The ‘Vanguard Economic and Market Outlook 2021: Approaching the Dawn’ says the expected path to economic recovery hinges on controlling COVID-19. An improvement in the health of the global population will result in an improvement in the economy. Thanks to swift fiscal and monetary policy responses, many economies are in a better position now than during the second and third quarters of 2020.

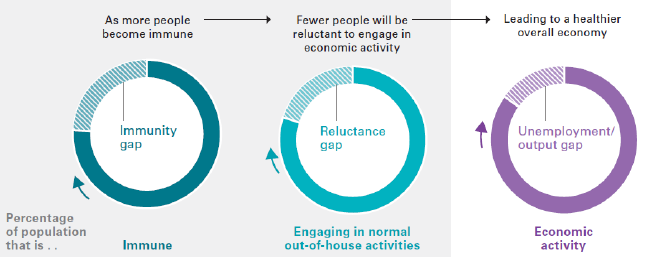

The next phase of recovery depends on greater immunity to COVID-19 and reduced consumer reluctance to engage in normal economic activities. Should a vaccine become distributed, administered broadly, and be effective, much of the economic losses from COVID-19 could be recovered in the next year. That said, there is risk that if immunity does not rise, economies may only see marginal progress from current levels.

The way the health recovery will drive economic activity is like this:

Which leads to the base case economic scenario for 2021:

- Major economies will achieve greater immunity to COVID-19

- Face-to-face social and business activity will normalize

- Unemployment rates will fall

- Inflation rates will move higher, and

- Pre-pandemic levels of economic output will be reached

In countries with more effective containment of the virus, such as in Australia and China, the return to normalcy may prove to be slightly faster, with Australia’s expected growth of 4% likely to fuel an expected return to pre-pandemic levels by the middle of next year compared to the end of the year for countries such as the Euro Area and the UK.

Three post-pandemic scenarios

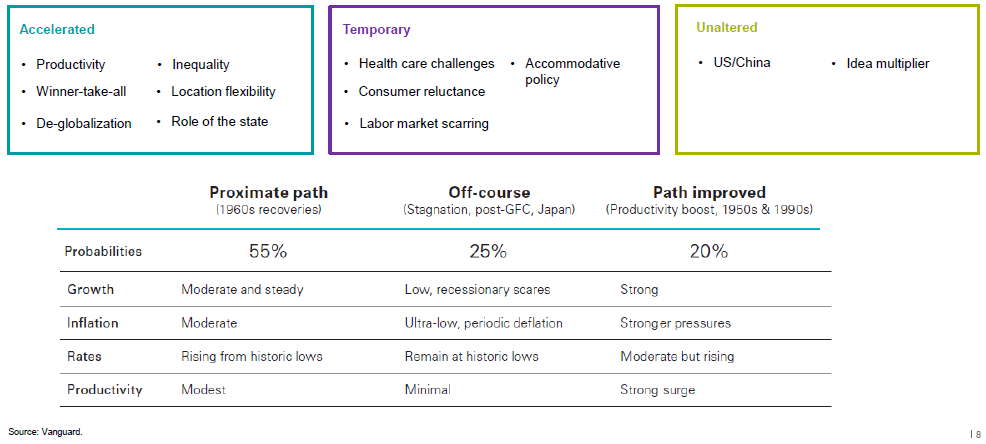

Looking beyond the shadow of COVID-19, our outlook details longer-term effects that the pandemic may have on the economy, including: the acceleration of work automation and digitalisation (i.e. working remotely), continued slow-deglobalisation and supply chain recalibration, as well as changes in the expectations and preferences for government policy.

Under the confluence of these forces, Vanguard hypothesises three possible post-COVID scenarios over the medium-term with consequences for growth, inflation, interest rates and productivity. We assign probabilities to each, as follows:

Compared with falling into a prolonged stagnation (‘off-course’) or a rapid reflation and surge in productivity gains (‘path improved’), we see a return to steady but still moderate growth, and interest rates normalising gradually from historic lows, though remaining low and supportive for some time.

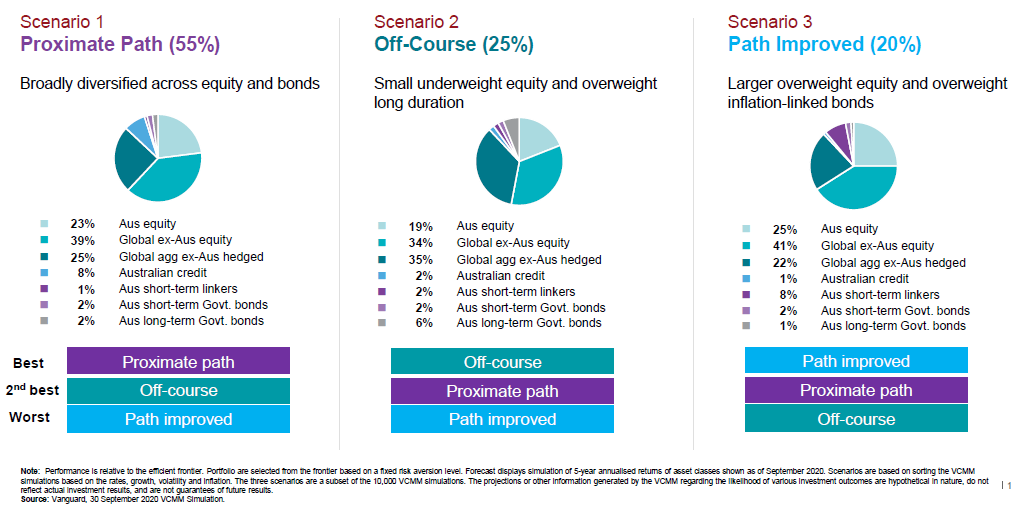

Based on these scenarios, balanced portfolios with different asset mixes may not always shoot the lights out but they will not produce the worst results either. They are a good solution for most long-term investment portfolios and for investors who do not hold a strong view about the future state of the economy.

A moderating outlook for global asset returns

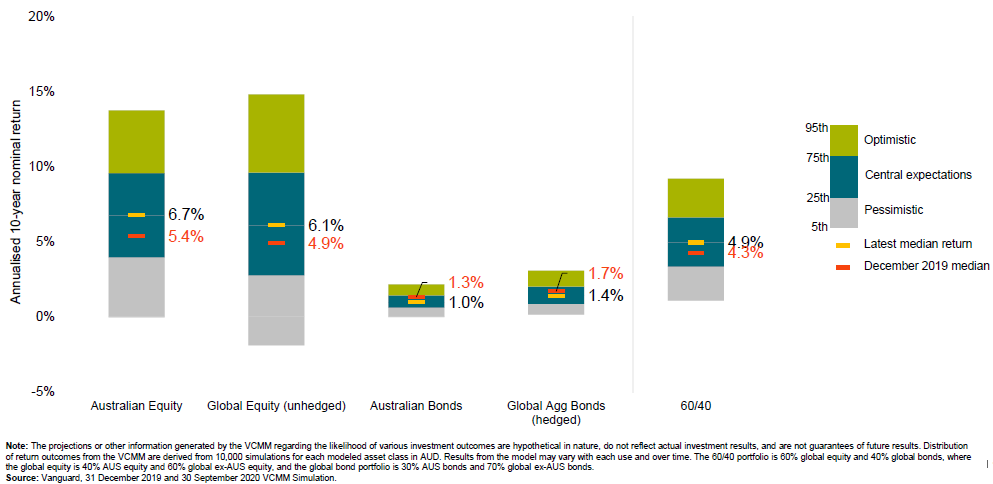

Vanguard’s Capital Markets Model projections gives an outlook for global and Australian equities in in the 5%-7% and 5.5%-7.5% range respectively for returns over the next decade. While this range is below returns seen over the last few decades, equities are anticipated to continue to outperform most other investments and the rate of inflation.

10-year annualised forecast: setting reasonable expectations

Interest rates globally are expected to remain low despite a constructive outlook for firming global economic growth and inflation as 2021 progresses. While yield curves may steepen, short-term rates are unlikely to rise in any major developed market as monetary policy remains highly accommodative. Bond portfolios of all types and maturities are expected to earn returns close to their current yield levels.

Risks to the Australian outlook

The risk to the economy and markets should shift as 2021 progresses. Between now and widespread vaccine distribution, health-related risks to economic growth and sentiment should prevail. However, as growth and inflation firm in 2021 and immunity to COVID-19 increases, an 'inflation scare' is possible. Ultimately, inflation could cyclically bounce higher in the middle of 2021 from current lows owing to an ongoing economic recovery, before plateauing back to the mid to low 1% levels, and such a move could introduce market volatility.

Meanwhile, the tapering of relief measures poses a risk to the consumption and financial stability outlook, but Vanguard takes comfort in the resilience and speed of the initial recovery to date, and expect the household savings buffer to be used to smooth spending.

In 2020, disciplined investors were yet again rewarded for remaining invested in the financial markets despite troubling headlines and a challenging environment. For 2021, the wisdom will be to maintain that same level of discipline and long-term focus, while acknowledging returns may moderate from the past.

Qian Wang is Chief Economist, Asia-Pacific and Beatrice Yeo is Economist, Australia in the Vanguard Investment Strategy Group. Vanguard Australia is a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any individual.

For articles and papers from Vanguard, please click here.