For non-specialists, one could be forgiven for believing the Australian real estate investment trust (A-REIT) sector is an efficient way to gain exposure to passive-style rental-based real estate returns. And in the past, this assumption would be true.

However today, the structure of the sector is such that a large proportion of the index generates income from highly active business which bears little resemblance to rental income flows.

Today, many REITs earn their income from one of three broad sources:

- Rental income (passive)

- Development income (fees and profits)

- Funds management / transaction income.

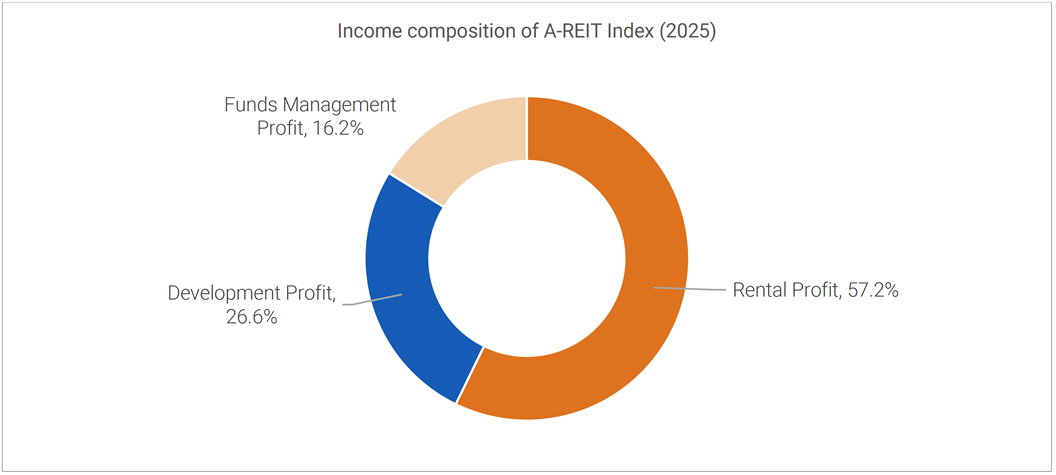

When weighted by index representation1, an investor’s underlying exposure to the index looks like this.

Source: Company reports, Quay Global Investors.

By comparison, in the 1990s when AREITS first rose to prominence as a source of low-risk rental-based income, the index looked like this.

Source: ANZ McCaughan (Australian Property Trust Review), Quay Global Investors.

In the 1990s, there were well over 20 listed REITs, with all but one earning passive rental income. The one exception was Stockland Trust Group where residential land subdivision accounted for ~20% of net income. Stockland was widely considered to be the ‘risky one’2.

The sector evolved into the early 2000s where companies like Multiplex and Mirvac added to the industry’s ‘active nature’ to underlying profits. By 2008 however, it was the excessive debt that decimated the industry as a global credit crunch forced highly dilutive equity issues or even bankruptcies on a number of local REITs.

While the sector learned its leverage lesson from the GFC, from our perspective, many companies simply swapped financial leverage (debt) with operating leverage (uncertain revenues and margins) all in the pursuit of higher returns.

Why this matters

There is nothing wrong with the management of property development model per se. Without developers there would be no real estate. In the same vein, the real estate fund management business model can make sense. But at times we think investors who try to compare A-REITs to global REITS are underestimating the risks of these alternate exposures.

The developers

The developer model is pretty simple: Buy or gain access to a site, build a structure and sell it for more than the cost. The difference is profit. A very reasonable business. What comes across to us as unreasonable is assigning a traditional rental or equity multiple on this type of profit.

This is significantly different to passive rental income. For a developer, revenues can literally disappear overnight as would-be buyers pull out of the market for various reasons (GFC was a perfect example).

The earnings volatility here can be extreme. A development division profit could turn negative in the blink of an eye. And as we learned during significant risk off periods, banks and financiers will be loath to extend credit to non-income producing development sites.

Compare this to a passive rental REIT. If the environment turns unfriendly, near-term profits are somewhat protected by lease duration. And without the need for immediate capital for development, it can be relatively insulated from credit events so long as leverage ratios are reasonable. And while some occupancy loss may result in some income erosion, this type of asset class does not go from profit to loss in a matter of weeks due to an external shock.

The fund managers

The real estate fund management model is equally simple: Collect fees (management, transactional, performance) by amassing assets on behalf of investors.

Again, this too can be more volatile than passive income, as both the AMP and Lend Lease have discovered recently with the loss of (or winding down of) funds due to client and risk appetite changes. And while owners of passive real estate can lose a tenant, short term income loss can be replaced as the building structure is still owned by the investor. So, the income loss is temporary.

At first there is no risk, then it comes all at once

In a rising market, or within a sector with demand tailwinds, developers and fund managers can meaningfully outperform the passive rental REITs. After all, operating leverage works in both directions.

Understanding the underlying nature of these businesses, and hence the underlying risk of the A-REIT index is important. Because during an up-cycle there does not feel like there is any additional risk. Stocks within the sector move around in a similar fashion based on earnings guidance, and macro forces. Traditional risk measures such as betas, tracking errors, and standard deviations all look normal. And in good economic times development profits grow and fund management and performance fees swell.

It is only when there is a meaningful shift in the economy or sector do the risks come – and they can come all at once as development profits dry up, or performance based / transaction fees disappear.

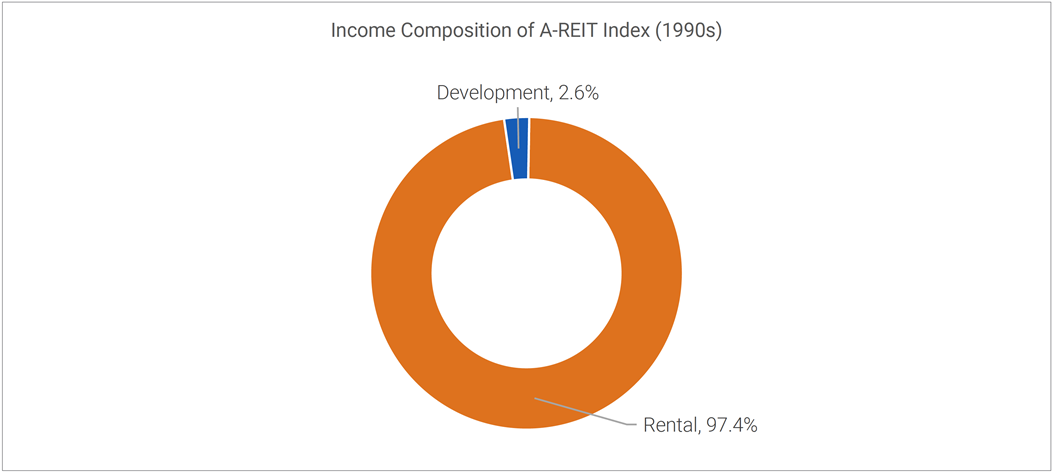

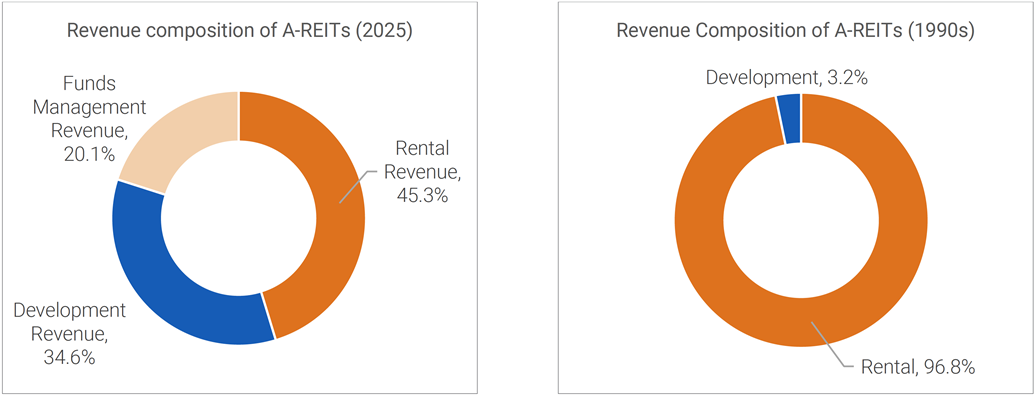

Which brings us back to our original charts.

When thinking about the development and fund management exposure, the risk is not on the income. The risk relates to the revenue. Re-casting the sector on this basis (and comparing it to the 1990s) highlights just how much the sector has evolved from its history of being a passive rental income exposure to a much higher risk asset class.

Source: Company reports, Quay Global Investors.

Concluding thoughts

We explicitly exclude developers and fund managers from our investment universe. We do this because:

- owning a developer runs contrary to our philosophy of seeking assets priced below replacement cost (where developers operate in the exact opposite environment); and

- we fundamentally believe owning assets with low-income risk backed by stabilised assets translates into low investment risk.

This is not to say the A-REIT sector can’t continue to perform in the near term, but for those that invest in the passive index, or in index aware strategies, be aware of your underlying exposure and just how much that exposure has changed over the years.

[1] S&P/ASX 200 REIT Index.

[2] As a side note, in the 1990s Stockland expensed all costs associated with the land bank through the profit and loss statement. The land was held truly “at historic cost”. This compares to the modern practice of holding land at cost plus capitalised holding costs and capitalised interest. Stockland’s margins were therefore wider and profits less risky.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed. This article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

This information is issued by Bennelong Funds Management Ltd (ABN 39 111 214 085, AFSL 296806) (BFML) in relation to the Quay Global Real Estate Fund (Unhedged) Active ETF and the Quay Global Real Estate Fund (AUD Hedged) Active ETF.