Weekend market update: Both the S&P500 and NASDAQ posted gains of around 0.8% on Friday despite the record numbers of COVID-related deaths in the US and a weak jobs number. Over the week, the US was 1.7% higher to a new record, while Australia increased 0.5% on the back of surging iron ore prices. Rising commodity prices are pushing the $A higher, now about US$0.74 versus a March 2020 low of US$0.62.

***

Last week, I moved my home for the first time in 31 years. It was a once-in-a-lifetime opportunity to rationalise everything from books to documents to furniture, much of which we would have kept until death do us part without the move. It made me feel great sympathy for those people who are unwillingly forced to move accommodation regularly, such as renters subject to the short lease conditions in Australia. We had months to plan our move, but regularly relocating lives and schools at a month's notice must be draining. It's another dimension to the value of owning your own home which does not feature in the debate on early access to superannuation.

Most people read our articles but probably then don't go back to check the comments. Last week, our pieces on the Retirement Income Review drew over 50 comments showing the strong feelings on the Review's conclusions. This week, Jon Kalkman continues our study of the Final Report by asking whether the panel members really understand the consequences of their findings for retirees who aspire to more than the age pension.

Our feature article is investing guidance from Hamish Douglass from the sidelines of the recent Morningstar Individual Investor Conference, with three short videos and transcripts with Lex Hall. It's a fascinating time for investing with great optimism around vaccines, a clear Biden win, signs of strong growth in Australia and the question of whether 2021 will reward different styles than during the pandemic.

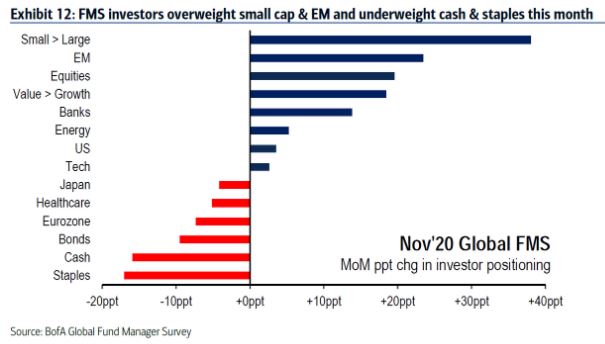

The latest Bank of America Global Fund Manager Survey (FMS) suggests professionals are positioning for change. As the chart below shows, the big moves over the first half of November 2020 were into small caps over large caps, into emerging markets, more value than growth and less defensive in cash, bonds and staples. Energy was back in favour. These moves are counter to the best positioning in 2020. The FMS growth outlook is strong, with managers rotating into previously hard-hit companies and sectors.

Also this week, we dive into the new numbers on the cost of running an SMSF versus fees on retail or industry funds. Turns out the break even is around $250,000 based on administration costs rather than investments.

Still on SMSFs, David Macri suggests that while trustees might handle their own cash and domestic equities, there are particular types of investments worth leaving to the professionals for a better outcome.

Building on this theme, the White Paper this week from BetaShares shows three global tactical trades that can be executed using ETFs listed in Australia.

When we hear an investing term such as 'growth' or 'momentum' or 'quality', it's tempting to put all funds into one bucket and assume they will perfrom in a similar way. Zunjar Sanzgiri takes a look at a popular segment of the Exchange Traded Fund (ETF) market and shows how funds with the same name differ markedly.

Then Aaron Minney makes a great point about retirement planning, showing why using average life expectancy produces misleading outcomes. All retirees and their financial planners need to consider this piece.

Finally, David Walsh delves deeper into the numbers which are supposed to show that local and global markets are seeing a big wave of Zombie companies propped up by supportive government policies.

Finally, with Australian states reluctantly opening their borders as community-based transmission is negligible, no such caution for Thanksgiving Day last week in the United States. Flightradar24 monitors jet movements, and millions of Americans honoured the tradition of celebrating the harvest. While Australia can afford to take its time watching the encouraging test results, the vaccine cannot come too quickly in a country with 280,000 deaths and 14 million cases. The US recorded its worst day for COVID deaths on record last week.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website