It’s been widely noted how profitless companies in the US have trounced the S&P 500 this year. Less spoken of is that a similar thing has happened here, according to Mark Freeman, CEO of Australian Foundation Investment Company (AFIC).

Gold and smaller miners have soared while many blue-chip stocks have been left behind. For fund managers like AFIC which favour quality companies, it’s been a tough ride.

Freeman cites Goodman Group (ASX: GMG), REA (ASX: REA), and Car Group (ASX: CAR) as examples - all fantastic businesses, though their share prices are down 17%, 15%, and 4% respectively in 2025, compared to the 5% gain in the ASX 200 index.

Source: Morningstar

Source: Morningstar

Source: Morningstar

Even after more than 30 years working in markets, Freeman has been taken aback by some of the volatility in share prices. The market has walloped any company with even a hint of disappointing news.

A cynic might suggest that his remarks are cover for AFIC’s underperformance versus the index this year. Freeman acknowledges that recent performance has been “confronting” for shareholders.

However, he is very comfortable – “relaxed”, in his words – about where the current AFIC portfolio is positioned.

Your author checked AFIC’s portfolio before the interview and had a similar reaction to Freeman’s. It’s a portfolio I’d be comfortable holding - full of quality, growing companies with generally sound balance sheets and management teams.

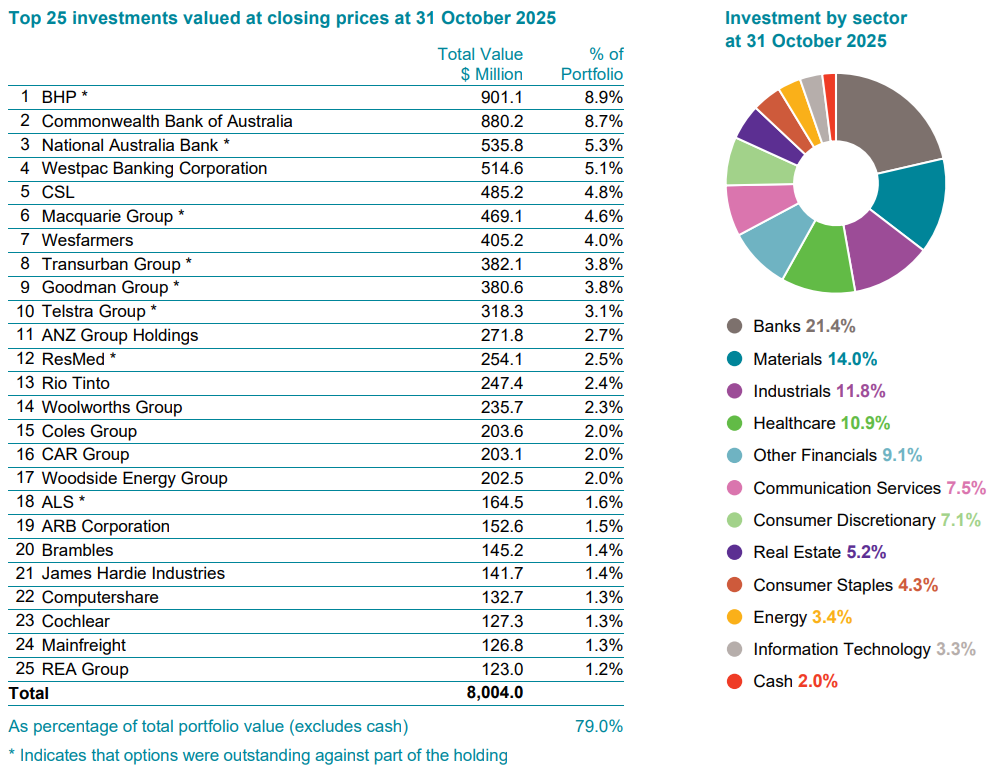

Source: AFIC

There are a few things that stand out with the portfolio. First, AFIC remains significantly underweight the Big 4 banks versus the index. It’s overweight NAB (ASX: NAB), but substantially underweight CBA (ASX: CBA) and ANZ (ASX: ANZ).

Second, it’s also underweight materials. The main holdings in resources are BHP (ASX: BHP) and RIO (ASX: RIO).

Third, there are major overweights in industrials, consumer discretionary, and healthcare. These are the main areas where AFIC is plying its trade.

Portfolio problem children

A few AFIC stocks have been in the news for the wrong reasons. CSL (ASX: CSL) is a big one given it’s AFIC’s fifth largest holding.

Freeman says the brutal plunge in the share price is partly down to a downgrade in earnings expectations. CSL had been guiding double-digit earnings growth but the latest profit growth has come in at 5-6%. The other factor behind the decline in the share price is valuation multiple compression. Previously, the market had been exuberant and priced CSL at close to 40x earnings. That’s dipped to 16x – a massive derating.

Freeman thinks the market reaction looks overdone if the company can deliver on guidance of high single-digit EPS growth. Conversely, if profit growth remains at current levels of 5-6%, then today’s share price may be close to fair value.

While the company has had its issues, Freeman believes if it can execute well and deliver high-single-digit earnings growth, then combined with a potential valuation rerating, it can reward shareholders going forward.

Source: Morningstar

James Hardie (ASX: JHX) has been the other problem child. The company was 2.3% of AFIC’s portfolio at the start of the year, and it’s now down to 1.2%. Much of the reduced holding can be explained by the sharp drop in the share price, though some of it is likely AFIC trimming its exposure too.

Freeman says the company’s acquisition of US-based outdoor living building products maker, AZEK, made some sense. However, James Hardie made two mistakes. First, it overpaid. Second, it used debt instead of shares to finance the purchase.

He thinks James Hardie is still a quality business, but it’s down to how you assess management and whether the current price factors in all the bad news. And on these things, Freeman was coyer.

Source: Morningstar

Major bank outlook

On the Big Four banks, Freeman likes the businesses, though he’s not enamoured with their growth prospects. He doesn’t see much earnings growth moving forward. And that means that if you get a 6% grossed-up dividend yield in a bank, that will be your annual return if earnings don’t move and P/Es don’t decline. If the bank with that 6% grossed-up yield has no profit growth and a 10% derating in its P/E ratio, then your return will be -4% over the next 12 months. Freeman sees P/E deratings as a big risk, especially in the likes of CBA.

AFIC has been underweight the banks over the past few years, and though that proved painful initially, it’s looking better now.

If money continues to move out of banks into other sectors, where will it go? Freeman isn’t sure that it will automatically rotate into the other large ASX sector, resources. He’s hoping it will also find its way into quality industrials, where AFIC has many of its holdings.

ASX 200 prospects

On the outlook for the Australian market in 2026, it was refreshing to hear Freeman’s reply: “I’ve got 100% confidence that I’ve got no idea.”

He says the market is expensive and at current multiples, future returns are likely to be lower. It could go sideways or return 4% per annum over the next 3-4 years, compared to its historical long-term return of 9% a year.

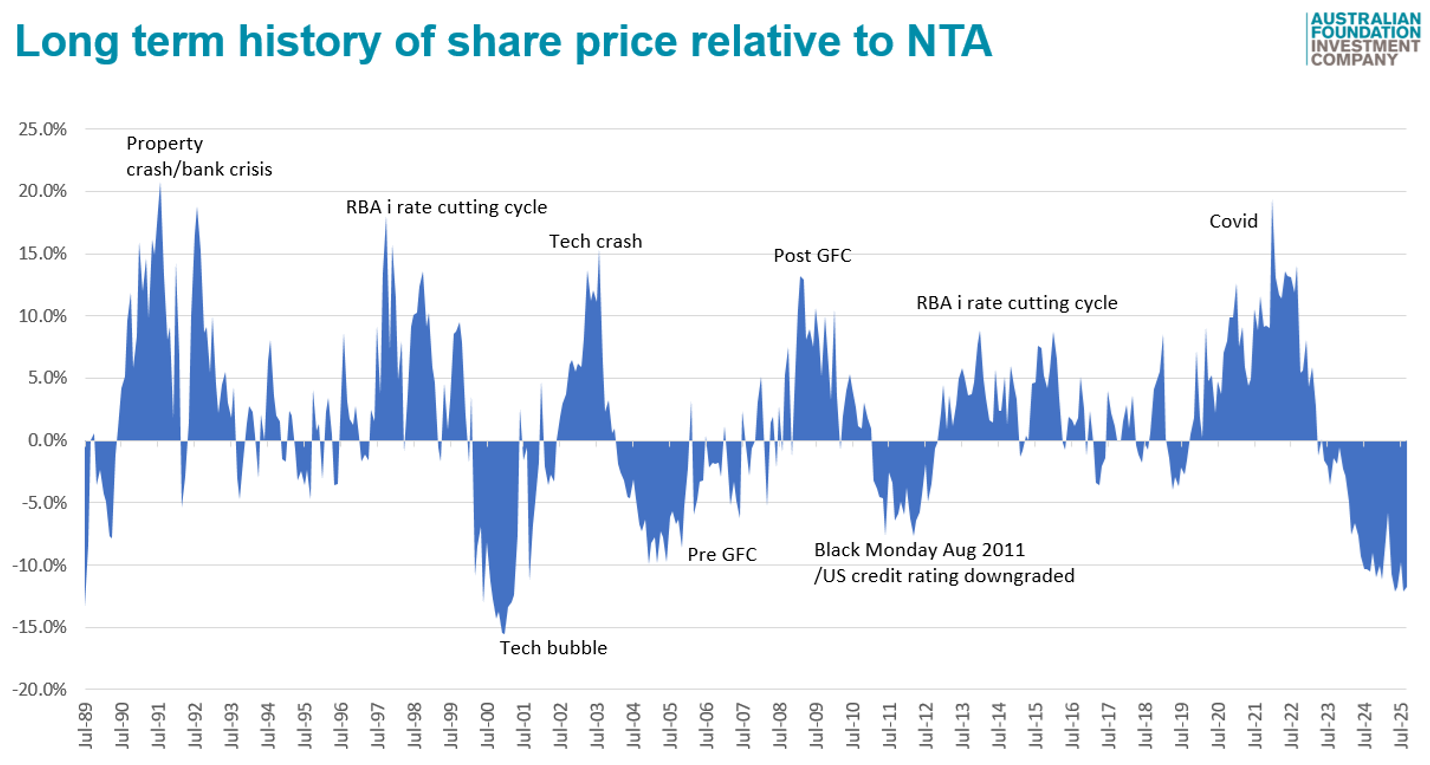

AFIC’s NTA discount

The large net tangible asset (NTA) discounts with many listed investment companies (LICs) has been a big investor discussion point over the past year. AFIC’s NTA discount remains at 9.3%, down from double digits for much of 2025.

While the discount isn’t ideal, Freeman isn’t too concerned. While many point to the rise of ETFs as a driver for the discount, he’s not buying that. He forwarded me this chart, which shows that previous market peaks have coincided with large NTA discounts for AFIC.

In 1999-2000, AFIC traded at an NTA discount of more than 15%. Then, after the tech crash, it traded at an NTA premium of up to 15%. The same sort of thing happened pre-and-post GFC.

Fast forward to Covid, and investors rushed into AFIC for its income during a turbulent period. That’s since reversed as markets have rebounded and soared to new highs.

Freeman’s point is that what’s happening now with NTA discounts isn’t new and it should turn at some point.

Meantime, his company is continuing to buy back AFIC shares. The buyback program is primarily to stabilise company share issuance – its dividend reinvestment program increases the number of shares, which is then decreased through buybacks.

Freeman says buybacks will also be used opportunistically when the stock is cheap.

AFIC’s prospects

Freeman pointed out that AFIC has built up a substantial pool of franking credits in recent years. Consequently, they paid a 5 cent special dividend this year, and they’ve just announced that there’ll pay another 5 cent special dividend in FY26, split 50:50 between interim results in January and full year results in July.

In sum, Freeman says he’s comfortable with prospects for AFIC’s portfolio, investors will get special dividends on top of the normal dividends over the next seven months, and the NTA discount may shrink if history is any guide.

Personally, I think Freeman makes a compelling argument and a turnaround in AFIC’s fortunes may not be far away.

James Gruber is Editor of Firstlinks.

Mark Freeman is Chief Executive Officer and Managing Director at Australian Foundation Investment Company (AFIC). He is also Managing Director of Djerriwarrh Investments Limited, AMCIL Limited and Mirrabooka Investments Limited.