The worst seems to be over. Road traffic is returning, retail sales are rising and house auction clearance rates have improved. In the US, air travel and hotel and restaurant bookings have bounced. Economies around the globe are cautiously and tentatively making the necessary steps towards recovery. Many sectors of the economy are not getting worse and some are growing quickly.

Meanwhile, markets are buoyed by optimism surrounding the reopening of commerce and the growing number of experimental vaccines under development.

Heading for a common destination

The post-pandemic news flow is so good that I am reminded of one of those trains in India, where upon every vacant centimetre there is a human desperate to travel to their intended destination. Crowded trains and crowded trades, it seems, are both part of the human need to go in the same direction.

Even as we talk of post-COVID-19 conditions, we are not yet certain the pandemic is under control. Developing and developed countries weigh the easing of lockdown restrictions even while new coronavirus infections and deaths rise. Meanwhile, the optimism about a still ‘hoped-for’ vaccine ignores the time it will take to manufacture billions of doses and the logistics required to disseminate it to everyone on Earth.

As borders are opened and restrictions eased, the risk of an explosive acceleration in infections, hospitalisations and deaths remains and so a measured approach to the reopening of businesses and economic activity is certain, as is the breaching of health and social distancing guidelines and requirements to keep populations safe.

But no matter, it seems. Investment markets don’t need the problems to be solved and concluded, they merely need the worst to be behind them. The recent strength in equity markets reflects an optimistic future.

Has it gone too far, too soon?

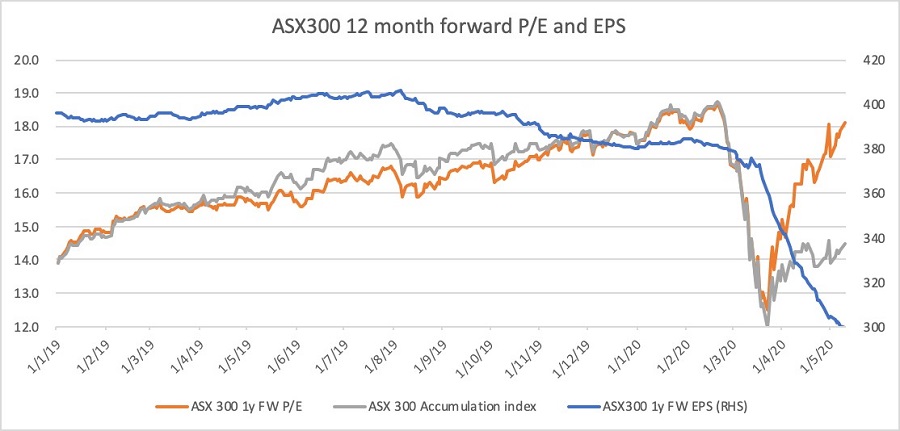

The recent rally and sustained recovery in share prices have expanded the price to earnings (PE) ratio for the ASX300 to 18 times earnings. While PE ratios aren’t always a reliable gauge as to value, in aggregate they can be helpful in establishing whether sentiment is dominated by enthusiasm and optimism, or pessimism and hopelessness.

Figure 1 reveals sentiment in the Australian market is almost as optimistic as it has ever been (recalling PE ratios at the end of calendar 2019 were the highest on record).

Figure 1. ASX300 PE v EPS

Source: Andreas Lundberg at Montgomery Investment Management using Bloomberg.

Notwithstanding the fact that a multitude of companies have pulled their guidance for FY20 and FY21, consensus earnings have plunged and multiples have returned to levels seen at the peak of the prior boom. Obviously, if earnings expectations recover materially in the near future, the forward PE ratio will contract, all else being equal.

At the time of writing, the ASX small companies index is trading at 21.4 times earnings for the next 12 months and 20.9 times FY21 earnings. Consensus earnings estimates suggest aggregate earnings will exceed 2019 levels in FY22.

Signs of better company results

Supporting this view is a litany of positive updates from Australian companies.

In the automotive parts and supplies sector, Eclipx has noted that the volume of end-of-lease car sales is picking up; Bapcor is optimistic; and even Mercedes is reporting a pick-up in sales off depressed levels. Other operators are also recording a recovery in used car prices, a clear sign consumers are spending.

With consumption a significant proportion of economic activity and output, it’s worth considering the recent aggregate consumption data.

Even back in March 2020, total retail sales were up 10.1% year-on-year and 8.5% higher month-on-month. The significant year-on-year jump was due to stockpiling and panic-buying of liquor (+33.9%), pharmacy items (+29.4%), and groceries (+26.7%), ahead of expected lockdowns. And anyone lining up at Bunnings for ‘essential’ items during the lockdown would not be surprised to also learn the Hardware category saw retail sales up nearly 18% year-on-year, while recreational goods were up 16.7%.

Retailers from Baby Bunting and Adairs to Kogan and City Chic are reporting accelerating year-to-date sales, a jump in online business (Kogan reported a more than doubling of April gross sales) and success in renegotiating cheaper leases and therefore a lowering of the cost of doing business.

Another measure of consumer activity is provided by the operators of consumer fintech solutions and platforms. Buy-now, pay-later operator Afterpay reported the online share of total retailing accelerated 10% in April, up sharply from 6% in February, while competitors Zip Pay and Flexigroup reported flat arrears and resilient volumes respectively. The UBS Consumer Survey recently indicated spending intentions are better than previously feared.

Housing, and in particular residential construction, is one area we have held concerns. The residential construction industry employs about 3.5% of the Australian workforce (representing a lot of potential retail consumers). Our channel checks had reported a near one-third drop in forward orders for new builds thanks to pressure on household incomes, contract cancellations, a forecast 30% drop in net overseas migration this financial year and an 85% fall in 2020/21. This would potentially have serious consequences for the likes of Stockland, Mirvac, Adelaide Brighton, Boral and CSR.

Most recently, however, the Prime Minister announced a package that would ensure support for the beleaguered sector.

We need to define 'recovery'

The question of course is whether optimism over a V-shaped recovery is warranted. It is true that we are witnessing a recovery from the impact of lockdowns. But what is the definition of a recovery? If recovery means a bounce from the bottom, then we are in a recovery.

But if the definition of recovery is a return to pre-crisis levels of demand, revenue and profits we are a long way off. Indeed, expectations of a rapid return to pre-crisis levels of activity look like wishful thinking.

Take restaurant bookings for example. According to Steve Hafner, the chief executive of OpenTable in the US, despite a slow and steady rise in seated-dining bookings across the US, as many as a quarter of restaurants in the US will never open their doors again.

In Australia, with unemployment a lot worse than the full-employment levels we enjoyed prior to February, restaurants can expect the same tentative recovery.

Meanwhile, the retail sector in Australia is unlikely to return, in aggregate, to the levels enjoyed previously. Retail is the second largest employer in Australia. With a plethora of household name retailers having collapsed or closing a significant number of stores (McWilliam’s Wines, Flight Centre, G-Star, EB Games, Bardot, Curious Planet, Jeanswest, Bose, Kaufland, Colette, Ishka and kikki.K) it is reasonable to expect that fewer jobs will be available for JobKeeper recipients to return to when their payments cease.

With market valuations at stretched, if not extreme, levels, the question investors must ask is whether the current buoyant recovery is more than a little fuelled by government support.

There is little doubt that it will take very little time for the economy and business activity to show a recovery from the lows, but it will take much longer to fully recover. And the time and sustainability of a recovery is very much dependent on the willingness of government to offer support. By September or October this year we will have a much better idea of the extent to which the recovery is self-sustaining. That is when many of the current support offerings by government, banks and landlords expire.

In the absence of government support, we believe household incomes would come under significant pressure by the end of the year. Combined with still record levels of household debt, it is a recipe suggesting too much optimism is currently reflected in the equity market.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.