There is a popular myth that rising oil prices are bad for stock market returns but is it just a myth or is it supported by fact? In theory, rising oil prices should hurt corporate profits, and therefore share prices, for two main reasons. First, virtually all goods and services sold by companies have an oil component in their cost structure (mostly in the form of transport costs) and so corporate profit margins should be squeezed by rising input costs that aren’t able to be passed on instantly to customers. Second, higher oil prices take money out of the pockets of consumers and businesses, money that could otherwise be spent on buying goods and services from companies.

Recent events affecting oil prices

Oil prices collapsed from a menacingly high $145 per barrel in July 2008 to just $30 by December 2008 as the world plunged into recession in the global financial crisis. From early 2009 prices rose back to around $100 and they are on the rise again. The oil price rises since 2008 have been driven by continued relatively strong demand from the big emerging markets, the economic recovery in the US, and now the tentative recoveries in Europe and Japan. Dramatic events in the Middle East have also played a critical role.

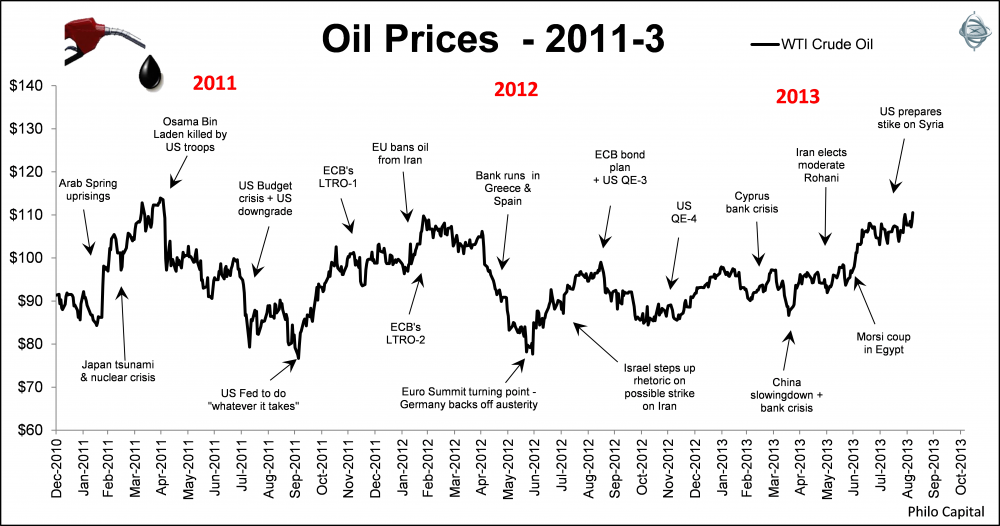

The first chart shows the benchmark West Texas Crude oil price since the start of 2011.

Oil prices rose dramatically when the Arab Spring uprisings started to gather pace in early 2011. Disruptions to oil supply lines were relatively minor, and the spikes in oil and gold prices reflected more fear than reality. Tunisia, Egypt and Libya are relatively minor oil producers, but Saudi Arabia and Iran are the critical players to watch.

The Iranian nuclear stand-off worsened with the EU embargo from the start of 2012 and tensions escalated further when Israel started talking up the possibility of a military strike on Iran in August of that year. Iran is critical as it can close the Strait of Hormuz to oil traffic very quickly – cutting off 25% of world supply (compared to only around 5% that passes through the Suez Canal and pipeline). If either Saudi Arabian or Hormuz supplies are disrupted, oil prices could spike up to $200 or even higher very quickly. Higher oil prices would threaten the weak economic recoveries in the US, UK and Europe.

Iranian tensions eased substantially with the landslide election of moderate leader Hassan Rohani in the middle of June of this year. However only a couple of weeks later the military ousting of the Egypt’s elected leader Mohamed Morsi in early July caused oil prices to shoot up again.

In Syria the nascent Arab Spring uprising was resisted by the incumbent Assad regime with increasingly brutal force in the worsening civil war there. It now seems increasingly likely that the US, with or without multilateral support, will make a military strike. This would no doubt send oil prices even higher still.

Impact of oil prices on Australian shares

What does all of this have to do with Australian share prices? Should Australian investors be fearful of rising oil prices?

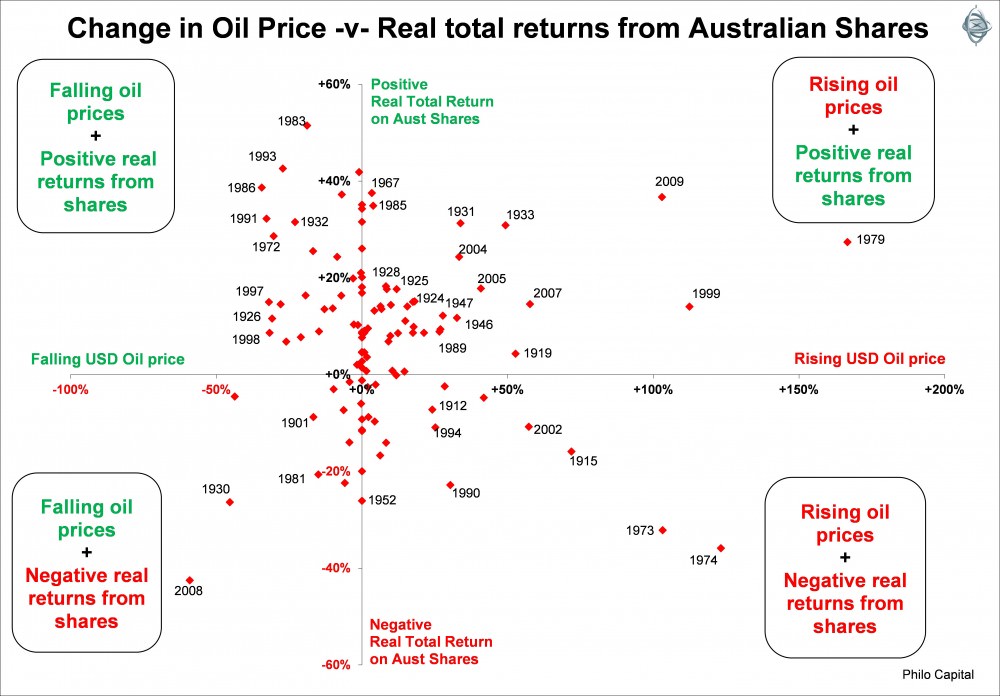

Contrary to the popular myth that rising oil price are bad for share prices, the fact is that most episodes of rising oil prices in the past have been accompanied by positive real returns from shares, even severe oil price spikes.

For example, oil more than doubled in price during five calendar years over the past century: in 1973, 1974, 1979, 1999 and 2009. In the cases of 1973 and 1974, real returns from Australian shares were -32% and -36% respectively in those years but oil prices were not a major factor. At that time Australian inflation rates were already above 10%, and Whitlam’s debilitating credit squeeze and dollar revaluation program were already underway even before the Yom Kippur crisis sent oil prices skyrocketing at the end of 1973. The share price falls in 1973 and 1974 were primarily a result of the combined impact of the collapses of the twin booms - the speculative mining bubble and the debt-fuelled property finance bubble, together with a severe domestic political crisis and fiscal and monetary policy errors.

In the other three out of the five years when oil prices more than doubled, Australian shares generated very strong real returns:

- +27% from shares in 1979 - when oil prices more than doubled with the Iranian revolution

- +14% from shares in 1999 - when oil prices more than doubled during the dot com boom

- +37% from shares in 2009 - when oil prices more than doubled in the rebound from the sub-prime crash

In fact many of the best years for Australian shares have been years in which oil prices have risen sharply, including 1924, 1925, 1931, 1933, 1945, 1946, 1947, 1978, 1979, 1989, 1996, 1999, 2004, 2005, 2007 and 2009.

A century of returns and oil prices

The following chart shows real total returns from the broad Australian stock market index (including dividends and after CPI inflation) for each year since 1900, together with the change in oil price during the year.

Oil prices rose in 56 of the 112 calendar years since 1990 up to the end of 2012 (the right hand two segments of the chart). In those 56 years of rising oil prices, the broad Australian stock market delivered positive real total returns in 40 (or 71%) of those years.

Further, in the 23 years since 1900 in which oil prices rose by more than 20%, Australian shares generated positive real returns in 14 (61%) of those years - 1911, 1917, 1919, 1931, 1933, 1947, 1979, 1989, 1996, 1999, 2004, 2005, 2007 and 2009 .

Rising oil prices may sound scary to investors, but if we go beyond the popular myth and look at the facts, we see a very different picture.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director and adviser to Third Link Growth Fund.