Weekend market update: On Friday and for the whole week, the US S&P500 was down about 0.7%, in contrast to gains in other major markets. Australia rose over 2% for the five days to take the monthly gain to 10.2%, the best for over 30 years. Amid renewed optmism about economic recovery in Australia, the US is balancing record virus cases and Donald Trump risks versus vaccine hopes based on strong test results from Moderna and Pfizer.

***

Underperforming asset managers receive little sympathy from critics and investors, but what does 'underperforming' mean? It's normally a reference to not matching a benchmark, but what should a fund manager do if the market is behaving in a way that is totally anathema to a belief in how companies should be priced? Change their style or tough it out? Most supporters want style consistency, even if it does not work in the short term. Investor choosing a fund manager should consider it a long-term commitment, at least seven years.

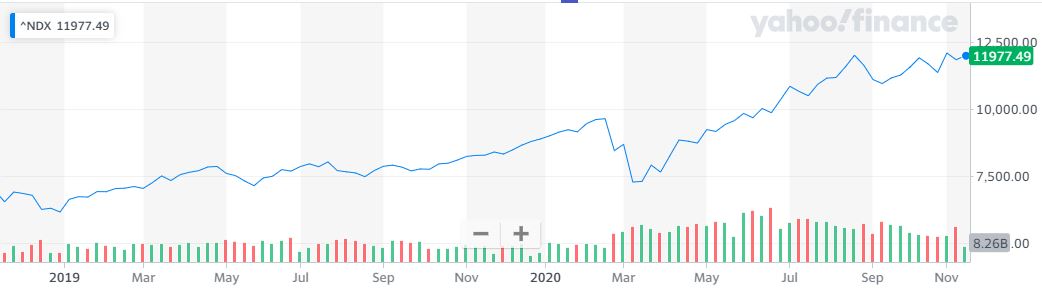

More than ever, this is where many of our highest-profile fund managers find themselves. For example, the tech-heavy NASDAQ index has doubled in the last two years, as shown below in the blue line. If earnings had doubled in the same period, many 'value' managers who focus on fundamentals such as quality earnings would have invested more in tech companies.

Source: Yahoo Finance

But NASDAQ company earnings have been flat for at least two years, as shown below highlighted in red. This is called 'multiple expansion', because buyers are paying higher prices as a multiple of the earnings. The NASDAQ price gains are driven by reductions in interest rates and excess liquidity, not higher profits. Yes, the period from 2009 to 2015 was excellent for tech earnings, but not more recently, and yet prices continue to run.

Our interview with Graeme Shaw of Orbis explores what has happened and why he thinks we are at a critical moment in investing history. As he says:

"But if you look in the last three years, the multiples applied to those businesses have expanded much faster than the underlying earnings. That's where a lot of the overvaluation has come from as everyone gets over excited and things start getting silly and that's what's happened."

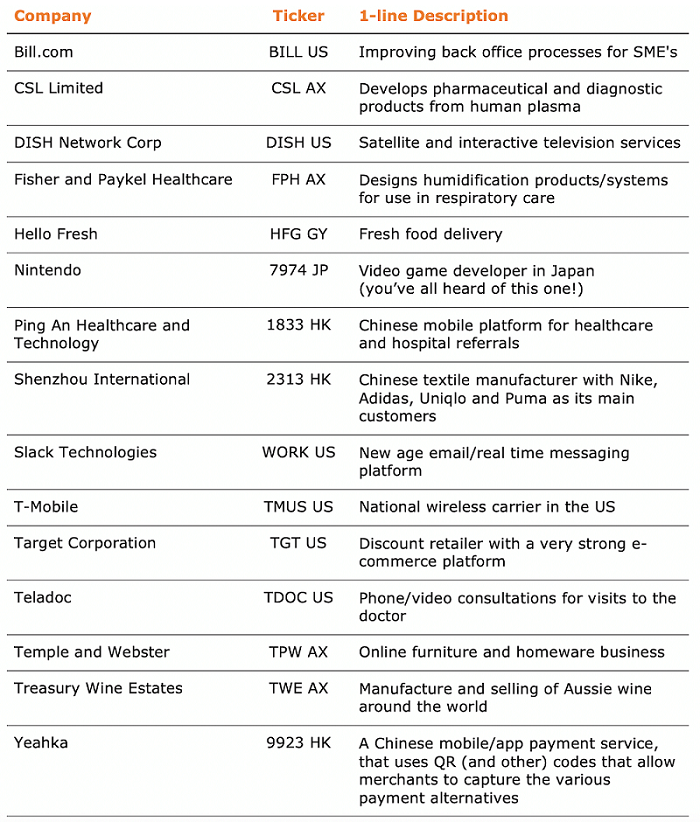

On the other side of the coin, many managers have benefitted from the tech theme, including some featured in Hearts and Minds Investments (ASX:HM1), chaired by Chris Cuffe. Its portfolio is constructed around the recommendations from core and other selected fund managers who present at the annual Sohn Hearts & Minds Investment Leaders Conference, held last week. The additions to the portfolio for 2020 are listed below. At HM1, instead of charging an investment management fee, a donation is made to medical research.

In this week's other articles, Adrian Harrington explains why there is life in the office market in a post-COVID world as businesses assign more space per employee. Anyone who has worked with me knows I was never a fan of activity-based working so it's good to see the end of that counterproductive idea.

Matt Rady reports on mid-pandemic research on retiree reactions to the investment climate. They are experiencing doubt about how long their money will last and their ability to withstand further losses. On a related theme, Max Pacella looks at intergenerational wealth transfers, especially as the Baby Boomers age and pass money to people with different spending and investing habits.

Many retirees expected to rely on bank dividends to compensate for negligible rates on cash and term deposits, and the surprise cancellation or reduction in dividends in 2020 was a shock. Hugh Dive checks the recent bank results and their potential to restore profits and dividends. Who will win in 2021?

While more investors are looking to bonds and bond funds for the defensive allocation in their portfolio, some of the terms are still confusing. I dislike references to running yield because it ignores the capital loss when a bond is purchased at a premium. Nathan Boon goes back to basics including four tips on the outlook.

The suspension of ASX trading this week showed real-time data is essential for investing. Ash Hart explains how a strong API should integrate many sources of data, improve speed, automate tedious processes and reduce risk.

This week's White Paper below from Shane Oliver of AMP Capital gives five reasons why Australian shares are likely to outperform in the next year. Most Australian feel lucky to live here during the pandemic, and Shane suggests it also a good place to invest.

On Friday, the Government released the Retirement Income Review. We will cover it in more detail next week, but there is plenty of evidence to support a stalling of increases in the Superannuation Guarantee.

Other observations made by the Review are:

"The Australian retirement income system is effective, sound and its costs are broadly sustainable.

As at June 2019, around 71% of people aged 65 and over received Age Pension or other pension payments. Over 60% of these were on the maximum rate. For most households aged 65 and over, the family home is their main asset. Superannuation makes up a small share of their net wealth. This will change as the superannuation system matures.

The Age Pension, combined with other support provided to retirees, is effective in ensuring most Australians achieve a minimum standard of living in retirement in line with community standards. Retirees receive health, aged care and other Government services worth more than the maximum rate of the single Age Pension.

Superannuation savings are supported by tax concessions for the purpose of retirement income and not purely for wealth accumulation. Yet most retirees leave the bulk of the wealth they had at retirement as a bequest.

The home is the most important component of voluntary savings and is an important factor influencing retirement outcomes and how people feel about retirement.

While the Age Pension helps offset inequities in retirement outcomes, the design of superannuation tax concessions increases inequality in the system. Tax concessions provide greater benefit to people on higher incomes.

Many very large superannuation balances were built up under previous high contributions caps and are expected to stay in the system for several decades. At June 2018, there were over 11,000 people with a balance in excess of $5 million. People with very large superannuation balances receive very large tax concessions on their earnings."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

nabtrade Charity Trading Day, 26 November, to support rural kids' wellbeing

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website