarter company earnings reports are released. If March is bad, June will be worse when the full impact of coronavirus will be felt. Expect reluctance from companies to provide 'earnings guidance'.

The variance in optimism and interpretation of turning points is creating the market's volatility. In only five days, battered stocks like Afterpay rose 45%, Corporate Travel 52% and Flight Centre 35%. In the US, casino operator, Wynn Resorts, was forced to close in Las Vegas and Boston. Its shares initially fell 75% from $140 to $35 at the peak of the panic, then rose 140% to $84 before falling again to $46. The market has no idea how to value it.

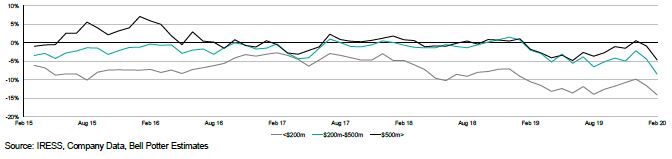

In Australia, it has been disappointing to see the discounts on Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) widen even further from their net asset backing, especially the smaller vehicles. As if it is not bad enough that asset values have fallen 50% in some cases, but investors face a further hit if they want to sell, as shown below.

Premium and Discounts to NTA for LICs and LITs by market value

As Bell Potter reports in its weekly update, the giant $1.3 billion LIC raising by L1 Long Short Fund in 2018 at $2 a share, trading last week at $1 after a low of $0.66, still cannot find any friends. The fall in NTA is worsened by a discount of about 30% (as at 7 April). Its IPO was launched with minimum raise of only $100 million, but they could not resist the stampede of money.

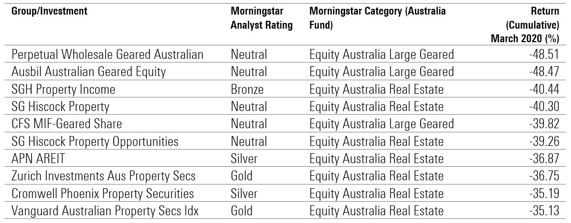

The worst-performing funds in any heavy sell-off are geared funds, as this article warned in January 2020: "Duh! Of course geared funds won, but know the risks". Now the article would be, "Duh! Of course geared funds lost". These funds are a good way to leverage into a rising market, but are not for the faint-hearted, as shown below for the month of March (source Morningstar Direct):

This table also shows many property trusts have collapsed, victims of a lockup nobody expected. How many people thought property was a defensive asset?

In this week's edition ...

Many readers are struggling to understand how governments are financing the trillions of stimulus spending. As one commented on our website:

"On this logic, if the stimulus was $500 trillion, it shouldn't matter. If my understanding is correct (hope not) we can solve world poverty in a moment."

We reached out to a global authority on debt financing and this 'monetarism magic', Professor Tim Congdon, and he provided an exclusive explanation in the simplest terms possible. In summary, when more dollars chase a smaller pool of goods and services, the result (eventually) will be inflation. That is the future cost, but not now, because the economy is weak with plenty of spare capacity and unemployment.

Back in the real world, Jun Bei Liu summarises the current dilemma facing all fund managers, mixing the poor near-term economic outlook with tempting buying levels for favoured companies.

Our Reader Survey on the impact of coronavirus produced some surprising results, with only 17% of the 700+ respondents saying we have seen the bottom of the market. The full report includes fascinating comments on how people are reacting.

Hasan Tevfik detects a fundamental change in stakeholder obligations for most companies, with profound earnings implications, but it cannot last in the long term.

David Bell explains how much taking $20,000 from super now will cost in retirement, while Ramani Venkatramani examines more options for super changes that the government might consider. Still on super, Julie Steed warns that the expected age-based changes for contributions are not legislated and may miss the 30 June deadline.

Bruce Gregor is a demographer, and he offers insights into Australia's coronavirus death statistics, and examines the health implications of a return-to-work.

Finally, a change of pace as lawyer Donal Griffin says his happiest clients are those who have escaped a near-death experience, and we should rethink how we approach life post the virus.

The BetaShares March 2020 ETF Report shows trading values reached an all-time high of $18 billion for the month, or 2.5x the previous monthly record of $7 billion recorded in February.

This week's White Paper from Neuberger Berman goes inside their asset allocation committee to see how coronavirus is changing the investing of one of the world's largest fund managers.

Graham Hand, Managing Editor

Latest updates

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

PDF version of Firstlinks Newsletter

Plus updates and announcements on the Sponsor Noticeboard on our website