The following is an edited version of an interview between Neuberger Berman MD, Gabriel Ng, and Firstlinks’ James Gruber.

James Gruber: What is the case for private equity and how should investors think about it compared to the public markets?

Gabriel Ng: We believe that private equity has a role to play in an investor's overall asset allocation.

There are a few reasons for that. Number one, private equity, over the long run, has generated premium returns to public markets, and there are some reasons contributing to that. For example, in terms of investing and sourcing for deals, these are typically done with the benefit of the ability to negotiate transaction terms with the seller, the benefit of asymmetrical information, access to private information, ability to do detailed due diligence, and form strong conviction around an investment thesis.

The second structural benefit takes place during the holding period, essentially what private equity fund managers are able to do with the companies that they acquire. Typically, they tend to take a hands-on approach, for example, hiring the right management team, launching new products, entering new geographies, optimising the cost base, optimising the capital structure, pursuing accretive target M&A's [mergers and acquisitions], or even transformative M&A's - these are the tools that private equity managers have at their disposal to improve the company's performance, and ultimately position a company for a sale.

The third part of that is how private equity managers exit or sell the company. Having the ability to control or influence the exit, they are able to determine the exit route which optimises the valuation of the company. Private equity fund managers have the ability to list the company on the capital markets through an IPO. They can sell it to a trade buyer, or they could even sell it to another private equity sponsor.

We believe all these features have enabled private equity to generate higher returns over the long run.

Of course, it comes with greater risks compared to public markets, and investors need to be cognisant of that. It's illiquid, it's less transparent and the investments are held for a much longer horizon.

So, there are trade-offs. But we believe that if you look over a 10, 15, 20 year horizon, you see that private equity has delivered premium returns.

Now, let's look at what environment we're in today, and think about how we position private versus public. If you look at the public markets, there's no denying that markets have done well in the last five years. However it has become fairly concentrated, with the Magnificent Seven accounting for a very meaningful portion of the index.

Therefore, we think of private equity or private markets as a way for investors to further diversify their exposure.

And then you have a valuation consideration as well. Public markets are fairly expensive at this point in time. Private markets could be another way to buy into some of these attractive companies at a more attractive entry valuation multiple.

JG: The fundraising environment for private equity has been challenging of late. How do you go about navigating that?

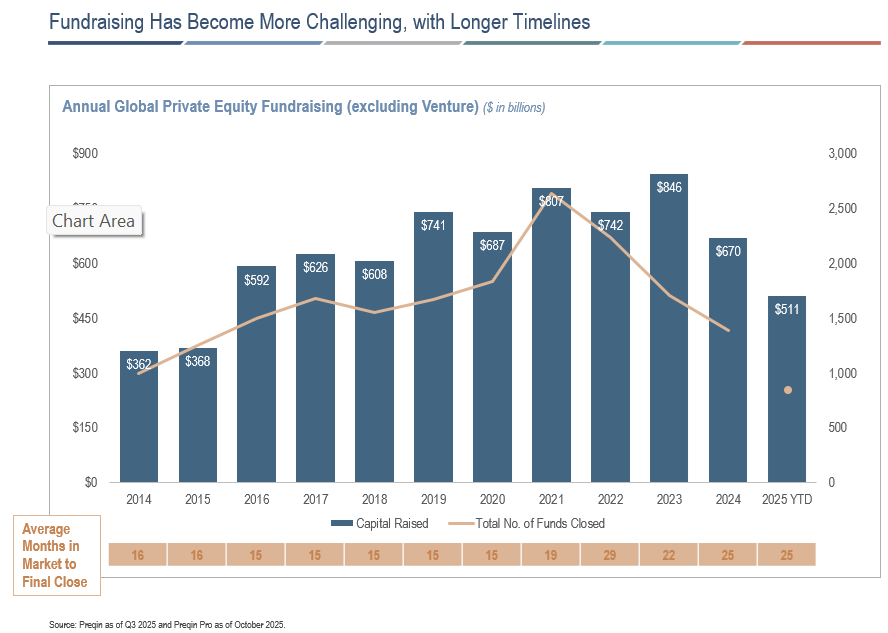

GN: Fundraising post 2021 has generally been very challenging for the industry at large. Historically, the average time taken for a private equity manager to raise a new fund was between 15 to 16 months. However, in more recent years, it's taken a much longer time, on average 24 to 25 months.

If you think about a fundraising environment, it's rather bifurcated. Many of the proven, established GPs [general partners] have managed to buck the trend. They've managed to successfully raise their funds, sometimes even beyond the target sizes that they go out with in a much shorter time frame.

On the other end, more emerging, less proven managers have really struggled to raise the target sizes or have taken very long to raise the funds.

JG: So-called co-investments and secondary investments are gaining traction - is that part of the opportunity set because of the current environment?

GN: Yes, absolutely. At the end of the day, the general partners or the private equity managers are nimble. There are several ways for private equity funds to generate distributions, and equally importantly, for investors like ourselves to be able to partake in some of those attractive opportunities.

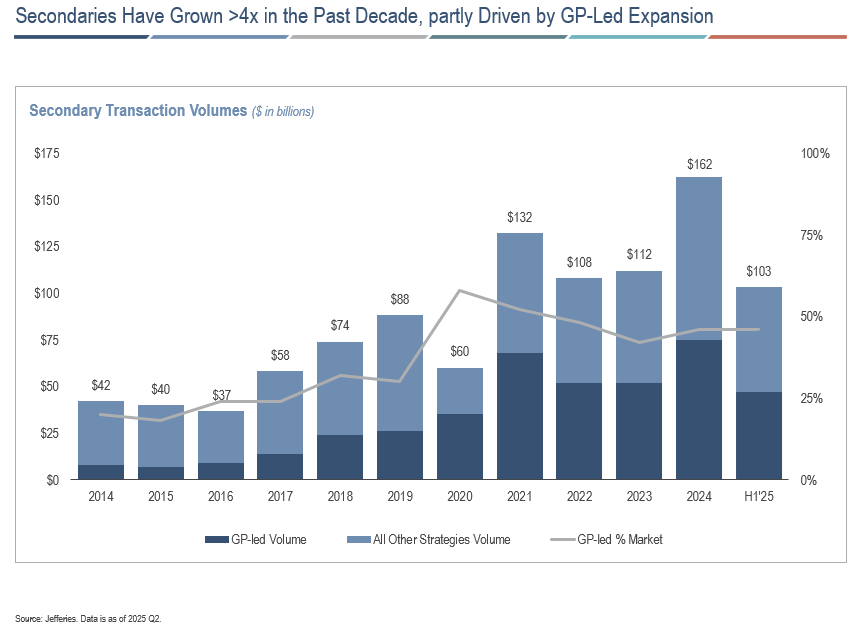

One such opportunity in the last two to three years has been GP-led secondaries. This is a situation where a private equity fund manager or GP takes one or a few of the assets in an older fund and moves them to a new continuation fund. And they bring in a new secondary investor to provide liquidity to the older LPs [limited partners], or investors.

So in that way, the general partners are able to hold on to their best assets for longer and to exit them in a more optimal exit environment and continue to compound and accrete value, but at the same time provide a liquidity option to the existing LPs.

If you look at the statistics, GP-led secondaries were a very small part of the overall secondaries market 10 years ago. But today, they represent approximately 50% of transaction volume. Consequently we are seeing see many new participants in this market.

The second way to generate liquidity is through partial equity recapitalisations. This is where a limited partner like Neuberger Berman invests in a company which one of our private equity fund managers has owned for a couple of years. Instead of selling the entire company, some private equity fund managers may choose to sell a small portion of some of the assets to an incoming, direct minority investor like us. In that way, they get to crystallize the valuation and they get to generate some distributions back to their investors. Importantly, they get to retain control for the eventual full exit.

JG: Evergreen and semi liquid funds are becoming more prevalent in private equity too - can you explain what they are and how you evaluate the different offerings?

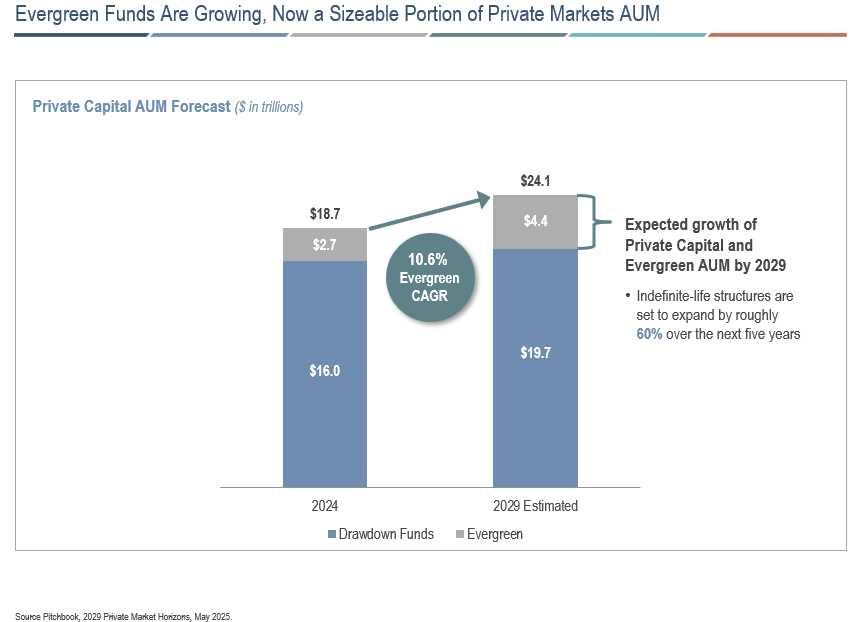

GN: If we take a step back, evergreen funds as a percentage of total private markets is still fairly small, at just under 15% of private markets AUM [assets under management].

Semi-liquid, evergreen funds aim to partially mitigate some of the constraints that have prevented individual investors or smaller investors from accessing what we believe is an attractive asset class.

There are a few ways that they go about doing it. First, these evergreen funds provide for periodic subscription and redemption (quarterly or monthly). This basically gives investors more optionality of when to invest and also when to exit (subject to liquidity gates).

Second, the minimum ticket sizes to invest are also more manageable. A lot smaller and more manageable for individual investors to create diversification by investing into one or several evergreen funds.

But of course, there are trade-offs. In return for having the option for periodic liquidity, not all the capital that is raised for the evergreen fund is deployed into investments. A portion of that, typically 10 to 15%, needs to be reserved in cash. That ultimately is a drag on performance.

And the second point to make is that while there are options for liquidity or redemptions, there are gates as well. There are certain limitations, typically as a percentage of NAV [net asset value] every quarter to which redemptions can be made.

There are also different types of strategies underpinning the various evergreen funds offers in the market so the education process and investors knowing what getting into is a very important factor as well.

JG: What does Neuberger Berman focus on in the private equity space?

GN: We've been investing in private markets for more than 30 years and have more than US$150 billion of assets under management. We have a broad ecosystem, including primary funds, co-investments, secondaries, as well as private credit.

If we focus in on what we were just talking about – evergreen funds. We offer a semi liquid evergreen fund and the overarching thesis is to create a very high quality portfolio for our investors. And we see the best way to be able to construct such a portfolio is through co-investments, as well as GP-led secondaries. And the reason being, the ability to conduct asset specific due diligence and select companies on a deal-by-deal basis. Ultimately, we seek to invest in companies that we have high conviction on, that operate in resilient markets, have a market leading position, and, importantly, are managed by a general partner or fund manager that we believe can win in that space

In terms of stage of company, we are not looking to invest in early stage, loss-making or cash burning companies within our evergreen fund offering. We're going after profitable, cashflow generating, established companies that are market leaders in their respective spaces.

James Gruber is Editor of Firstlinks.

Gabriel Ng is a Managing Director of Private Equity at Neuberger Berman, a sponsor of Firstlinks. This material is provided for general informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. You should consult your accountant, tax adviser and/or attorney for advice concerning your own circumstances.

For more articles and papers from Neuberger Berman, click here.