Reserve Bank (RBA) Governor, Philip Lowe, looked surprisingly happy this week, given the recent criticism of his judgement a few months ago that conditions for an increase in cash rates would not be met until 2024. Both wages growth and inflation are much stronger than he expected, but Lowe sees this as an early achievement of two RBA targets.

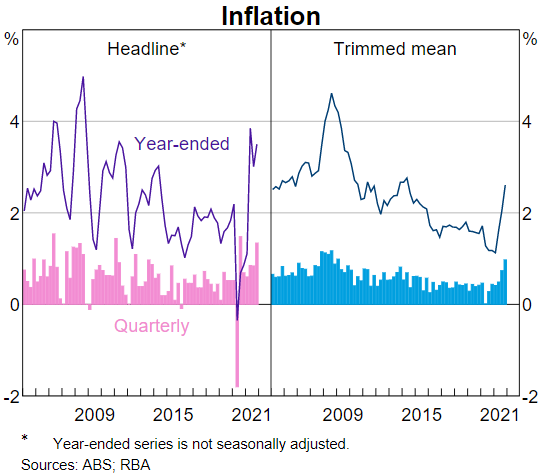

Although he conceded the RBA does not really know what's happening, he seems delighted with progress. Underlying inflation is up around 2.5% for the first time in seven years and the unemployment rate is heading for a 50-year low. In his speech to the National Press Club, Lowe argued that low rates and bond buying have done exactly what they were supposed to and "More people have jobs than ever before. It's a real benefit to people and the community."

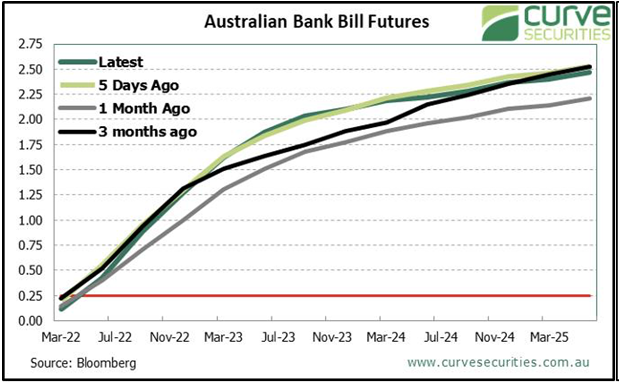

When challenged that he is moving too slowly on rates, he reminded the audience that inflation has just hit the mid point of the RBA 2-3% target. He is prepared to wait before moving, seeing many factors such as supply chain blocks as temporary. Although he said a rate rise in 2022 is 'plausible', he believes the market's expectation of four rises this year is highly unlikely. Here is where the market is pricing short-term rates over coming years.

RBA Board meeting

The RBA made important announcements on Tuesday this week which will set the tone for interest rates, and everything that flows from them, for the rest of 2022 and beyond.

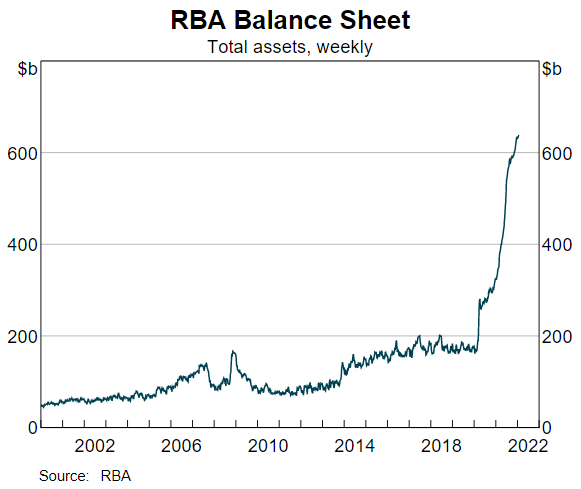

First, the RBA decided to cease further bond purchases under its stimulus programme, as the economy now seems resilient enough to sustain a recovery. Since the start of COVID, the RBA's balance sheet has more than tripled to around $640 billion.

Here are some highlights of the monetary policy announcement:

"The RBA's central forecast is for GDP growth of around 4¼% over 2022 and 2% over 2023 ... The labour market has recovered strongly, with the unemployment rate declining to 4.2% in December ... The RBA's central forecast is for the unemployment rate to fall to below 4% later in the year and to be around 3¾% at the end of 2023."

"Inflation has picked up more quickly than the RBA had expected, but remains lower than in many other countries. The headline CPI inflation rate is 3.5% is being affected by higher petrol prices, higher prices for newly constructed homes and the disruptions to global supply chains. In underlying terms, inflation is 2.6%. The central forecast is for underlying inflation to increase further in coming quarters to around 3¼%, before declining to around 2¾% over 2023 as the supply-side problems are resolved and consumption patterns normalise."

"As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range. While inflation has picked up, it is too early to conclude that it is sustainably within the target band."

Governor's speech to the National Press Club

Although much of his speech was a confession that the RBA's forecasts had been wrong in 2021, Lowe was upbeat about the economic recovery.

"That recovery is being underpinned by a number of factors. These include household balance sheets that are in generally good shape, with households having accumulated more than $200 billion in additional savings over the past two years. An upswing in business investment is also underway and there is a large pipeline of residential building to be completed over the next year or so. The decline in the unemployment rate has been accompanied by a welcome decline in underemployment, which is at its lowest rate in 13 years."

While he accepts inflation will increase modestly, he expects supply problems will be resolved. He said wages growth remains low and he will be patient reviewing monetary policies. Several times in response to questions, he emphasised that underlying (trimmed mean) inflation has just entered the target range, and that is a good thing. He wants inflation neither too low or too high.

"We are in the position where we can take some time to obtain greater clarity on these various issues. Countries with higher rates of inflation have less scope here. The Board is prepared to be patient as it monitors the evolution of the various factors affecting inflation in Australia."

And there was no mistaking his pride in the unemployment achievement:

"It is also relevant that Australia is within sight of a historic milestone – having the national unemployment rate below 4%. This is important because low unemployment brings with it very real economic and social benefits for many Australians and their communities. Full employment is one of the RBA's legislated objectives and the Board is committed to playing its role in achieving that objective, consistent with also achieving the inflation target."

When asked whether he would borrow at a fixed or floating rate if he had a mortgage, he was not prepared to commit, but rather, he advised borrowers to manage their obligations with a suitable buffer.

Although we like to think the RBA has some magical insights, this week confirmed that the information that will determine interest rates this year has yet to be released, and the Governor is guessing as much as any economist.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.