In the past decade the value of the Australian dollar has dropped more than 35% against the world’s most important currency, the US dollar. Since the start of 2018 the Australian dollar has declined 18%, a significant enough fall to have real impacts on investments and prices.

A clear impact is on travel. If you were planning to buy US dollars for your travel needs a decade ago and converted A$5000, you would have received about US$5,350 in your pocket. Today, those same savings will only be worth about US$3350.

Your exposure to currency

The direction of a currency has other significant impacts unrelated to travel yet important to your purchasing power and even your overall wealth. For instance, we purchase a lot of overseas goods, including food, cars, fuel, clothing and electronics.

When our dollar is down, retail prices for those goods tend to rise, as importers usually pass on the added costs to end customers.

The ebb and flow and interdependence of global trade has made foreign exchange the world’s largest financial market, with more than $US5 trillion a day worth of currency exchanged. In Australia, nearly $120 billion of currency changes hands every day and its growing rapidly.

There are several factors driving forex growth in Australia, including increased inbound and outbound travel, a growing number of foreign students undertaking study in Australia, and new migration.

Given the sheer size and pace of growth in this market, it is surprising that more Australians are not attuned to the implications of currency movements on their hip-pocket.

How can you do more with your cash?

Australians hold a large portion of their wealth in cash and, not surprisingly, specifically in Aussie dollars.

When investors do this, they expose their portfolio to substantial downside risk.

A portfolio, with only Australian-focused assets, is dependent on the outlook for the local economy. If our economy has a downturn, a localised portfolio will take a similar or even greater hit.

Currently, this risk is heightened, with the outlook for the Australian dollar uncertain because of low wage growth, low inflation rate, a softened housing market and issues relating to trade wars and markets.

By holding different denominations in overseas currency and investments in a portfolio, investors can spread risk across different geographic regions.

This can potentially smooth out investment returns over the long term, as Asia, the US and Europe will follow divergent growth paths.

During the GFC, for instance, when developed countries saw their growth downgraded, Asian economies scraped through relatively unscathed.

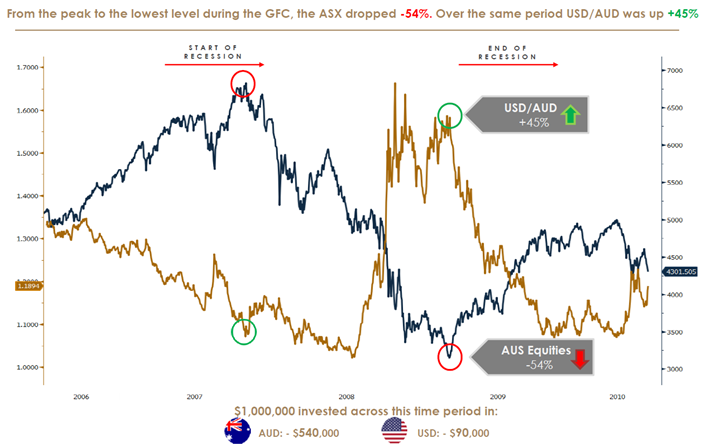

A currency's importance in the global economy will also determine how it’s affected by internal and external events. The US was one of the countries hardest hit by the GFC and yet its dollar actually appreciated.

As the globally-recognised reserve currency, the US dollar is what’s known as a ‘safe haven’ currency, meaning people buy it if they are uncertain of the direction of less globally-important currencies, like the Australian dollar.

So money often flows into US dollars in times of uncertainty. Even if the US economy suffers a shock, the US dollar can still remain strong.

This compares with the Australian dollar, which can be sold off aggressively in times of risk.

The Aussie dollar's value is tied to its dependence on the export of minerals, gas, agriculture and bulk commodities, such as iron ore, bauxite and coal.

Earnings on cash

The cash rate is another factor to consider when looking at currencies. If we look to next year, if you hold Australian dollars in 2020, the cash rate may be around 0.50%. If you hold US dollars in 2020, the cash rate may be around 1.50% to 1.75%. Both of these levels factor in a further two predicted rate cuts in Australia and the US.

While holding cash in different currencies may seem difficult, recent digital advancements have made this a relatively-straightforward option for ordinary Australians. Locally, international banks and fintechs have good options for customers to keep their money in a variety of currencies.

However, people still need to do their research to ensure they are choosing an option that best suits their needs, paying particular attention to any hidden fees.

Depending on the situation, this could just relate to holding currency or perhaps doing more with it such as buying foreign currency bonds. We are seeing a trend among our high net worth clients where they are buying US$ as a safety proxy, and then investing in high quality US dollar bonds. Year-to-date, we’ve seen a 36% increase in US$ bond purchases.

For investors and savers alike, managing currency exposure within a portfolio is an important part of a wealth management plan. It can both protect and enhance returns while improving risk management.

Gofran Chowdhury is Head of Investment Specialists at Citi Australia, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any individual.

For other articles by Citi, see here.