Weekend market update. Global markets delivered a strong week with Australia up 1.9% and the US 1.2%. The S&P500 was slightly up on Friday and NASDAQ hung on to recent gains as the market balances worsening new virus cases with hopes of a vaccine. Signs of a V-shaped recovery in China and a softening of Trump's trade antagonism were also encouraging.

***

The ways we think about investing are guided by several foundational texts published decades ago. One classic still read by students of markets is Security Analysis, continuously published for almost 90 years with the latest edition carrying a foreword by Warren Buffett. Although written by Benjamin Graham and David Dodd in 1934, much of it rings true now as markets remain subject to human behaviours that change little over time. Consider how this reflects the current stock market:

"Instead of judging the market price by established standards of value, the new era based its standards of value upon the market price. Hence, all upper limits disappeared, not only upon the price at which a stock could sell, but even upon the price at which it would deserve to sell."

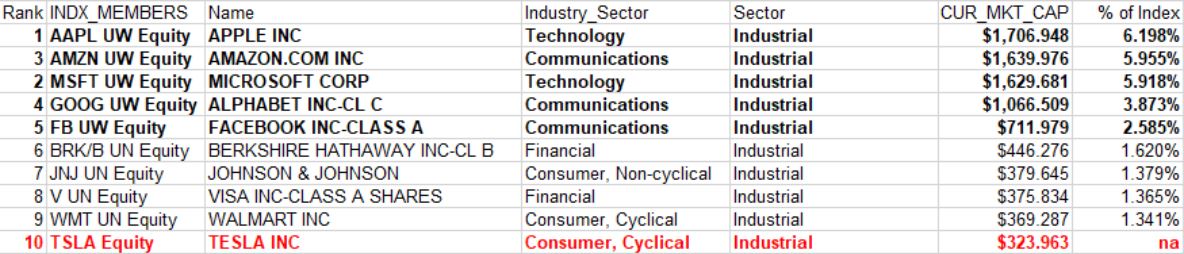

With COVID-19 driving big winners and losers, the US market has taken on unusual characteristics. The S&P500 is now at its most concentrated for 50 years, with the Top 5 companies at 25% of the index and the Top 20 at 40%. Yet the 10th largest company in the US, as shown below, is Tesla, which is not even in the S&P500 because it is not profitable enough to qualify. It's not considered a blue-chip despite its US$300+ billion market value, exceeding Proctor & Gamble, Mastercard, JP Morgan and Home Depot. Elon Musk doesn't care as his wealth has overtaken Warren Buffett.

As significant is the lack of any bank in the US Top 10, showing how successful the big tech stocks have been. Australia is not quite the same, although CSL is now our largest company and BHP is third as our banks have also struggled.

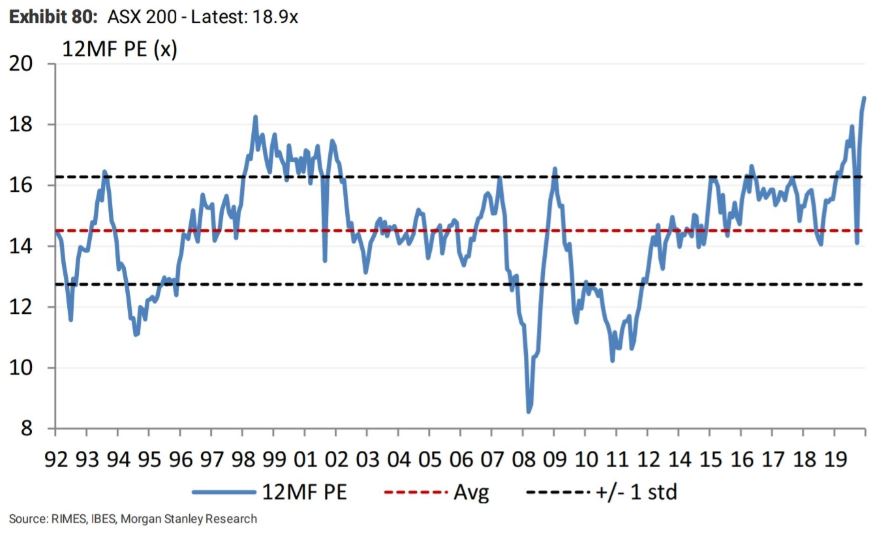

On the theme of markets at extreme levels, this week we check six popular charts often used by analysts to monitor financial conditions, and it's clear that the elastic is stretched. In Australia, the disconnect between stocks and the real economy shows in the high Price/Earnings ratio in the middle of a recession and a pandemic, a long way above the long-term average of about 15. Hamish Douglass of Magellan said this week:

"It isn’t unusual during an extended crisis for markets to bounce strongly followed by a second sharp sell off. While we do not know how things will play out, investors should be prepared for a wide range of potential outcomes in the next 12 months. There is a real possibility of a collapse in equity markets, just as there is for a continued grind higher in equities supported by low interest rates."

Nobody knows how much of the early release of superannuation is finding its way into the stock market, but requests have reached $23 billion from 2.5 million applications. No doubt many people need the money but that's a lot of people with compromised retirement savings. Hopefully, they have their paperwork sorted as some people who qualified in April or May may no longer be eligible for the second round if they have returned to work.

Also this week, Hamish Tadgell describes how his investing has changed during the pandemic, and he reveals the companies best able to withstand the current storm. Then Will Baylis looks at income investing under these new circumstances, and explains a 'dual technique' in analysing stocks.

Kevin Davies was a member of David Murray's Financial System Inquiry, and he has identified a product which is not suitable for retail investors but ASIC seems unable to regulate.

Many people do not recognise that Australia has two main exchanges, not only the ASX but also Chi-X, a new sponsor of Firstlinks. As an introduction, Shane Miller describes how they selected the most recent additions to their TraCR range, which facilitates purchases of leading US companies on local exchanges.

Gold ETFs are experiencing record inflows (see the BetaShares ETF Report below) as investors focus on possible currency debasement due to limitless money printing. Michael Armitage says another benefit of investing in unhedged gold is its uncorrelated returns versus stock markets in times of stress.

As many of our readers manage their own SMSF, it's always good to read an update on rule changes, and Graeme Colley summarises some old and new rules in operation from 1 July 2020.

This week's White Paper is the BetaShares ETF Half Year 2020 Review of a sector which continues to prosper regardless of market conditions.

Finally, two bonus articles for the weekend. Michael Collins shows how China could soon become the world's leading consumer, while Russel Pillemer argues there is a future for global LICs by focussing more on fully franked dividends.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF June 2020 and Half-year Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website