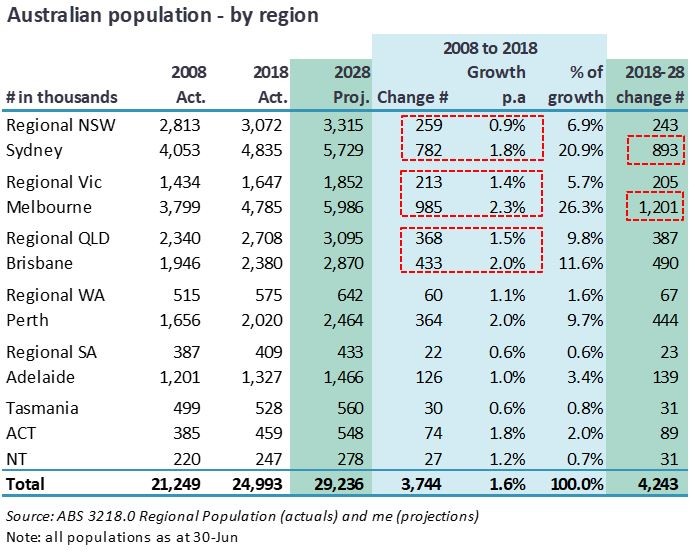

Australia's population grew by 1.6% p.a. over the last 10 years, reaching over 25 million people in 2018. This rapid growth has been concentrated in our major cities with Melbourne, Sydney and Brisbane absorbing 2.2 million of the total 3.7 million population growth over the period. Immigration has been the largest contributor to our population growth, supplying around 60%.

There is currently a lack of effective policies on our future population to address the mix of growth (natural versus immigration), pace of increase and a geopolitical strategy of dispersing population out of the south-eastern corner of the country.

Understanding demographics is vital to successfully planning for the future, including:

- Population growth: what it has been and where it is going

- Ageing population: who is going to pay for all the retirees

- Natural increase: can we encourage copulation

- Immigration: the benefits and opportunities migrants bring

- Australia in Asia: a small fish in a big, opportunity-laden pond

The beauty of demographics is that the future has already been written.

1. Historical and forecast population growth

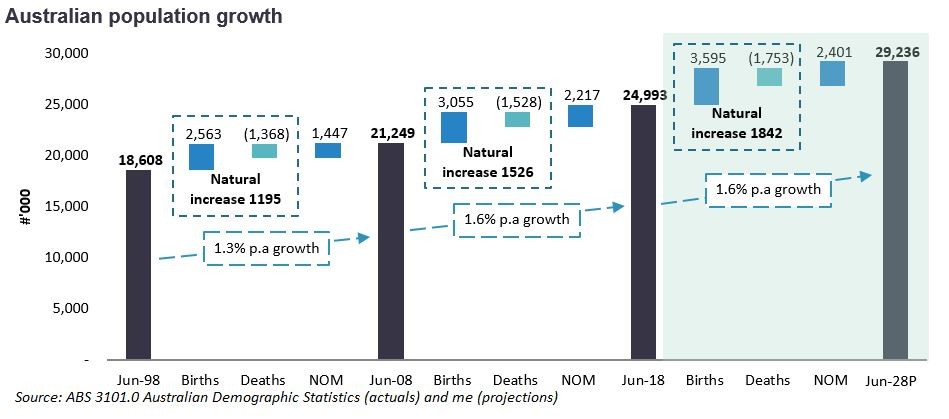

Australia has experienced phenomenal population growth over the last 20 years. Since 2008, our population has increased by an average of 375,000 people a year! This has been underpinned by Net Overseas Migration (NOM) which contributed 2.2 million people over the last 10 years. Our 1.6% p.a. growth rate ranks us in the top half of global population growth rates and has supported our record 28 years of unbroken economic growth.

Notably, big advanced nations such as the US, France, United Kingdom and Germany all recorded population growth below 1% over the same period. Some of our big neighbours’ populations are stabilising (China's population is forecast to peak in 2029 and thereafter decline) and others are already experiencing declines (Japan's population declined by around 450,000 people in 2018).

Extrapolating our current growth rate into the future projects a population of 29.2 million in 2028. This assumes a comparable rate of annual natural increase of 0.7% (variations will be driven by fertility rates and life expectancy) and NOM remaining at the 2018 level of around 240,000 people per year.

Where is the growth going? Into the bigger states and predominantly into the capital cities.

The high rates of growth in our major cities are not being matched with appropriate infrastructure which is resulting in increasing congestion, lower livability standards and worsening pollution. Can Sydney and Melbourne really accommodate another 0.9 million and 1.2 million people, respectively, over the next 10 years without impacting the livelihoods of current residents?

2. Ageing population

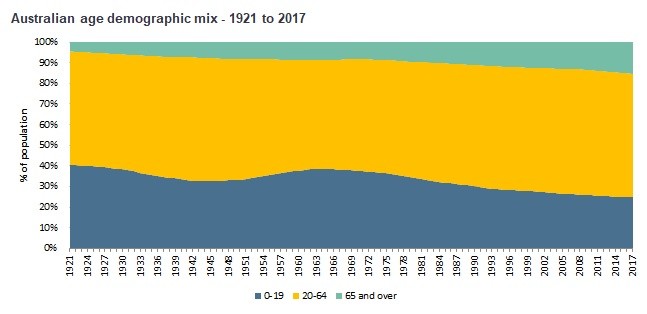

Added to a growing population we have, like many countries, an ageing population. This will cause imbalances in the fiscal demands on governments (pensions, health, aged care) and infrastructure (schools, hospitals, caravan parks, nursing homes).

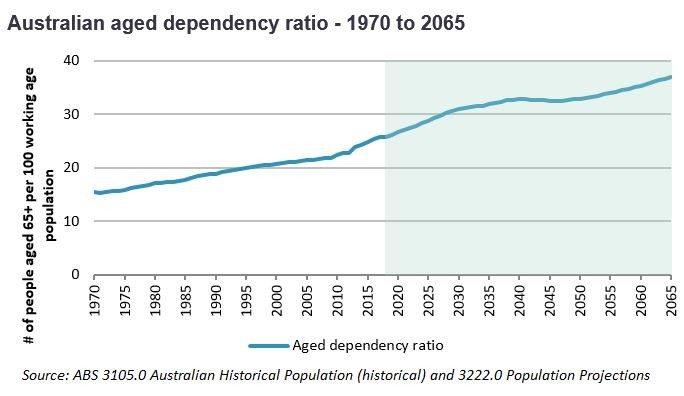

Australia's aged dependency ratio (defined here as the number of people over 65 / working age population (20-64) * 100) has been steadily increasing. An increasing dependency ratio indicates more retirees for each worker thus putting an increasing fiscal burden on the current working age population.

In 1970, there were 15.5 people aged over 65 for every 100 working adults (aged 20-64). In 2017, there were 25.8 over 65 for every 100 workers. The ABS has forecast that this trend will continue and the aged dependency ratio will rise to 30.9 by 2030, placing further pressure on government budgets and exacerbating intergenerational inequality.

Part of the rising ratio is simply due to higher life expectancy which has risen from around 70 years in 1970 to 83 today, which is one of the highest in the world. However, a big driver is our fertility rate (births per female) which has declined from around 2.96 in 1970 (the end of the baby boomer period) to 1.79 today. The rate required for a stable population in Australia (ignoring net immigration) is 2.1 births per female.

Without immigration, our population is in decline.

There have been a few positive policies to counter the inevitable impacts our ageing demographics, such as:

1) the introduction of superannuation by the Hawke Government in 1986 to help retirees become financially self-sufficient, and

2) the formation of the Future Fund by Peter Costello in 2006 to cover certain superannuation contributions of public servants.

Understanding the rise in the dependency ratio, governments should be creating surpluses now to mitigate the future impact of lower taxes from a relatively-shrinking workforce. Continued budget deficits only increase the cash crunch for future generations. The government needs to reconsider the tax breaks that currently benefit older generations in the context of the need to lower the national debt or fund infrastructure.

3. Natural increase

We predominantly rely on immigration to boost our population. If we want to change the mix, we need policies that encourage a higher birth rate.

Millennials (now aged 23-39) are the current baby-producing generation. As 62% of the population live in our five largest cities, Millennials face uncomfortable choices between children and lifestyle. I don't mean missing out on smashed avocado on the weekend, but between living in cities where opportunities exist (which entails high mortgages) and having bigger families.

We all know how high the cost of living is in our major cities. How many under 40's can afford a four-bedroom house in a major city to support a three-child family? It should be obvious to governments that the stretching of family budgets impacts the options of family size and consequently the birth rate.

The Federal Government claims that natural increases (births over deaths) is largely out of its control. This is not true. If we want higher natural increases, we need policies that encourage Australians to have larger families, such as effective parental leave, affordable and accessible childcare and housing, family financial support, parental return to work schemes, quality state education and flexible career options. Simple policy changes such as replacing stamp duty on property transactions (which disincentivise potential downsizers from selling their family home) with a comprehensive annual land tax could make a difference. Governments and companies should be collaborating on this together.

4. Immigration

Australia is a successful multicultural society. Around 7 million of our current residents were born overseas. However, immigration has become unpopular amongst many people in the West.

It shouldn't be. We need debate, not demonisation. Governments are not spending enough money on infrastructure (schools, hospitals, transport etc) in high growth areas. We must review how immigration impacts the social construct of existing communities. Both issues are under-addressed in high immigration countries. The left and right of politics both have a role to play in fixing how immigration impacts everyone.

The simplest economic impact of immigration is the incremental GDP a new arrival brings to the country and the additional tax they pay. IMF estimates show that Australia’s current migration programme will add between 0.5% – 1% to annual GDP growth from 2020-2050. Non-humanitarian immigration (which accounts for around 70% of migrants) should focus on bringing positive outcomes to Australia:

- greater population (a given)

- positive fiscal impact (highly likely with skilled migration)

- improved productivity and innovation (highly likely with skilled migration)

- improved diversity and social cohesiveness (more likely with targeted policies).

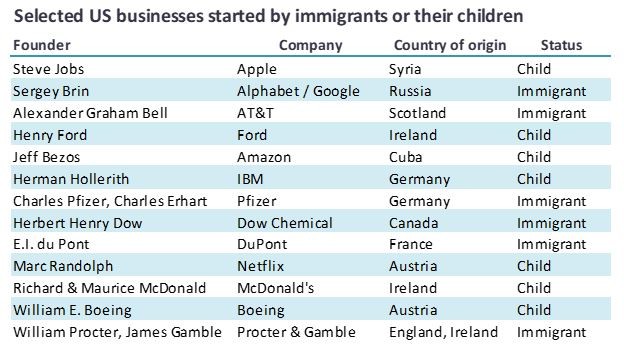

Immigrants often play an outsized contribution to business development and enrich cultural diversity which should be celebrated. Successful Australians who are immigrants or children of immigrants include Frank Lowy, Dr Karl Kruszelnicki, Harry Triguboff, Tan Le, Majak Daw, Anthony Pratt, Justin Hemmes and Huy Truong ... the list is endless. There is a positive correlation between migration and lower government spending per capita as migrants are predominantly of working age and therefore are more likely to contribute towards tax revenue than be dependent on social services.

The US is renowned for the number and size of successful businesses that have been developed by immigrants or their first-generation children. Here is a table of some companies and their famous founders. This analysis suggests 216 of current Fortune 500 companies have been started by immigrants or their children. That is a phenomenal economic contribution!

We are the lucky country as foreigners want to live in our modern, democratic, liberal society. With such significant levels of immigration, we need to ensure that it does not adversely impact the social cohesion of the country and the people we attract add to the brain gain.

Policies such as continuing to attract skilled migrants, providing a path to residency, sensible infrastructure and showcasing Australia as innovative to attract the most ambitious should be pursued.

5. Australia in Asia

Australia's place in rising Asia again reinforces our lucky country status and the opportunities that it presents. However, it also brings into focus the planning we need in order to secure our prosperity and future. Geopolitical shifts are forcing us to consider strategic and economic partnerships. Regardless of the population growth Australia achieves, we are a blip in the Asian region which is currently estimated at 4.6 billion people.

China’s and other Asian countries' middle class continues to expand rapidly. The Brookings Institute estimates that the global middle class will rise from 3.2 billion (2016) to 4.2 billion (2022) to 5.2 billion (2028). About 80% of this increase is forecast to come from Asian nations, meaning around 1.6 billion additional higher-spending middle-class consumers on Australia’s doorstep by 2028.

These customers offer us a tremendous opportunity. Australia can provide high value goods, services and experiences not available within their economies.

Conclusion

What is a sensible population for Australia? I don't know. However, I do believe if we continue a 'business as usual' approach (increasingly, a two-city nation), our population ceiling is close. Our sustainable population could be significantly higher if we consider some radical new approaches to infrastructure, environmental impact and immigration. If we want to rely more on natural increases to underpin population growth, we will need to re-imagine how our big cities operate and the support we provide families.

Most importantly, we need our politicians to start publicly discussing our future demographics.

David James is an Associate Director at Alpin Advisory, an investment and advisory firm based in Sydney.