Data is everything. Even with a pandemic causing shockwaves in capital markets, data is a driving force. It powers modern, interactive technology, and the personalised services that attract consumers.

However, it also does something more. Data produces data. The information that comes from people using technology is vital. In some ways, that data is better than content in this digital era. The difference is that it incorporates real-time events.

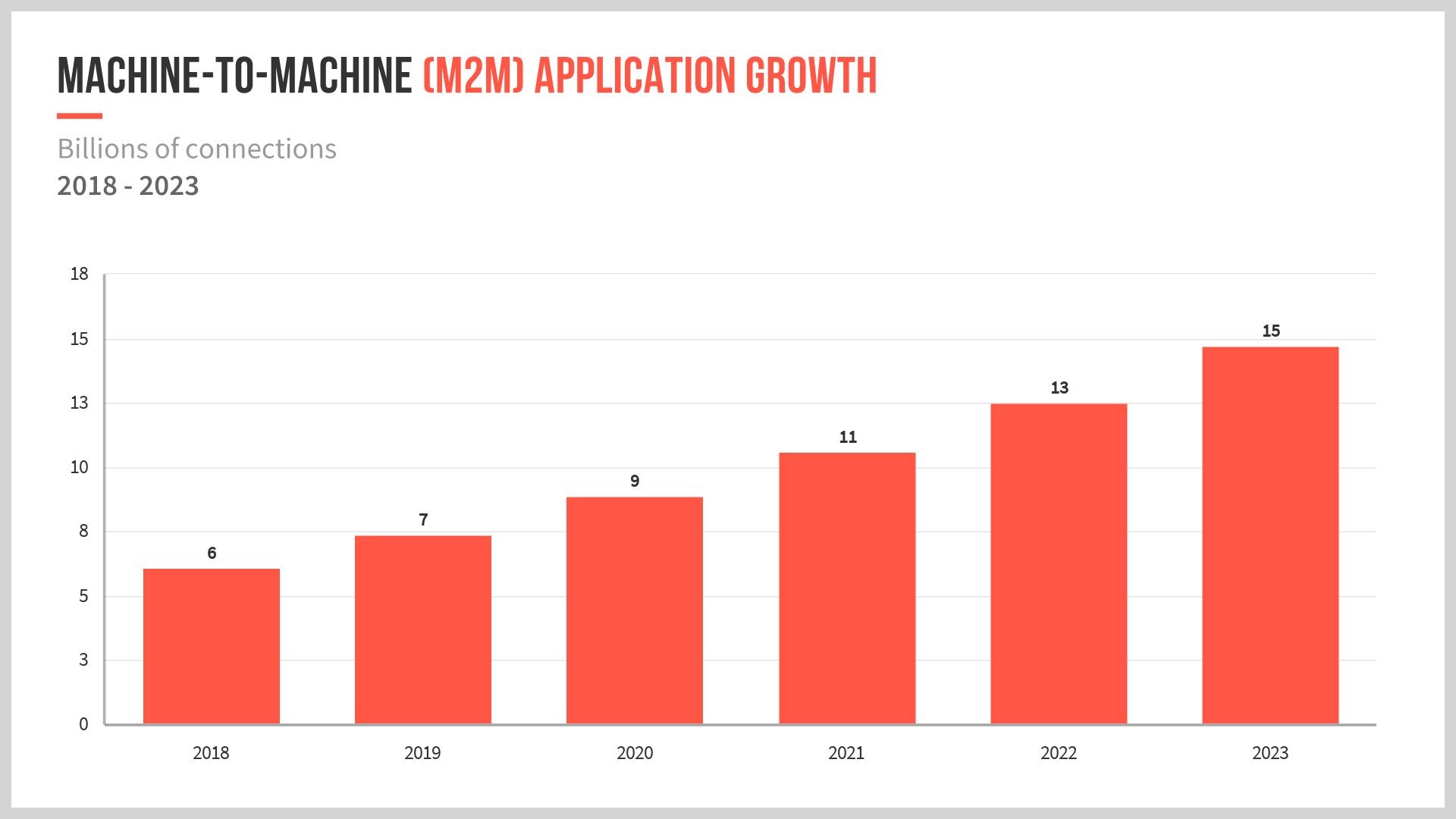

Look at the world of finance. People watch the markets closely and follow the subtlest movements that sway financial predictions. They pay attention to industry and company news. Then, they make their investments accordingly. In this climate, providing investors with real-time data is no longer an exception but a rule. As shown below, machine-to-machine data applications will continue to increase rapidly.

Machine to Machine connections will grow 2.4-fold, from 6.1 billion in 2018 to 14.7 billion by 2023. Source: Cisco Annual Internet Report, 2018–2023.

Understanding data and potential problems

But what is data?

By itself, the word is an umbrella term. It can include confidential personally identifiable information (PII). For investors, data refers to resourceful information. It includes any information that can shape sound investment strategies. Data may include stock indicators or company news.

Unfortunately, not all data is created equal. The common problems with traditional data management are:

- Human input is prone to errors and inaccuracy, which can cause severe losses in the market.

- Organisations usually need accurate data from many sources at any given time. Manual measures are not cost-effective and sometimes impossible.

- Data needs to be automatically updated to remain relevant. ‘Real-time data’ is useful because it is timely.

For capital markets, each piece of data has the potential to move the market. In turn, each market movement has the potential to cascade into a more significant shift.

Understanding real-time data

Real-time data refers to market information that is reported as it happens. Before the advent of real-time data, investors relied on analysing stocks at the end of a trading day. The old method prevented investors from responding to short transactional opportunities. Today, real-time data informs investors of potential losses and gains, and lets them gain greater control over their portfolios.

The trade stock volume is a guide to how much interest other market players are showing toward a stock. Technical traders and analysts compile volume data according to stock movement trends.

Real-time data goes through APIs (application programming interfaces). In turn, they connect to centralised backend databases.

What are APIs?

API software effectively functions as the ‘middle-man’ in the stock monitoring process. It exists between the applications used by investors and the platforms powering backend operations. Each API solution supplies data according to what is wanted and when it is needed. To enjoy the full benefit of APIs, investors need to be specific about their goals. Data glide paths and other reference points can streamline that process.

Effective API solutions minimise delays in the transfer of information across the channels. The right API can help investment firms build more robust and productive relations with their investors. Offering tighter surveillance over market movements is a powerful benefit.

Open Banking in the UK and PSD2 in the EU prompted Australia to follow suit. Nations are passing new regulations that improve transparency and offer data protection. This resulted in the creation of more open API frameworks that support greater user control in data management. Progressive API standards started with the banking sector involving four of Australia’s biggest banks in 2019, which have permeated other aspects of the market.

Real-time data in Australia

Australia, the UK, and the USA are currently seeing real-time data advantages through API frameworks. For example, the ASX processes its information from the Australian Liquidity Centre through advanced analytic systems. The ASX provides flexibility for investors who may opt between real-time data or end of day licensing. This arrangement allows investors to adapt to the rapid pace of real-time data analytics gradually.

But exchanges driven by real-time data are not without their hazards. On Monday this week, the ASX saw its biggest outage since 2016. Trading halted at 10.24 am and did not resume that day. According to the Exchange, the cause was a software issue that affected only the trading of multiple securities in a single order (combination trading) and created inaccurate market data on bid and offer prices.

Even though the bug only directly affected a limited number of orders, any inaccurate data in a market is unacceptable, as its effects can ripple rapidly outward. Investors must be able to trust that all the data they see, and any data driving the market’s movements, is accurate.

The ASX is not the only exchange in Australia. Another lesson learnt from the ASX halting was that equity exchanges are in an interconnected ecosystem. Chi-X, a leading alternative securities and derivatives exchange, continued to trade after the ASX halted but trades on Chi-X were a trickle at best. Chi-X said the ASX put the market in 'enquire status', freezing all trades, where it should have put the market in the 'adjust phase' to allow brokers to cancel trades and move liquidity to Chi-X. The ASX said that brokers could have cancelled their trades while the market was in 'enquire status' but chose not to. Investigations into the glitch by market regulator ASIC should tell us more.

Real-time data moving forward

Real-time data is an essential aspect of modern investment strategies but an API is only as good as its integrity. The quality of real-time data determines the accuracy of investment potential. Investors should always opt for a platform that is certified and accredited by leading market experts.

An API coupled with real-time data can supercharge data management by:

- Easily integrating many sources of data

- Improving the speed of data transfer

- Automating otherwise tedious processes

- Eliminating the risk of user entry error

- Improved quality of investment services

- Constant innovation in data monitoring and investments

Sticking to delayed and conflated analytics can hurt investors. It deprives people of being able to make informed decisions. Investors need solutions that support the quickest, most reliable responses and interventions. A comprehensive API can achieve that through the implementation of smart real-time data.

Ash J Hart is the CEO of CGD Digital. For over a decade, the company has served NZ’s top-performing asset management firms by creating applications to support client goals. This article is general information.