Quick weekend update on last week. US shares were flat on Friday but gained a healthy 3% for the week. Australia sold off on the final day but still rose 4.7% for the week with strong gains from banks. Amazingly, since the 23 March lows, global shares have risen 32% and Australia is catching up at 29%.

All in a week when US jobless claims topped 40 million and millions more gave up looking for work.

***

We recently sold the family home we have lived in since 1989 for a high multiple of the original purchase price. Does that make us good investors? No. Did we pick a particularly fine house? No. The prices say more about our age than our skill. It simply means we live in Sydney and we allowed the investment to grow over a long time without selling any part of it, like millions of other Australian home owners.

Investors who treat equities the same way will be better off than those who try to time the market. What if we had sold our house in 1992 when it had fallen in value during the last recession? It's the day-to-day revaluing, worrying about markets and moments of panic which compromise the compounding potential of simply holding an equity portfolio for decades. Our lead story this week looks at the amazing numbers.

At the moment, the stock market is reacting to each piece of news on COVID-19 while other long-term problems are pushed into the background. The most serious risk is the heightened trade tensions with China, which buys one-third of all Australia's exports. This is more important than whether another person dies in a nursing home or the US hits 100,000 deaths.

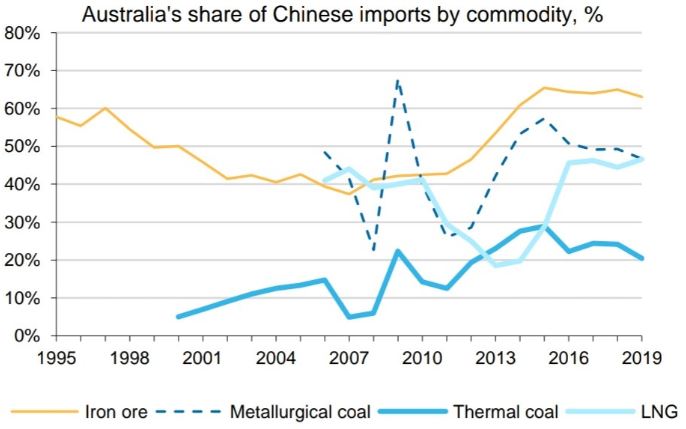

On first look, our dependence on China looks like a threat and a need to diversify. However, the issue is far more complex, as China also needs Australia, as shown below.

Source: IHS, Macquarie Commodities Strategy, May 2020

China buys two-thirds of its iron ore and almost half its metallurgical coal and LNG from Australia. With Brazil hard hit by COVID-19, facing more daily deaths than any other country, where else will iron ore come from for a long time? A bigger threat comes from the tension with the US and its impact on global growth, especially when one person will do all he can to use China as a political weapon until the November election.

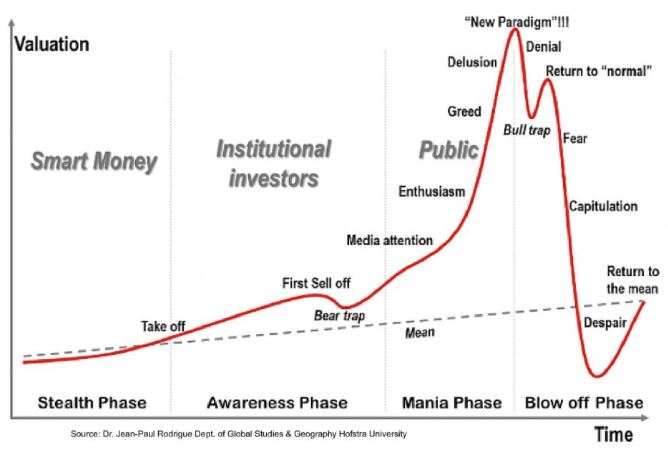

So where are we on the investment cycle chart? Here's one version by Canadian scholar, Jean-Paul Rodrigue, who shot to fame in the GFC with his 'four phases of a bubble' model, as shown below. He argues the stock market works by some smart investors picking the initial 'stealth phase' (is that happening now?), and then institutions join the buying. The media write articles about how much money others are making, FOMO kicks in and the general public drive a 'mania phase'. At some point of greed and delusion, there is a 'blow off'.

Put your own arrow on where you think we are at the moment, it's as valid an opinion as anyone's. Are we near the point labelled 'return to normal'?

That's the problem with investing, there are few absolutes. Outcomes depend on human behaviour, it's not physics or chemistry. Our first article goes back to basics with a mathematical certainty everyone can play with. There's more investing learning in a simple formula than any other lesson.

Also in this week's edition ...

Two high-profile fund managers who have run portfolios for many decades update their latest views. Paul Moore is a value investor who saw his style returning to popularity before COVID-19 blasted the focus back to growth companies. Then Roger Montgomery explains why the market has run so strongly in the face of economic headwinds, but there are limits to whether it can test the previous highs.

Many investors feel they have missed the rally, so Emma Rapaport delves into the Morningstar database to find 10 companies rated 4 or 5 stars but with a more predictable earnings outlook than most.

As investors look to alternatives, Jordan Eliseo fielded questions from SMSF trustees on gold and where it might sit in a portfolio, while Leonie di Lorenzo says HNW investors are moving from cash to fixed interest, tailored investments and foreign currencies.

On COVID-19, Francis Scotland argues time in lockdown is a major risk, and lessons from the past argue for a return to business activity, while David Bell describes intriguing work by two young actuaries, Calise Liu and Alan Xian, who have mapped Australia for regions vulnerable to a virus outbreak.

Finally, the long-running saga on conflicted remuneration for LICs and LITs has been addressed, but commissions can still be paid on other listed issues, which is a disappointing outcome for Jonathan Rochford.

This week's White Paper from AMP Capital switches focus from the short-term impact of COVID-19 to examine 10 longer-term implications.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Latest LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website