Interest rates are falling, which means the cost of money is getting cheaper. It’s a big reason most asset classes are flying this year. However, those declining rates aren’t so good for savers and those after income.

So, where can investors find income in an increasingly income-starved world? Here are some of the places to hunt for yield.

Savings deposits

There are banks that offer ok deals in this space. For instance, ING has a savings maximiser account that has a 5.0% variable interest rate.

That sounds great, though the key word in the previous sentence is ‘variable’. Markets are predicting three rate cuts of 25 basis points over the next 18 months. In my view, that’s conservative. And that means savings deposit rates are only going one way in the near and medium term: down.

Another thing to be aware of with banks offering ‘savings maximiser’ or ‘savings plus’ accounts is that the offers normally come with conditions attached, like having to make a certain number of deposits and card transactions per month.

The other downside to savings deposits is that they’re taxed as income and that isn’t great if you’re in a high income tax bracket.

So while bank savings deposits offer an easy and convenient place to park money, they may not be the best option for those after decent, sustainable income.

Cash ETFs/money market funds

‘Cash’ ETFs are an alternative to bank saving deposits. They’re listed on the ASX and invest in a range of bank savings deposits across Australia.

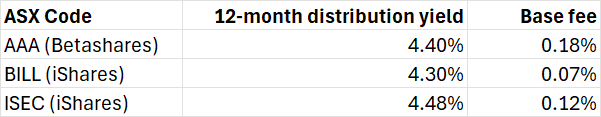

Source: Companies, Firstlinks

Like bank savings deposits, they offer ease and convenience. They’re also susceptible to lower interest rates. The 12-month distribution yields quoted in the table above should be ignored as they’re backward looking.

As a guide, the largest of the cash ETFs, AAA, says the current yield based on its holdings is 3.93% net of fees. With falling rates, that yield is likely to head further south.

Term deposits

Fixed term deposits are another cash-like option. Unfortunately, the yields on term deposits have dropped quite a bit over the past year.

Here are the current “special offers” from the big banks on term deposits now:

- CBA has a 3.8%, 12 month term deposit.

- Westpac has 4%, 11 month term deposit.

- ANZ has a 3.8%, 8 month term deposit.

- NAB has a 3.7%, 12 month term deposit.

Of the other banks, some of the better offers include:

- Macquarie Bank has term deposit rates of 4.2% for 3 months and 4.1% for 6 months.

- ING has a 4.3%, 3 month term deposit.

- Judobank offers a 4.35%, 6 month term deposit.

Rates on term deposits will drop so if you want to take up any of these offers, you’d better be quick.

Bonds

Bonds have had a torrid time over the past five years. As interest rates hit multi-century lows in 2020, they’ve since leaped higher. As rates rise, the price of bonds fall. Hence, why they’ve been the poorest performing major asset class this decade.

With higher starting yields today, bonds look in better shape. And with interest rates falling, that should also be bullish for bond prices.

At the time of writing, the 10-year Australian government bond yield is 4.30%. You can invest directly in government bonds though an easier route is via various ETFs. For example, Betashares Australian Government Bond ETF (ASX:AGVT) invests in Commonwealth and state government entities and has a yield to maturity of 4.6%.

You can get more yield with corporate bonds though it comes with greater risk too (corporates are more likely to default vs governments). There are plenty of low-cost ETFs that invest in corporate bonds. For example, VanEck’s Australian Corporate Bond Plus ETF offers a portfolio with an A- credit rating (reasonably high) with a yield to maturity of 4.9%.

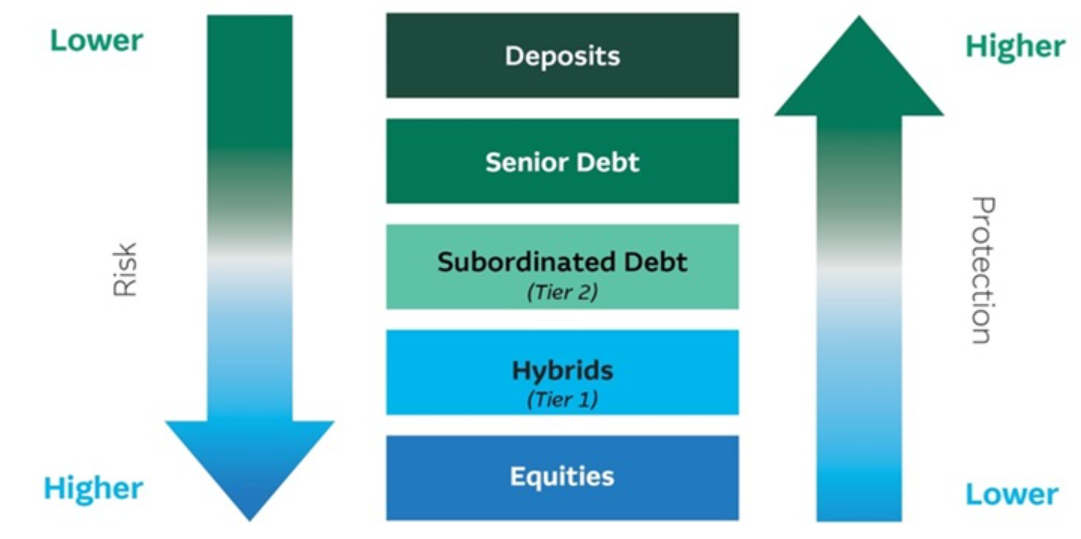

Another option that is becoming more popular is subordinated debt. Also known as Tier 2 capital, subordinated debt is debt owed to an unsecured creditor. The securities rank below senior debt in terms of repayment priority in the event of insolvency of a company.

Source: Macquarie Asset Management

Naturally, there are ETFs for subordinated debt too. For instance, VanEck’s subordinated debt ETF (ASX:SUBD) invests mostly in Australian bank tier 2 debt and currently has a yield to maturity of 4.82%.

When investing in any bonds, it’s important to check their characteristics including their duration, average maturity and credit quality.

The risk for bonds is if inflation and interest rates reverse course and start going up. That shouldn’t be discounted given governments, especially in the developed world, are complacent about running ever higher budget deficits and debt levels.

Stocks

Historically, Australian stocks have been great sources of yield, though that’s not so much the case today. Dividend yields have plummeted as the ASX has soared. The ASX 200 dividend yield stands at just 3.3% or 4.7% when grossed up.

The largest weight in the ASX 200, CBA, has a yield of 2.6%. The other banks offer better potential income, with NAB, Westpac, and ANZ, having dividend yields of 4.5%. 4.6%, and 5.5% respectively. Unfortunately, these banks aren’t growing earnings much, so there’s little prospect of growing dividends going forward.

The other index heavyweights, the miners, have reasonable dividend yields. However, I’m of the view that investors should never buy resource companies for their dividends. That’s because they’re highly exposed to the swings in commodity prices and that makes future earnings and dividends hard to gauge.

Minus miners, you may have to dig deeper to find ASX companies with decent, sustainable yields. The following are four stocks that I like for income:

1. Chorus (ASX:CNU)

Chorus is the owner of New Zealand fibre network. New Zealand’s economy has been in the dumps and that’s hit the company’s revenue and earnings. At its half-year results, EBITDA (Earnings before interest, tax, depreciation and amortization) fell 1%, however it was still able to raise its interim dividend because capital expenditure declined. The full year dividend should come in around 57 cents, which equates to a 7.15% yield. And that yield seems assured, without much risk attached.

2. Dalrymple Bay (ASX:DBI)

The company owns the Dalrymple Bay Coal Terminal which is the largest exporter of metallurgical coal in the world, with the capacity to move over 80 million tonnes of coal every year. It’s a monopoly asset that’s regulated though the regulators apply a light touch.

The current agreement on prices runs to 2031 and gives certainty to future revenue and returns. Current distributions of 5.9% should rise in the years ahead.

3. Charter Hall Retail REIT (ASX:CQR)

This REIT owns $4.5 billion in neighbourhood retail assets. Typically, these assets have a big supermarket with 5-10 tenancies surrounding it, like pharmacies, butchers, bakers, and cafes.

These are secure tenancies. And that’s evidenced by CQR’s occupancy rates, which have averaged close to 98% over the past 20 years.

The company has a current dividend yield of 6.5%.

4. Woolworths (ASX:WOW)

Woolies has been in the doghouse for a while. It had the disastrous Masters misadventure, then lost market share as competition heated up from Coles and Aldi. The worst is likely behind it and market consensus has earnings growing by 15% p.a. over the next three years.

While the dividend yield is low at 3.1%, the dividend has the potential to increase moving forward.

Dividend ETFs

Rather than directly investing in stocks, you can also buy dividend ETFs. Vanguard’s Australian Shares High Yield ETF (ASX:VHY) is the granddaddy of the dividend ETFs. It currently sports a dividend yield of 4.3% - quite a bit higher than the ASX 200 yield.

The risk with this ETF is its heavy exposure to banks and miners. Financials are 40% of the portfolio and materials and energy are 30%. Given financials have limited growth prospects and commodity companies are inherently volatile, there are question marks about whether VHY’s dividends can rise much from here.

Listed investment companies (LICs)

There are three primary listed investment companies that offer investors exposure to income. The Plato Income Maximiser (ASX:PL8) and Whitefield Income (ASX:WHI) invest in ASX companies have dividend yields of 4.7% and 5.1% respectively.

ETF newcomer, WAM Income Maximiser (ASX:WMX), provides an equity/bond portfolio, with a current 66%, 34% split between the two. And it has a 5.2% yield including franking credits.

The three LICs have merits, however all trade at premiums to their net asset values. Plato is at a chunky 20% premium, while Whitefield and WAM are at 8% and 7% premiums.

Given this, it might be wise to wait for the popularity of these income-type LICs to simmer before taking the plunge.

Summing up

I’ve tried to go through the various options for income, assessing the pros and cons for each of them.

Let me know of any alternative income sources I may have missed.

James Gruber is Editor of Firstlinks.

Charter Hall, Vanguard and VanEck are sponsors of Firstlinks.