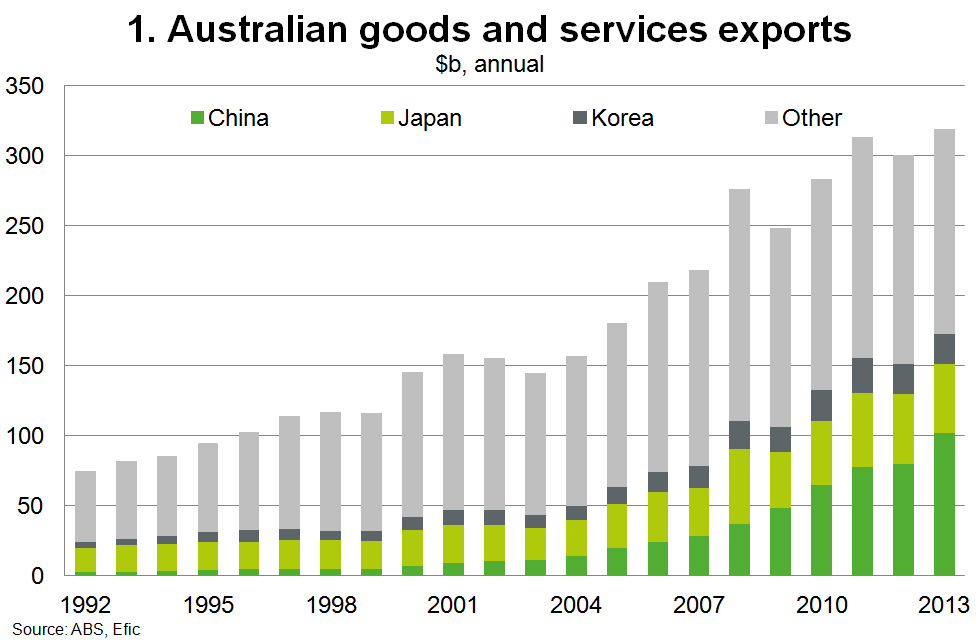

Exports are increasingly skewed towards Australia’s three largest trading partners, making the Free Trade Agreements (FTA) with these countries vital for further growth. China, Japan and Korea bought more than half Australia’s $320 billion of goods and services exports in 2013, an increase of 300% on a decade earlier (see Chart 1). Exports to other overseas markets have not kept pace.

Pre-eminent North Asian markets

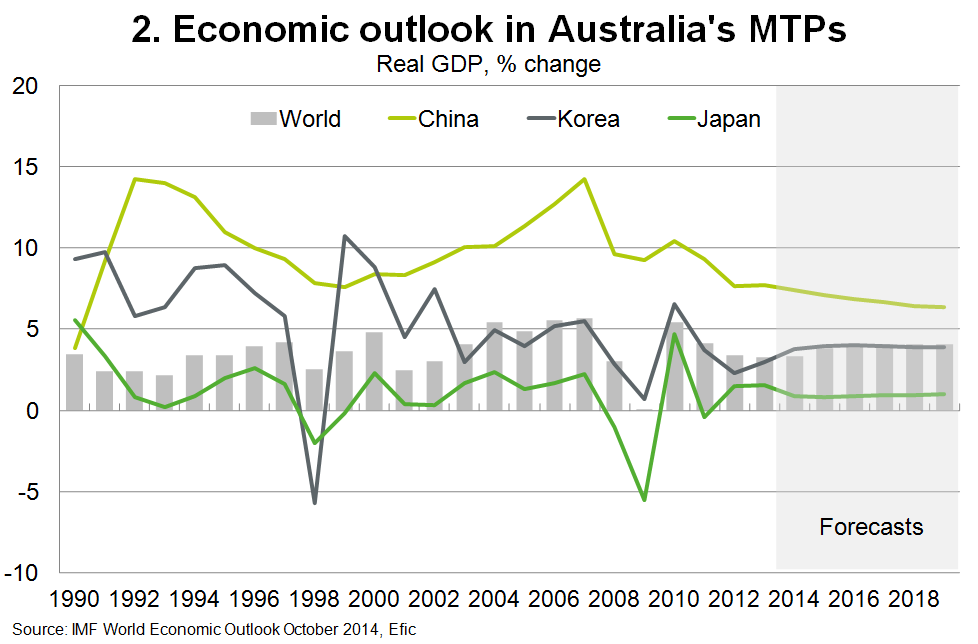

Our economic fortunes now depend on these countries more than ever. Yet in China, which buys almost a third of Australia’s exports, the 'new normal' of slower growth has arrived. Authorities are aiming to stabilise real GDP growth at around 7.5% in 2014 – the slowest pace since 1999. This gradual economic slowdown is set to continue in the longer term reflecting efforts to rebalance the economy towards a more sustainable and consumption-driven model of growth. In Japan, GDP growth is forecast to stagnate at around 1%, while in Korea a modest economic acceleration is expected over the forecast period (Chart 2).

Strong export performance dominated by resources

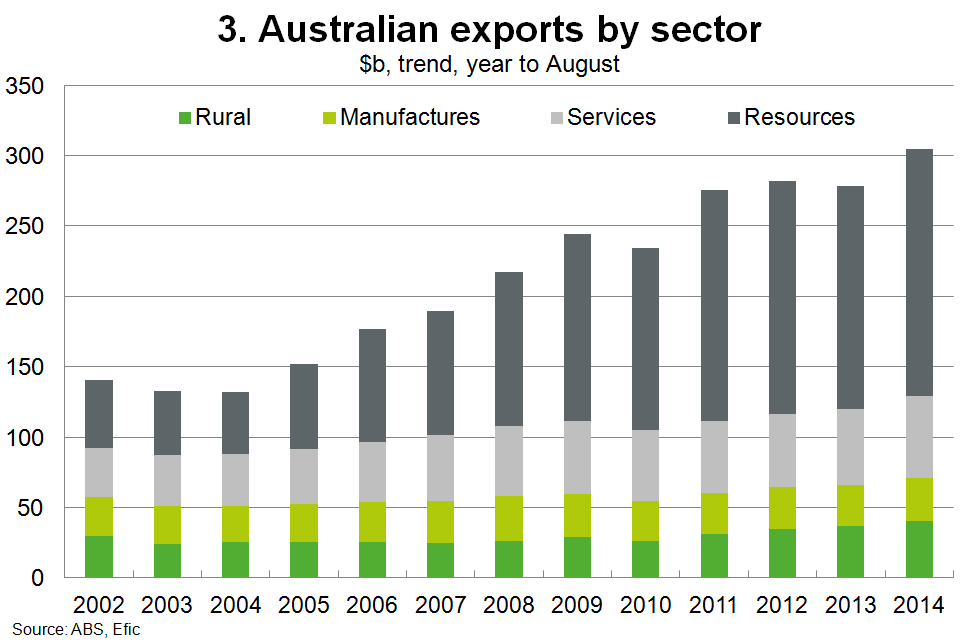

Australia’s resource exports totalled $178 billion last financial year – a 320% increase since 10 years earlier. In particular, minerals exports to China have increased almost 20-fold over the last 10 years, fuelled by China’s rapid industrialisation and urbanisation. Over the same period manufactures have stalled and service and rural export growth has been anaemic (Chart 3).

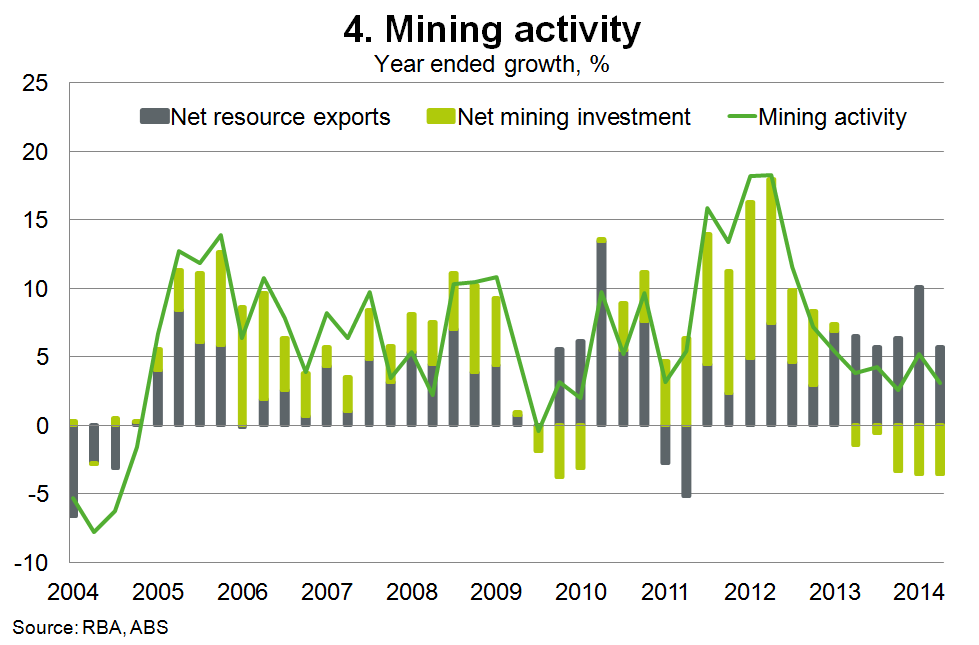

But the mining boom has now ended. Mining investment growth peaked in mid-2012 and turned negative in the second half of 2013. Net mining investment (equal to real investment by the mining sector less the RBA’s estimate of the imported component of mining investment) is now a drag on the Australian economy (Chart 4).

Strong export volumes are expected to continue. Rebalancing in China will not mean that its consumption of commodities will peak any time soon. That is unlikely to occur until the country’s per capita income doubles from current levels. Rather, commodity consumption (globally and for China) is predicted to continue to rise, but to shift gradually toward high-grade foods and metals as well as cleaner primary energy fuels. (Higher-grade commodities are associated with the consumption-led phase of growth where higher incomes drive demand for higher-quality goods, namely consumer durables which use more tin, aluminium and zinc.)

‘Trifecta of trade’ will help Australia diversify and rebalance

The landmark China-Australia Free Trade Agreement (ChAFTA) announced last month completes the government’s ‘trifecta of trade’ with Australia’s three largest export markets. Similar trade agreements were secured with Japan and South Korea earlier this year.

These trade deals will boost Australia’s export competitiveness and promote diversification of exports, by delivering unprecedented access to North Asia’s burgeoning agricultural and services markets. For instance, ChAFTA allows for 85% of Australian goods exports to enter China tariff-free upon entry into force, rising to 93% in four years and 95% on full implementation. The government stresses that ChAFTA also secures ‘the best ever market access provided to a foreign country by China on services’. This will assist Australia to rebalance growth towards non-resources – an important economic cushion as the mining boom ends.

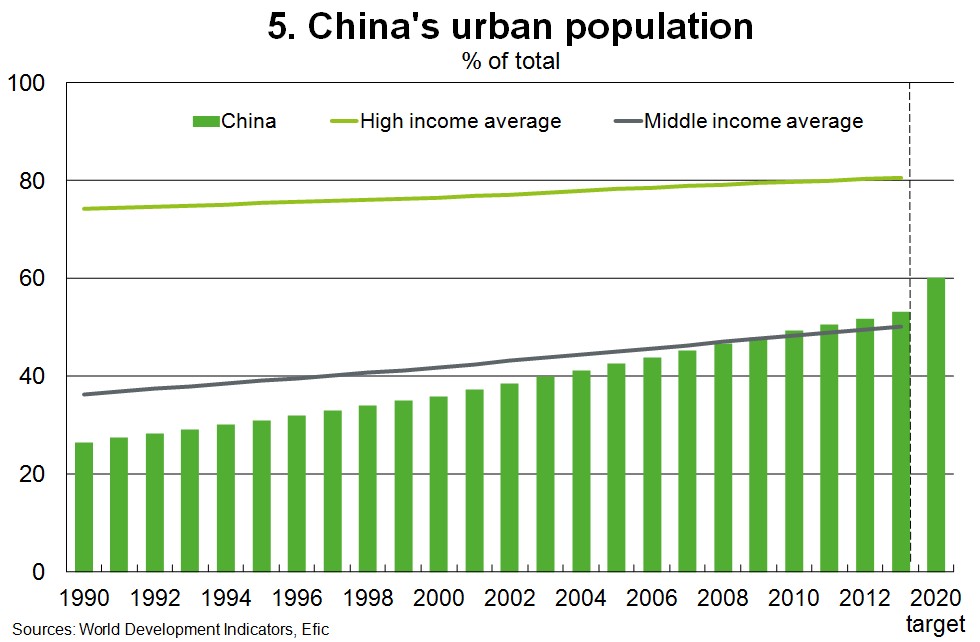

Despite gradual economic slowdown, strong Chinese demand for Australian exports is expected to continue, facilitated by trade policies but driven by internal demographics. China’s middle class is expected to expand by 400 million people over the decade to 2022 fuelled by rapid urbanisation. China aims to lift the proportion of its population living in cities to 60% by 2020 (Chart 5) – this equates to moving 100 million rural Chinese to towns and cities – a project of unprecedented scale.

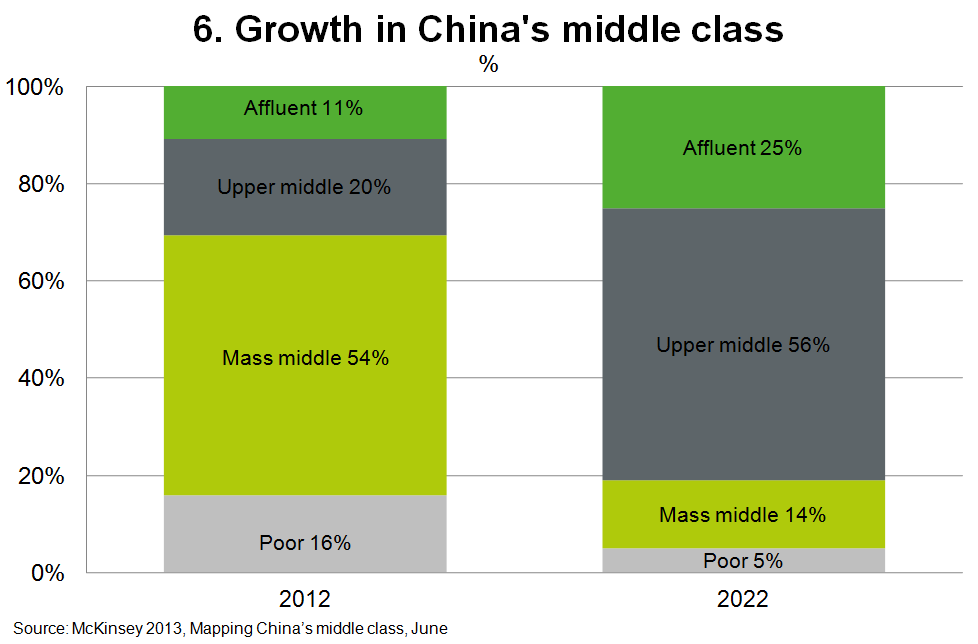

Due to all this the IMF expects that, on average, per capita incomes will rise 35% over the next five years. But importantly, the share of China’s population considered ‘upper middle class’ or ‘affluent’ will increase from 30% to 80% over the decade to 2022 (Chart 6). These households spend less than 50% of their income on necessities and display distinctive consumer behaviour – they are sophisticated and seasoned shoppers, able and willing to pay a premium for quality and discretionary goods. As such, Chinese private consumption is expected to grow healthily – by 10% a year over the decade to 2022.

In particular, China is expected to account for almost half of a 75% increase in world food demand between 2007 and 2050. While resource constraints will curtail Australia’s ability to become a ‘food bowl of Asia’, there may be a competitive position for Australia as the ‘delicatessen of Asia’. Already Australian businesses are winning sales in niche premium markets by trading on the clean and green image of the ‘Made in Australia’ label. Indeed, Australia's agricultural exports to China have almost tripled over last the five years to a record $8.7 billion. China is now our most important agricultural export market. But there remains significant scope for expansion.

ChAFTA will reinforce export momentum and give Australia’s exports an advantage over competitors from the US, Canada and EU. It also places Australia on equal terms with competitors from countries like New Zealand and Chile that have already negotiated trade deals with China. For instance, Australian beef exports to China are currently taxed almost 19%, while comparable exports from New Zealand enter the Chinese market almost duty-free. ChAFTA will counter this advantage over coming years, and provide Australia the same terms offered to any other country that signs an FTA with China in the future.

Supporting the ambitions of Australia’s optimistic export sector

Australia’s exporters are ambitiously targeting new opportunities in the Chinese market. The Australian International Business Survey, commissioned by the Export Council of Australia with the support of Austrade and Efic, found that 80% of agricultural respondents planned to expand overseas in the next two years. At 34%, China was overwhelmingly the most popular new target market.

This is despite three quarters of respondents saying that China is more difficult to do business in than Australia. Evidently the payoff is worth the challenge. The ‘trifecta of trade’ will improve market access and help Australian exporters realise the full potential of North Asia.

Cassandra Winzenried is a Senior Economist for Efic, a specialist finance provider for Australian export companies.