We may have been extremely unlucky with the unforgiving weather plaguing the East Coast of Australia this year. However, on the economic front we are by many measures in a strong position relative to the rest of the world. This was partly reflected by the ASX 200 claiming pole position versus most major markets in March.

There is a tall wall of worry that has stood forebodingly in front of investors of late. Yet, many of these issues such as the war in Ukraine, monetary tightening, inflation, (or its more feared cousin, stagflation) vary in their degree of severity across regions.

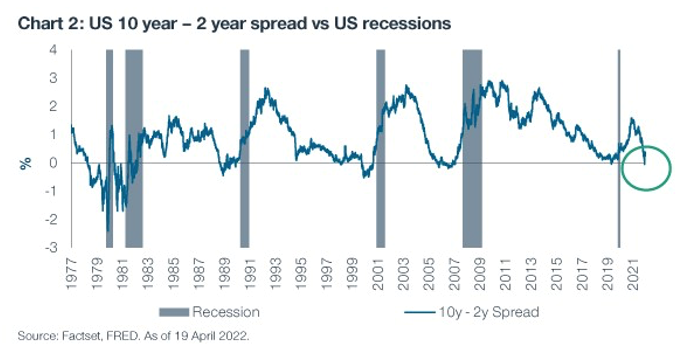

For example, Europe's growth and company earnings outlook has been severely marred by the ongoing war in Ukraine that has led to punitive sanctions on Russia. Across the Atlantic, US inflation is at its highest since Olivia Newton-John's “Physical” topped the charts (December 1981), forcing the Fed to move aggressively, while recession risks continue to rise - the latest warning indicator was the US 2 and 10 year spread flipping negative earlier this month (Chart 2).

Growth for the US and major European economies have been downgraded in the wake of those developments. Conversely, the economic outlook for Australia is relatively positive. We are far enough removed from the conflict in Europe to avoid direct impacts and stand to benefit from Russian sanctions. Our main geopolitical risks are closer to home as highlighted by the recent developments in the Solomon Islands. Similarly, the inflation picture had been much less heated than offshore (particularly the US). However, this week’s CPI figures suggest this may be more of a timing issue. Higher domestic inflation can be expected to translate into faster action from the RBA to raise interest rates to slow the economy. We believe the strong commodity price environment, high level of domestic savings and tight labour market will help provide support to the economy, but inevitably an economic slowdown is required to get inflation back under control. The risk is that we get tipped into recession in the process.

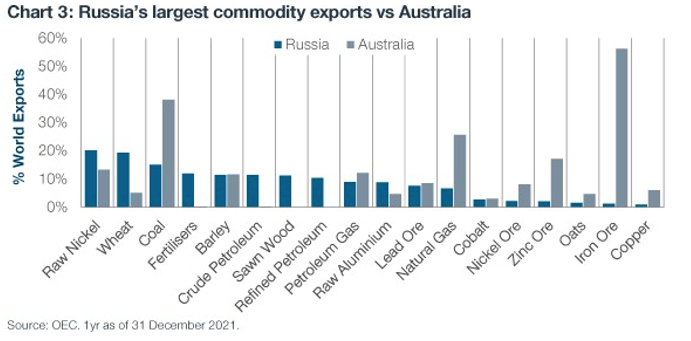

The recent surge in prices across the commodity complex, from agriculture to metals, provides a large uplift to our terms of trade. There has been a sizeable gap in some commodity trade created by sanctions on Russian exports.

Australia can help to plug that gap as a top exporter of many of the same commodities (Chart 3). Moreover, our largest trading partner China, is moving in the opposite direction to most by embarking on monetary easing and fresh fiscal stimulus.

Hence, it is not surprising that the miners and energy players have been among the top performers locally this year. At the same time, not all of these commodities enjoy the same outlook. Oil and gas names have benefited from the spike in energy prices. However, longer-term the terminal risks for the sector have increased. The importance of energy security is front-and-center and as such the need to shift to renewables has accelerated. This has reinforced our long-term preference for those commodities leveraged to electrification - nickel, zinc, copper and lithium for example.

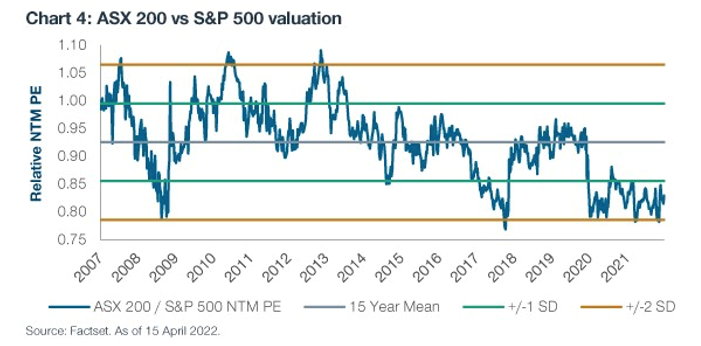

More broadly, the Australian equity market’s earnings outlook has improved relative to peers, who are in contrast facing earnings downgrades. Further despite the price correction offshore, valuations are also more attractive than markets like the US with a larger than average P/E discount that has persisted throughout the pandemic (Chart 4). These factors combined with the relatively stronger economic outlook have driven an increased allocation to Australia from Global asset allocators, who are for the first time in many years increasing their weighting to the Australian Equity market.

Overall, the global investment landscape is certainly not rosy. We have written many times that we have passed the peak of global economic momentum. Australia is also poised to decelerate. However, we are in a relatively stronger position to endure some of the global storm fronts. If only we could be as fortunate with our own weather fronts.

Randal Jenneke is Head of Australian Equities and Portfolio Manager at T. Rowe Price. This article is general information and does not consider the circumstances of any investor.