Weekend market update: After the S&P500 in the US fell 6.5% on Thursday, and Australia was down 2.5% for the week, many investors thought a fall back in share prices had started. Perhaps the market finally realised that ignoring economic reality was foolish. Then on Friday, the S&P500 rose 1.3% in a show of resilience, although it was down 4.8% for the week. It's being depicted as a battle between bearish professionals and optimistic retail.

***

Legendary US fund manager Peter Lynch was an early adopter of what we now call 'high frequency indicators'. He would sit in shopping malls watching which stores people went into and what they bought. He would give his children money and see how they spent it. He was looking for frequent and early signs before they were recognised by the market. Lynch's Fidelity Magellan Fund averaged 29% per annum from 1977 to 1990, more than twice the S&P500. He was considered the best money manager of the 1980s.

Many traditional economic indicators are out-of-date when they are released, such as the recent GDP update for the March quarter. Treasurer Josh Frydenberg received more questions about the June quarter and he responded based on early feedback from the Reserve Bank. The market has developed many high frequency indicators which have become far more sophisticated than Lynch's sitting around malls (although with little evidence they are any better).

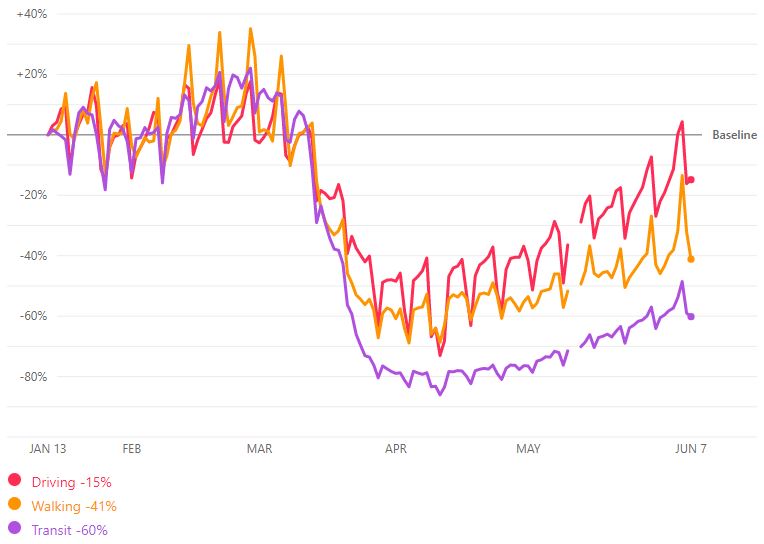

Some daily examples include travel numbers from the US Transportation Security Administration, bookings of movie tickets from Box Office Mojo and OpenTable's reporting on restaurant bookings (including for Australia). Apple is releasing mobility data for many countries and cities based on requests for directions on Apple Maps. Australia is shown below, indicating how quickly driving is recovering but not public transport.

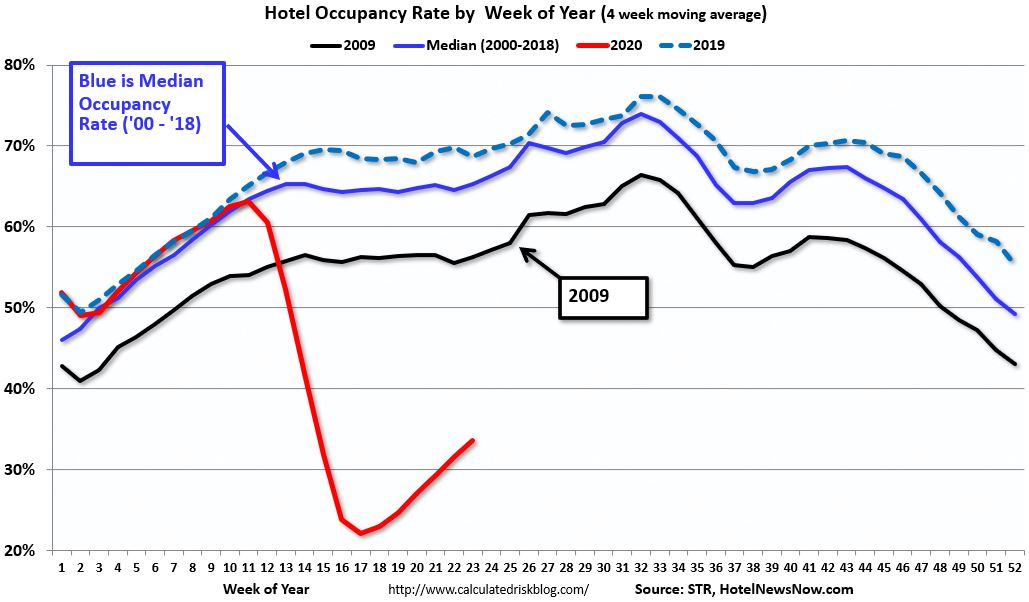

Another example from HotelNewsNow is hotel bookings, with the data below for the US showing the usual seasonal trends, the fall off a cliff in March and the start of a recovery.

By watching these early signs, investors try to stay ahead of the pack. It's a game anyone can play: how busy is the car park at your local shopping centre? What does your favourite coffee shop say about business? Are your friends buying as much stuff as normal or saving more? (Some examples above come from Bill McBride of Calculated Risk).

In this weekend's edition ...

How would you like a portfolio of quality shares especially selected by a famous, highly-experienced fund manager at a 20% discount to their market value. Well you can, every day of every week. What's the catch?

The stock market is booming in the middle of a recession, and while this one is unlike anything we have seen before, Ashley Owen shows a rally is what usually happens. It's not so weird.

Yes, it's that time of year with a few weeks left to tidy up financial accounts, with some special features in super funds including SMSFs. Liam Shorte identifies 20 tips for FY2020.

Many investors fear they have missed the bargains but Katie Hudson explains what her team looks for in a stock market rebound like this one.

There's little doubt the majority of professional investors have been shocked by the market's recovery. Sean Fenton says the usual price signals a market needs have been lost in a sea of central bank liquidity, and Moray Vincent argues the extent of the rises simply cannot be justified. We are returing to pre-COVID levels as if no long-term damage has been done to the economy.

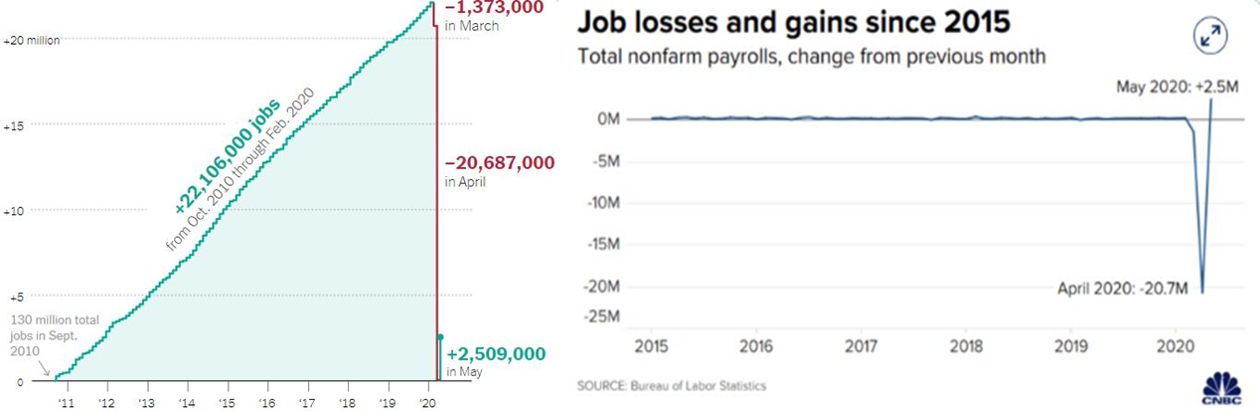

The market (and Donald Trump) was excited by the US jobs gain last week but it's good to put it in perspective. Do you consider one of these diagrams on the same data highly misleading?

Source: Bureau of Labor Statistics by Ella Koeze via NY Times

Many retirees will know the difficulties juggling around assets, eligibility for the age pension and the vagaries of the taper test, as explained by Andrew Boal.

Finally, we reprise an article where Chris Cuffe warns about investing in unit trusts during June. Watch you do not convert your capital into taxable income.

This week's White Paper from UBS gives the view of Nobel Laureate Sir Christopher Pissarides, a labour market economist, on the epidemic and the way markets are responding.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review for May 2020 from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website