2025 was another great year for equity investors, the third year in a row where the ASX 300 returned more than 10%1. All investors want the good times to keep rolling, but the longer they do and the higher valuations creep the closer we are to an inevitable market correction. Investors that want to de-risk their portfolios might be tempted to sell out. However just like a great party, you don’t want to leave too early. Time in the market is more important than timing the market, and very few investors can pick the turning points.

We think there’s another option for investors wary of valuations – consider switching part of a portfolio to income-focused stocks. Long-term returns are similar, but while capital appreciation from stocks fluctuates significantly, dividends are much more resilient through the cycle.

Income is more consistent than share prices

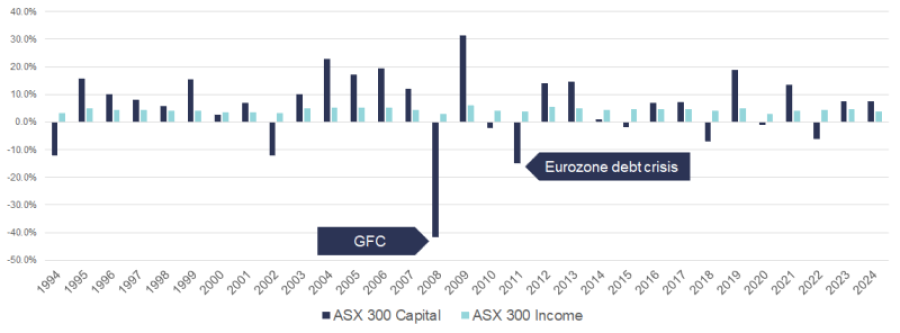

Around half of the returns from the ASX300 over the past 30 years have come from dividend income and around half from share price appreciation2. However, the way these returns have been delivered is very different as can be seen in the graph below.

Figure 1: Calendar year returns of the ASX 300 – capital vs income

Source: Factset, as of January 1, 2026. Past performance is not a reliable indicator of future performance

While capital returns have yo-yoed over the past 30 years, dividend yields have quietly motored along at around 4-5% almost every year. Dividends are inherently less volatile than share prices as dividends are paid based on the underlying profitability of the company, whereas share prices fluctuate depending on the whims of the market. Investors can also further reduce the volatility of equities by focusing on higher-quality companies, and increase the income they receive by investing in companies that pay consistent dividends.

But getting income from dividends is harder these days

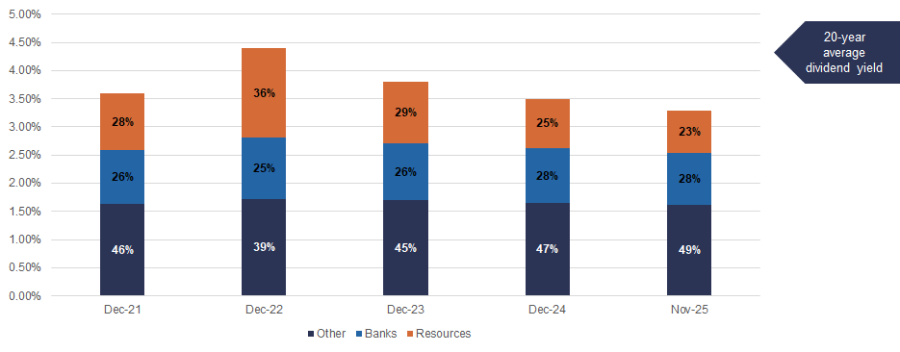

Dividends remain more reliable than capital returns, but unfortunately dividend yields have been steadily declining over the past 5 years. The dividend yield from the ASX300 is around 3.2% right now, which is down from the long-term average of 4.4%3.

The lower yields are simply a case of valuations increasing which send dividend yields lower. Financials and materials stocks make up around 50% of the index and yields for both sectors have fallen. Financial stocks have risen significantly this year and outpaced growth in earnings and dividends which means lower yields. The dividends for materials stocks have fallen even further, particularly for the big iron ore miners.

The graph below shows the drop in dividend yields from 4.5% in December 2022 (around the long-term average) to 3.2% at the end of 2025. In the past 3 years yields from financial stocks have dropped from around 5.1% to 3.8% and dividend yields from Resources stocks have fallen from around 5.5% to 2.9%iv. While the yield from banks and resources has dropped, other sectors have remained relatively consistent, and now make up a greater percentage of the overall yield.

Figure 2: ASX 300 forward dividend yield contribution

Source: Factset, as of 30 November, 2025. Past performance is not a reliable indicator of future performance

While dividend yields from resources and bank stocks have dropped, and yields in Consumer Discretionary and IT stocks are also low, it’s not the same story in other sectors. Utilities stocks are paying yields of 5.6% on average5 and there are also healthy dividends available in the Industrials sector. Many of these stocks also have steadier earnings which leads to more consistent dividends, have lower macro-sensitivity and are still trading at reasonable valuations. We like select holdings in Infrastructure and Real Estate as well while remaining cautious of anything with high debt or rate-sensitive valuations. We favour holdings with inflation protection – for example inflation-linked price rises.

Our top three income stocks for 2026 and beyond

At IML we focus on quality and value stocks and have a strong focus on lower volatility to protect capital when markets fall. We think a great income stock is one that is low risk with highly recurrent revenue to support dividend stability and growth. In this stage of the economic cycle, with inflationary pressures again threatening, we also favour businesses that are resilient through the economic cycle, have low debt, valuations that are less sensitive to interest rates and some kind of inflation protection.

In short we want to avoid dividend traps and hold businesses where we have a high degree of confidence they will pay the dividends we expect - not just this year but also in years to come.

Here are our top 3 income stocks:

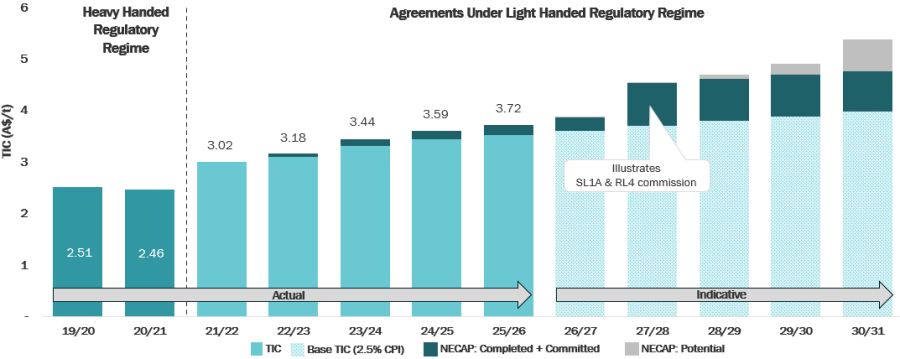

1. Dalrymple Bay Infrastructure (ASX:DBI) is one of the best assets listed on the ASX. It operates the port at Dalrymple Bay, south of Mackay in Queensland, which is a major coal export facility. It has contracts which stipulate 100% take-or-pay for the coal that runs through its ports (which means that it gets paid the same amount even if it doesn’t ship any coal). It has a long-term lease on the port to 2051 with an option to extend until 2100. The company is able to increase its prices by CPI every year and in 2031 there is a further opportunity to lift prices. The business takes very little operational or capital expenditure risk. We think this chart best exemplifies the case for DBI as it shows how steadily and consistently revenue has grown since the new, lighter touch regulatory regime. The chart aslo includes predicted growth in revenue until 2031, split up into three different levels of certainty:

- The light blue is relatively certain

- Green is completed and committed, so also nearly certain

- Grey is contingent on DBI being able to follow with its intended capex spend.

Figure 3: DBI historic and predicted growth in revenue

Source: Dalrymple Bay Infrastructure, August 2025, Half year financial results investor presentation.

Chart is indicative only and does not represent a forecast or future outlook.

DBI was up nearly 50% in 2025 but we think it has room to keep going up and is paying an attractive and growing dividend.

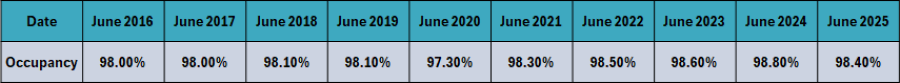

2. Charter Hall Retail REIT (ASX:CQR) is our pick from the real estate sector. It operates neighbourhood centres around Australia which have very low vacancies through the economic cycle. These centres have great anchor tenants like Coles or Woolworths, and they don’t require a lot of capital to maintain their centres from year to year. The rent for many of CQR’s tenants is linked to CPI, and rents without CPI protection have increased by more than 3% in 2025, showing strong pricing power. Reduced debt levels puts CQR in a good place if interest rates continue to rise. The table below highlights the investment thesis for CQR as it shows the stability of vacancy rates throughout the economic cycle.

Figure 4: QR convenience shopping centre retail portfolio – occupancy rates

Source: Charter Hall Retail REIT 2025 Full Year Results, 18 August, 2025

CQR was up ~40% for 2025 but is still trading at a 14% discount to net tangible assets with a dividend yield of 6.2%.6 We think it still looks reasonably priced.

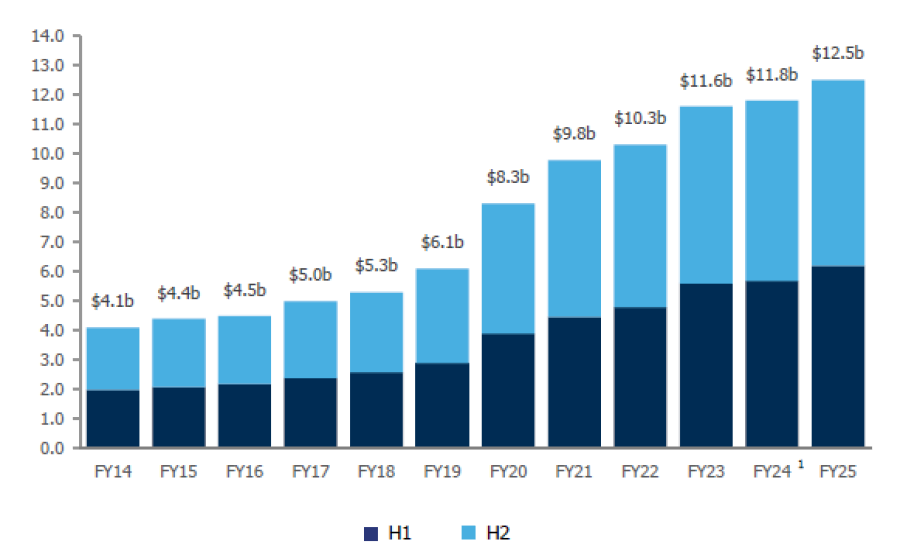

3. Steadfast (ASX:SDF) is our final income pick and one of our favourite stocks at the moment. It’s the largest insurance broker and underwriting agency in Australia and NZ, but doesn’t take any insurance risk itself. Think of your neighbourhood broker that has been in your community for 20 years, but backed by an ASX100 listed company. We think insurance broking is a great industry. It’s very reliable with consistent margins and recurrent revenue through the cycle. With an enviable 95% client retention rate insurance broking has been one of the only financial sub-sectors globally to grow in the aftermath of the GFC. SDF is winning share in distribution from insurers (like mortgage broking did decades ago) and is growing organically and through roll-up acquisitions. This increase in scale translates to improved bargaining power which allows SDF to grow its margins and earnings. The following chart shows the incredibly consistent growth in insurance premiums through the proprietary Steadfast Client Trading platform, which is gaining share of insurance premiums in the small-to-medium enterprise sector.

Figure 5: Steadfast historical growth in gross written premiums

Source: Steadfast, FY 2025 Results Investor Presentation, 28 August 2025. Note 1: FY24 restated for comparison purposes, with GWP from PSC, Honan and Envestbrokers excluded from 1 July 2023.

You can buy Steadfast today at an attractive PE ratio of ~15x, as the stock has been sold off with the insurance cycle. It has a yield of more than 4% and has been growing its dividends 13.5% pa on average since 20137. We think it still has a long runway ahead.

We think income is a good place to be this year

Many investors reassess their portfolios for the year ahead in January. It makes sense to reflect on your investments after three years of double-digit returns on the ASX 300. If you’re looking to derisk your portfolio, we think it’s worth considering a greater allocation to equity income. While earning good dividends from the ASX is harder than it used to be, there’s still plenty of high-quality stocks available to buy at reasonable prices that also offer good opportunities for capital growth. Stocks with reasonable valuations and good dividend yields tend to hold up better in a market correction. Focusing on income helps you to manage the pressure of trying to time the market while staying invested.

1. Source : ASX.com.au, as of January 1, 2026

2. Source: Factset, as of 31 December 2025 ASX 300 30yr Total Return is 9.1%, Income return = 4.3%, Capital return = 4.8%.

3. Factset, as of 31 December, 2025

4. Source: Factset, from 31 December, 2022, to 31 December 2025

5. Source: Factset, As of 31 December, 2025

6. Source: Factset, as of 16 January, 2026, both P/E and Dividend forward 12 months.

7. Source: IML estimates as at 31 December, 2025. Past performance is not a reliable indicator of future performance.

Michael O’Neill is a Portfolio Manager at Australian equities fund manager Investors Mutual Limited. Michael jointly manages the IML Equity Income Fund with Portfolio Manager, Tuan Luu. This information is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell, or hold that stock. Past performance is not a reliable indicator of future performance.