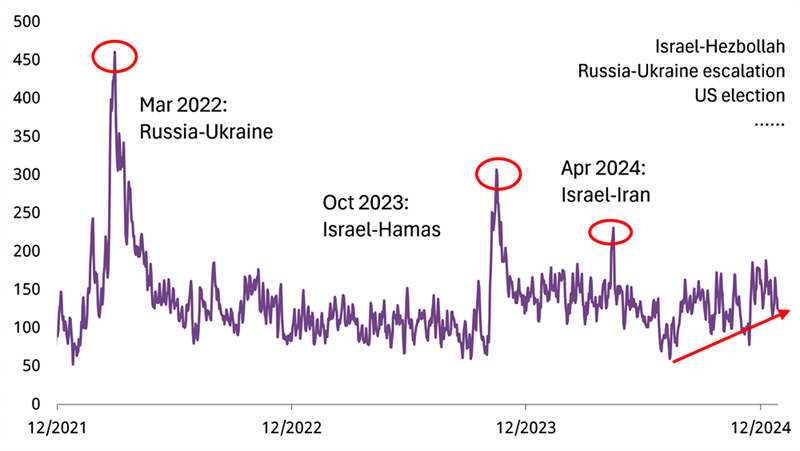

2024 witnessed a variety of events which shaped investor sentiment and asset performance. US elections stirred markets, while ongoing geopolitical tensions kept global investors cautious (Chart 1). The US Federal Reserve initiated an easing cycle with three rate cuts totalling 100 basis points, while the Reserve Bank of Australia (RBA) held rates steady, lagging its peers.

Chart 1: Relentless parade of geopolitical risks kept casting shadows over global landscape

Geopolitical risk index*

*As of 31 December 2024, on a 5-day rolling average basis. Source: GPR, World Gold Council

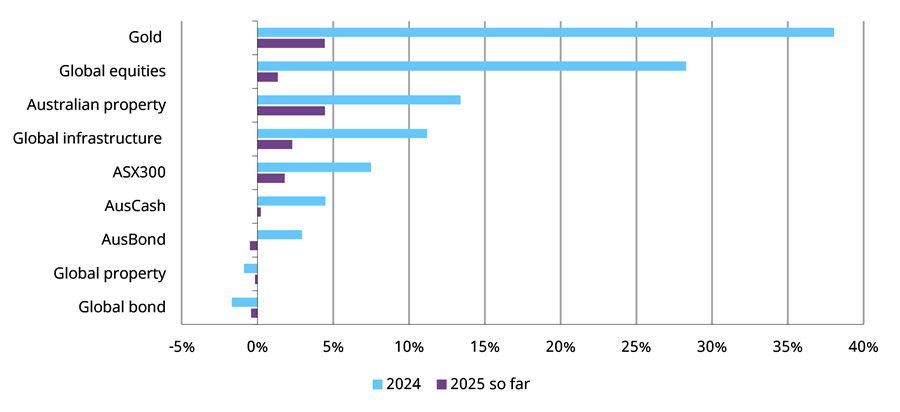

Assets saw varied performances (Chart 2). The AUD weakened by 10% against the dollar - the widening US-Australia yield spread, particularly in Q4 amid diverging stances from the Fed and the RBA, was a key contributor. Local equities finished the year stronger and Australian properties also powered higher.

However, gold, denominated in AUD, led all others in 2024, delivering a stunning 38% surge. Strong investment demand, rising geopolitical risks and a weaker AUD supported gold’s rally. And similar drivers have extended gold’s strength into 2025, delivering a 4.9% return so far.

Chart 2: Mixed bag domestic asset performance and gold held the lead

Various assets’ performances in AUD during 2024*

*As of December 2024 & 17 January 2025. Based on LBMA Gold Price PM, MSCI World Index, ASX REITs Index, Bloomberg AusBond Bank Bill Index, ASX300 Index, FTSE Global Infrastructure Index, Bloomberg AusBond Composite Index, Bloomberg Global Agg Index and FTSE Nareit Developed Index. All calculations in AUD. Source: Bloomberg, World Gold Council

2025 outlook: A case for gold in AUD to thrive?

This year is likely to be supportive for gold. As our 2025 Gold Outlook noted, while US Treasury yields and the dollar may stay elevated, upside potential for gold could come from continued central bank gold purchases and possible spikes in geopolitical risks. Meanwhile, volatilities in equities and bonds as well as potential weaknesses in non-US currencies could all provide additional boosts to investment demand for gold. Also, with uncertainties in US bond market staying elevated, we believe the impact from yield changes may be less pronounced on gold as our recent analysis shows.

Furthermore, we believe potential weakness in the Australian dollar may provide an additional boost to gold in local currency terms. Such currency weakness may stem from two main fronts:

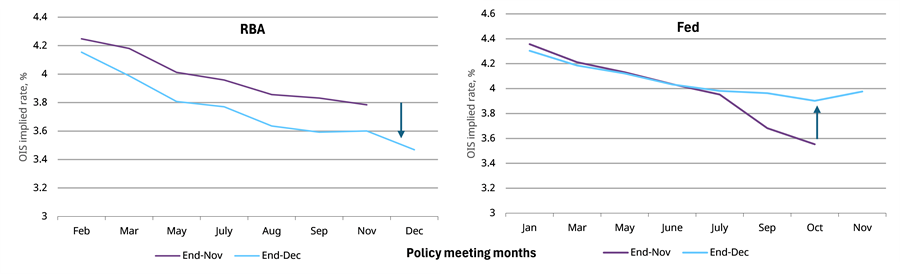

1. Changes in monetary policy expectations

Although the RBA left rates unchanged in their December meeting, they noted that growth momentum has weakened and the upside risk of inflation has also diminished. And while labour market prints may muddy the case for a cut in February, Q4 inflation data should have more weight in the rate decision – and the cooling momentum may continue judging from November’s downward trend in the trim-meaned monthly CPI. Currently, the market is pricing in a 70bps cut in total for 2025, much higher than the previous expectation (Chart 3, left).

Conversely, reflation concerns in the US and the surprising strength in both growth and the labour market have made investors push back their expectations of further rate cuts – now the market is only pricing in around 50bps rate reduction in 2025, a pivotal change from around 100bps in December (Chart 3, right).

Thus, there is a possibility that the RBA delivers more rate cuts than the Fed, further widening the interest rate spread between the two countries, weighing on the AUD.

Chart 3: Diverging rate expectations

Policy rate expectations reflected in OIS futures*

*As of January 2025. Source: Bloomberg, World Gold Council

2. Potential growth risk

Restrictive financial conditions, declining real income and cooling momentum in the housing sector have weighed on Australian growth in 2024. And these risks may continue into 2025 if rates remain restrictive or the lagging effect of elevated interest rate continues to kick in. Additionally, uncertainties surrounding Chinese economic development may also pose challenges.

As historical data shows, sluggish growth usually lead to weakening currency of the country.

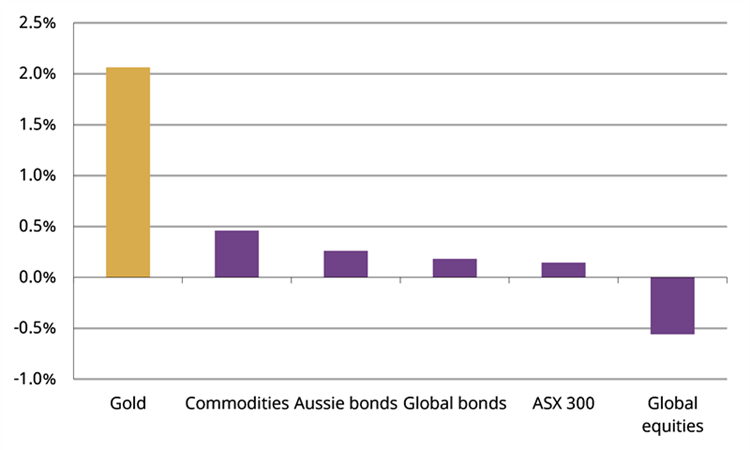

Other risks such as geopolitical challenges may also induce volatilities in local assets, creating stress for Australian portfolios. This was a key topic of concern among APAC investors discussed in our previous research. We believe gold’s positive outlook and its ability to cushion geopolitical risks should make it a key asset in local portfolios (Chart 4).

Chart 4: Gold has performed well during geopolitical risk surges

Performance of various assets during geopolitical risk spikes*

*Based on average weekly performances in AUD of the LBMA Gold Price PM, Bloomberg Commodity Index, Bloomberg Australian Bond Index, Bloomberg Global Bond Aggregate Index, ASX300 Index, and MSCI World Index. We show here the average of the top 10 geopolitical risk surges based on the Geopolitical Risk Index. Source: matteoiacoviello.com, Bloomberg, World Gold Council.

In conclusion, after an exceptionally strong year, we believe gold could continue to shine in 2025. Although the macro development this year may bring some headwinds, the global geopolitical landscape and risks stemming from financial markets will keep attracting attention from both official institutions and retail investors. Meanwhile, the potential risk of the AUD weakness could make gold more attractive in local investors’ portfolios. And over the longer term, we anticipate a resilient return from gold, largely in line with global GDP growth.

Ray Jia is a Senior Research Analyst and Marissa Salim is a Senior Research Lead, APAC, at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.