I have previously warned that the combination of the demographic avalanche of retiring baby boomers, low interest rates and a disproportionately large amount of their wealth in cash would mean that stocks and property would continue to rise for a while. I call it ‘The Boom We Have to Have.’ But like all booms, this one will also bust.

These conditions, especially low rates forcing a big part of the population into riskier products, corrupt investors’ sense of risk. Rising prices amid a wave of buying reinforces the behaviour of investors and their brokers who believe their thesis is correct.

New listings and credit point to problems

I am not alone in the view that at some point in the next six to eighteen months, there is a real chance that baby boomer retirement plans may sink thanks to their inability to avoid repeating the investment mistakes of their past. Stanley Druckenmiller is an American hedge fund manager, famous for being the lead portfolio manager for George Soros’s Quantum Fund. In 2010, Druckenmiller handed back the billions he had been managing for 30 years through his firm Duquesne Capital. He remains a noted philanthropist, keen golfer and speaker on the global investment and macroeconomic circuit.

Druckenmiller should be heeded. He observed that low rates have skewed peoples’ sense of risk, particularly in two markets – new share listings (IPO’s) and credit. He pointed out that 80% of companies listed in 2014 have “never made a dime”. In 1999, just before the tech crash, that number was 83%.

(As an aside, over the Christmas break, I read You Only Have To Be Right Once: The Unprecedented Rise of the Instant Tech Billionaires. Including Twitter, Facebook, Instagram, the book was a who’s who of the world’s biggest tech companies and the backgrounds to their stunning rises. But I couldn’t help noticing that all the references to billions had little or nothing to do with profits or in some cases even revenues. Some of the businesses discussed, which were sold for billions, not only had no revenue but no revenue model either).

Druckenmiller had another warning on credit markets. Last year, speaking on CNBC, Druckenmiller said, “When I look at credit … corporate credit is growing at a record rate, far faster than it grew in 2007. And S&P pointed out that 70% of debt issued has a B-rating or worse. To put that in perspective, in the ’90s, that number was 31%. Do you remember the hullabaloo in 2007 about covenant-light loans? Companies issued $100 billion of them in 2007, and 38% was B-rated. This year we’re going to $300 billion, up from $260 billion last year and $90 billion a year earlier, and 58% of them were B-rated.”

At the more recent speech, Druckenmiller also observed, “There are some really weird things going on in the credit market … but there are already early signs starting to emerge. And if I had a message out here, I know you’re frustrated about zero rates, I know that it’s so tempting to go ahead and make investments and it looks good for today, but when this thing ends … I think it could end very badly.”

Why is Druckenmiller so worried? It’s simple. If interest rates rise, many investors in corporate debt will want to exit at the wrong time. Australian investors in bank hybrids and corporate bonds (G8 Education is a recent example of a popular corporate bond issuer) should consider the warning too. And if interest rates don’t rise, but the economy weakens significantly, then some industries will be unable to cover their debt costs. Either way, investors will face problems at some stage.

Low rates support asset prices

Low interest rates are here to stay for a while and that will support asset prices. Eventually however the price of those assets (stocks and property) will be pushed way too high (we think a strong bull market is likely for some part of this year) as people panic buy amid a fear of missing out when their income is eroded from low rates on cash. After that, a large number of investors will, sadly, suffer financially again – from buying too late and paying too much.

There is a way to avoid it. You must be invested in high quality businesses with bright prospects and buy them when they are cheap. We can think of only a handful of stocks that meet this criteria currently. When we cannot find such opportunities, the only safe alternative is cash (even though rates are low) and we are 20-30% invested in cash at the moment.

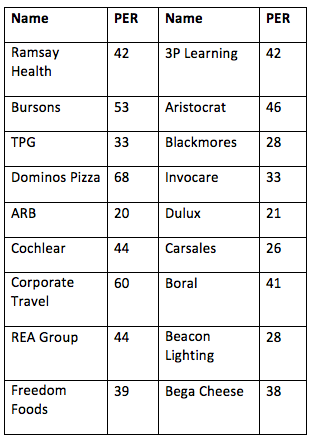

If you are invested in a high-performing fund that is fully invested in stocks like REA Group (P/E ratio 44 times), Dominos Pizza (68 times), or many of the expensive stocks below, consider switching at least some of your retirement nest egg to a larger cash weighting. The cash won’t make your investment 100% immune to a declining market but it will allow additional purchases at cheaper prices, which offers the opportunity to significantly reduce the time to recovery. In Table 1, PER is Price to Earnings ratio.

Table 1. Expensive stocks? You be the judge…

RM Picture1 270215

Of course if interest rates stay at zero, the party could last a while yet, but as I have warned previously, be sure to be dancing close to the door in case you need to leave. Druckenmiller refers to a “phony asset bubble”, with a bunch of investors ploughing money into assets which will “pop”. Then we’ll see how many people are still enjoying the party.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management.