As he sighed wistfully he thought, “It seems like only yesterday, but here’s another GFC so soon. Will it be the same as the last or different?”

I can say, with considerable conviction, that the next one won’t be different. The drivers are the same: moral hazard ramped up by thoughtless governments and fear. Fear is based on ignorance. Knowledge is power.

One would have thought that with the GFC still fresh in people’s minds we would not be reacting in the same way. It never ceases to amaze me that this sort of thing happens again and again yet still we never learn. To paraphrase George Santayana: “If we don’t learn from the past we are doomed to repeat it.”

Stock markets reflect human endeavour

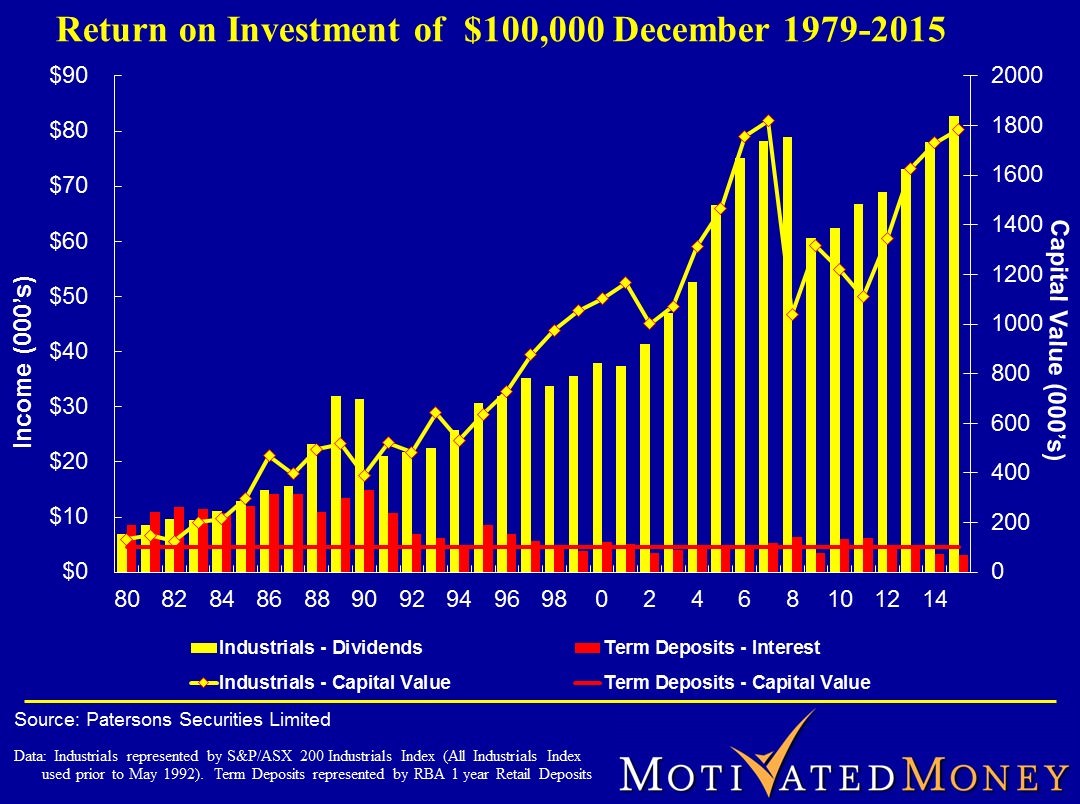

Below is the pattern of stock movements and dividends paid superimposed on a term deposit and the subsequent interest payments over the last 35 years.

The GFC saw a drop of 50% in share prices, similar to the market correction of 1987. Although the GFC looks more substantial, it is only because the same drop of 50% was applied to an index that had grown steadily over the intervening 21 years since 1987.

Throughout all this, $100,000 invested in Australian industrial companies in 1980 now generates an income of about $80,000 a year and has a capital value of about $1.8 million. A term deposit is still worth $100,000 and delivers income of about $3,000 a year.

At the time of the GFC and during the seven years since, I have reminded audiences that we would recover from the GFC as we have from all previous falls throughout history. This would then be followed by another correction as greed, stupidity, speculative activity and misguided government intervention once again drove the prices up.

My rationale is that the stock markets of the world ultimately reflect the profitable endeavours of the human race (the unprofitable endeavours inevitably fail). For markets to collapse totally requires that all human endeavour comes to an end and I find this rather hard to imagine. However, I am surprised at the speed with which we have forgotten or, perhaps, never learned this lesson.

I will admit to one aspect of current conditions that we haven’t experienced for some time is low interest rates. It has been roughly 5000 years since we have had rates at the present levels! This is courtesy of misguided governments who, wishing to appear in control, have driven them down in an attempt to improve balance sheets resulting from our appalling financial behaviour. They are incapable of allowing us to suffer the consequences and this has led to the rise in moral hazard over recent decades.

Headlines ignore strength of company balance sheets

Here in Australia company balance sheets are generally in much better shape than they were prior to the GFC and it is clear that fear not fundamentals are driving the present gyrations. If I may quote a few headlines from recent media:

Market bounces back but fears China will drag down the world

Fear indexes surge to highest since GFC as China slide spooks markets

The day began with investors fearing the worst as the market fell to a fresh two-year low of 4929 in early trade.

Fear driving sideshow but no need to panic here

$A drops to six-year low as ‘fear takes over’ in global markets

Chinese fears spark region-wide rout

And so it goes on, ad nauseam!

Check the preponderance of comments relating to China amongst the above. I guess it makes a change from the ‘European crisis’ or ‘Middle Eastern crisis. Recently, an article in The Australian newspaper titled ‘Stock shock leaves a trail of victims’ caught my eye. The example given was a white collar worker in Beijing who had sold his house in March 2015 to INVEST (my emphasis) in the Chinese equities market.

Predictably, he has seen his ‘fortune’ eliminated in a few months. He told the journalist that he knew the risks when he joined with friends to invest nearly 2 million yuan in the volatile market but was still angry with the consequences. He is now worried that his decision to invest in equities could have long-lasting consequences. “I am old enough to get married and you know here that girls prefer guys who own their own houses,” he said. “I didn’t tell my Mum that I sold the house; she would be too mad.”

What right did this lunatic have to feel angry I ask myself? I feel angry with the journalist who included the word ‘invest’ in the article to describe the stupid speculation that this young man indulged in.

The saddest footnote to all this pathetic reporting was an article titled: “Global market rout means surge in fear indexes.” With a sharp correction on Wall Street earlier in the week the US ‘fear index’, otherwise known as the Chicago Board Volatility Index, surged as much as 90% to levels not seen since the height of the GFC. Fear has now become a tradeable commodity.

It’s irrelevant for investing

None of it has anything to do with investors or investing. I suggest that the only appropriate action taken by investors should be to top up or add holdings to their portfolio. I am on record, when asked in an interview after the GFC, what was on my wish list for coming weeks, I responded with, “Another GFC please”. The interviewer was clearly nonplussed and asked why. My response was, “I would like to buy some more CBA at $26.00 and more Wesfarmers at $13.50!”

As this irrational process of rise and fall continues I ask people to heed the words of that famous Australian philosopher, Chopper Read, and “Toughen up, princess”. As the human race appears incapable of recalling the past, consider again the chart above and merely be prepared to take advantage of the ‘fear factor’, step up to the mark, lock and load and wait ‘til you see the whites of their eyes.

Peter Thornhill is a financial commentator, public speaker and Principal of Motivated Money. This article is general in nature only and formal financial advice should be sought before acting in any of the areas discussed. Cuffelinks attended the Australian Shareholders Association conference in Sydney this week at which Peter presented some of these views.