Even as the global economic outlook weakens, powerful tailwinds are forming behind certain areas of the equity markets that previously spent many years in the wilderness.

Chief among them are stocks in markets such as Europe and Japan, which have surged in recent months amid a pronounced decline in the US dollar. This trend is part of a larger broadening of investment opportunities over the past year — in contrast to the prior decade when large-cap US tech stocks dominated market returns.

Declining dollar could boost non-US stocks

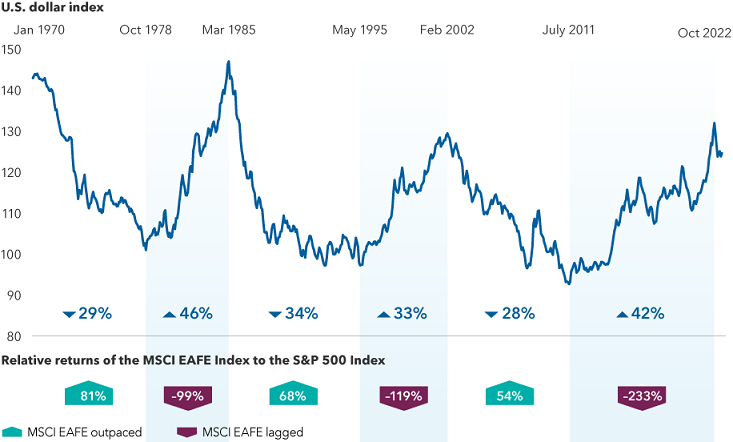

At least part of this dynamic has been driven by a significant reversal in the strength of the US dollar. After an 11-year bull run, dollar dominance appears to be on the ropes as the greenback weakens against the euro, the yen and many other currencies. A continuing downward trend would be welcome news for investors in non-US stocks and bonds, where currency translation effects have eroded returns in recent years.

Non-US stocks have rallied in periods of dollar weakness

Sources: Capital Group, J.P. Morgan, MSCI, Refinitiv Datastream, Standard & Poor’s. Relative returns and change in the USD index are measured on a cumulative total return basis in USD. The U.S. dollar index reflects J.P. Morgan’s USD Real Broad Effective Exchange Rate Index, which is re-based to 100 as of 2010. As of May 31, 2023. Past results are not predictive of results in future periods.

Markets outside the US are already showing signs of a currency boost. As the dollar slipped, European stocks generated the strongest returns among developed markets during the fourth quarter of 2022 and the first quarter of 2023. Japanese stocks, too, have staged an impressive rally — with the Tokyo Stock Price Index, commonly known as TOPIX, rising to a 33-year high in mid-May.

Since reaching a peak last October, the dollar has declined about 6%, as measured by the J.P. Morgan USD Real Effective Exchange Rate Index. While that may not seem like much, as my colleague Andrew Cormack points out, currency trends often play out over long periods of time. He says, “The dollar tends to move in big cycles over many years. And I think the strong dollar cycle we saw over the past decade was a bit long in the tooth.”

While the dollar may yet see intermittent periods of strength due to its perceived status as a safe-haven asset, Cormack believes the long-term trajectory is lower. That’s due to several factors, including a soft US economy, a weak housing market and indications that the Federal Reserve may be done raising interest rates for the balance of 2023.

US equities also have done well so far this year, largely thanks to a rebound in Big Tech stocks. Technology has been the best performing sector so far this year in the S&P 500 Index, driven in part by investor enthusiasm for the rise of artificial intelligence (AI) systems, such as ChatGPT. Earlier this year, ChatGPT, co-owned by Microsoft and Open AI, became the fastest growing consumer app in history.

The difference now is that tech stocks are no longer the only game in town. Other areas of the market are also enjoying time in the spotlight, suggesting the future of growth investing may be more inclusive.

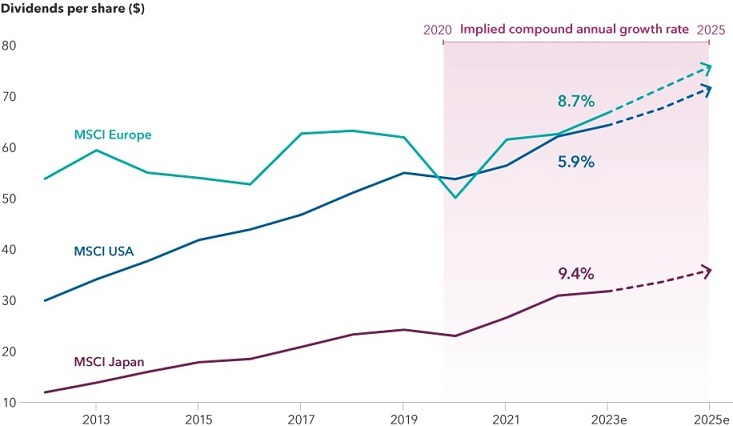

Dividend stocks rise in importance

In this environment, dividend-paying stocks may take on greater prominence, especially if global economic growth continues to slow and market volatility returns. This is also an area where international markets have had an advantage given the higher number of dividend-paying companies headquartered outside the United States and the emphasis they place on returning cash to shareholders.

For example, French drug maker Sanofi has increased its dividend payout for 28 consecutive years. UK-based consumer goods giant Unilever has done so for 22 straight years. As of 31 May, 2023, more than 600 companies headquartered outside the US offered hefty dividend yields between 3% and 6%. That compares to 130 in the United States.

Across all markets since the start of 2022, dividend contributions to total returns have increased, as have total payments to investors. Global companies distributed more than $2 trillion in dividend payments for the 12 months ended 30 April, 2023, an 8.9% increase from the previous 12.

Caroline Randall, a portfolio manager at Capital Group comments: “I expect dividends will be of greater significance to investors this year and beyond. But in a period of relative instability and rising debt costs, it is essential to focus on the quality of dividend payers.”

The dividend decade is here

Source: FactSet. Data for 2023 to 2025 is based on consensus estimates as of May 31, 2023. CAGR = compound annualized growth rate.

For Caroline, finding quality dividend payers means closely scrutinising company balance sheets, credit ratings and interest costs. This has guided her to select companies across the pharmaceutical and medical device industries, utilities, energy producers and some industrials.

“It is critical to track what management says about dividends and equally critical to follow what they do. If you are going to rely more on dividends, you must be confident the companies will pay them. That’s where we can add value as active managers.”

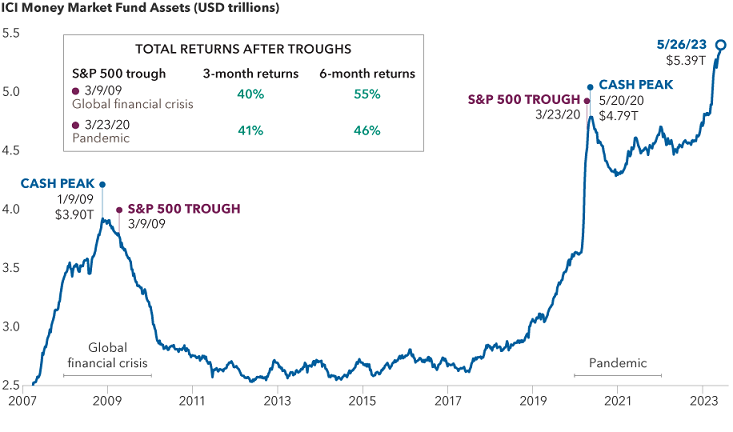

Bullish signal: A mountain of cash on the sidelines

Given these and other opportunities, now may be the time for investors to consider moving out of cash. In recent months, investors have shifted assets from stock and bond investments and driven money market totals to a record $5.39 trillion, as of 26 May, 2023.

This flight to cash and cash alternatives such as money market funds and short-term Treasuries is understandable following last year’s tandem decline of stocks and bonds in the face of rising interest rates, inflation and slowing economic growth. Many investors moved deposits from banks to money markets amid ongoing volatility and relatively high yields on cash alternatives.

Investors’ flight to cash has been followed by strong returns

Sources: Capital Group, Bloomberg Index Services Ltd., Investment Company Institute (ICI), Standard & Poor’s. As of May 26, 2023. Past results are not predictive of results in future periods.

But conditions have shifted thus far in 2023, and long-term investors may want to rethink their approach. Levels of cash alternatives peaked near two recent market troughs. During the global financial crisis, for example, money market fund assets peaked two months before the S&P 500 Index reached a bottom on 9 March, 2009. The stock market recorded a 40% return over the subsequent three months and a 55% return over the following six months.

Similarly, during the pandemic, money market fund levels reached a high weeks after the S&P 500 hit its trough in March 2020.

After the painful losses of 2022, more risk averse investors might consider allocating some cash to dividend-paying stocks, which can provide income and capital appreciation potential, as well as select short- and intermediate-term bonds, which have been offering higher yields than in 2022.

Looking out across the investment landscape, short-term bonds, dividend-paying stocks and non-US stocks stand out for their attractive valuations and historically lower volatility, offering potentially attractive alternatives to cash for cautious investors seeking a re-entry point.

Matt Reynolds is an Investment Director for Capital Group Australia, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.