As Australian equities have rebounded from the lows of late March 2020, many investors have doubted the rally's staying power. Pessimists argue that, based on most valuation metrics, stocks are pricey, which implies weak returns ahead.

But we believe that this overrates the predictive power of valuations, particularly in the short term. Instead, investors need to understand that long-run equity returns are driven by multiple components, of which valuation is often the least important.

Indeed, it is likely that in coming years investors won’t be able to rely on rising equity valuations for their returns. To achieve high returns and realise their investment goals in this environment, they are going to have to become even more focused on identifying the companies that can produce strong earnings growth and cash flow.

There are only three components of returns

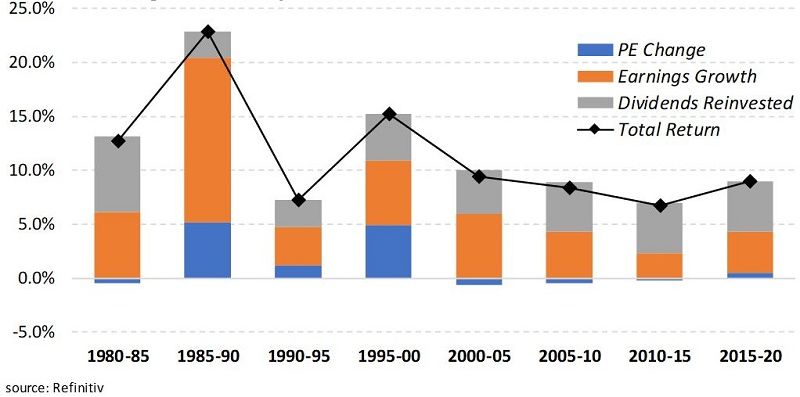

Figure 1: Components of ASX Total Returns (% per annum)

Figure 1 decomposes Australian equity market returns into their key components. As you can see, there are only three sources of returns:

- Income (grey bar) – dividends

- Earnings (orange bar) – how fast have companies grown their earnings?

- Valuations (blue bar) – how has price/earnings multiple changed? Does the market now value companies more or less for a given level of earnings?

The first two components of return are generally referred to as the ‘fundamental’ components, whilst valuations are often referred to as the ‘speculative’ component of return. The latter has earned this moniker because it is driven by unpredictable investor emotions, such as fear and greed, in the short term.

(The sum of these components approximates the return on the stockmarket, shown with a black diamond.)

An erratic contributor

The sources of return never change but their order of importance does. That is, during any of the five-year periods presented, one of these variables will exert a disproportionate influence on total equity returns. Conversely, there will be periods where a component makes little contribution.

There is no doubt that when valuations expand it can have a dramatic positive impact on total return. But valuation’s contribution is highly erratic: sometimes positive, sometimes negative. When the P/E ratio expands, the stock market generally produces double-digit returns. And when the ratio contracts, returns fall into the single digits.

In the second half of the 1980s and the second half of the 1990s, for example, the P/E ratio was a strong driver of the era's spectacular market returns. But P/E detracted from market performance through the years 2000 to 2015 when valuations subsided from the start of the high-tech bubble.

The exhaustion of PE expansion

When P/E multiples are expanding, interest rates are typically falling, and vice versa. For the two decades between 1980 and 2000, the downward trend in interest rates boosted P/Es, which resulted in huge growth in total equity returns.

More recently, we have seen this play out as central banks worldwide have drastically cut interest rates to support economies facing pandemic pressures.

But with interest rates now having already been reduced to the floor, the era of P/E expansion has been exhausted: it is unlikely that rates can fall much lower and push further P/E expansion. Instead, rising rates over the coming years – as economic growth recovers -- are likely to force a modest decline in equity valuation multiples, similar to what markets digested through the years 2000 to 2010.

This negative outlook for P/E ratios emphasises the other two sources of equity return: earnings and dividends. As you saw in Figure 1, earnings and dividends, unlike the highly volatile P/E ratio, have had a consistently positive effect on total return over the last 40 years. In fact, for much of the last 20 years, earnings and dividends have continued to boost total return, while P/Es have hindered market performance.

The emerging primacy of earnings and dividends

But while earnings and dividends become more important as sources of returns, the period of double-digit earnings gains for the broader equity market will soon be behind us as economies normalise post the COVID-19 pandemic. Going forward, earnings growth will likely occur at a more modest single-digit rate.

Fortunately, our investment process has always focussed on finding the companies that can materially grow earnings. In this environment, our expertise in identifying the profitable growing businesses of the future comes to the fore.

Meanwhile, because they are often a preferred method of free cash flow deployment, dividends are set to emerge as a more important component of total equity returns. Although we are biased to companies that can grow earnings faster than the market, we will continue to learn everything we can about a company's free cash flow and what it signals for the businesses capital management policies.

A solid year of returns from equities

Valuations are not good predictors of short-term market returns. It is futile for investors to use valuations to time the market day-to-day or month-to-month.

Valuations could fall but that does not mean returns have to be negative if the other two drivers contribute enough.

For long-term investors, the best course is to continue investing according to your plan, regardless of what the market does. You may, at times, buy when valuations are high; on other occasions, you will buy when valuations are low. It should all come out in the wash over the long term.

Our base case is we expect a year of solid returns from equities in 2021, but with the usuall high degree of uncertainty. The global economic recovery, which is currently playing out, suggests that earnings growth should positively contribute to markets in 2021.

The big differences could arise from valuations. Dividends should also be well supported this year, particularly in commodity and consumer-related stocks.

We think investors can no longer rely on a rising tide of higher valuations to lift all stocks. Alpha or outperformance, where it can be found, will be a larger portion of total investor returns. We focus on finding undervalued small and mid-cap companies that through a superior product or service can become the future leaders of tomorrow. These types of businesses will continue to be rewarded with expanding valuations as the market recognises their superior growth trajectories.

Andrew Mitchell is Director and Senior Portfolio Manager at Ophir Asset Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

Read more articles and papers from Ophir here.