As with most things in life, it is the less exciting aspects of managing a portfolio such as rebalancing that turn out to be the most important. So what does rebalancing mean? Quite simply, it’s repositioning your portfolio back to target weights.

This is the first in a series exploring different methods to rebalance a portfolio. There are plenty of ways to do this, but here we start with the simplest method – calendar rebalancing, which means rebalancing over a set period of time, and it can be done at different time intervals.

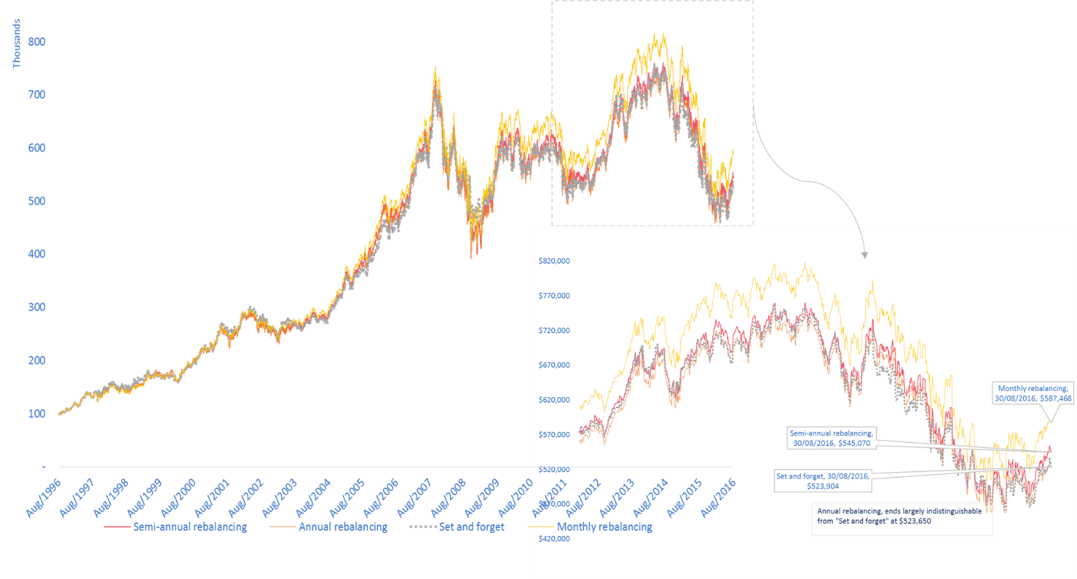

'Set and forget' performs worst in this example

Assume we started in August 1996 with $100,000 to invest and run the analysis for 20 years. We chose four stocks – BHP Billiton (BHP), Commonwealth Bank of Australia (CBA), National Australia Bank (NAB) and Woolworths (WOW). We set our target weights at 30%, 20%, 20% and 30% respectively. This is not about portfolio construction, so for illustrative purposes four stocks is enough.

We consider four scenarios; ‘Set and forget’, monthly, semi-annual and annual rebalancing. We rebalance our portfolio irrespective of what the stock price has done, what we think (or hope) it’s going to do and simply buy or sell shares at the calendar end of the period to take our target weights back to our starting position. With calendar rebalancing, there is no emotion.

‘Set and forget’ lets us down here with a final portfolio value of $523,000.

Source: FactSet, Owners Advisory, September 2016 (Click to enlarge)

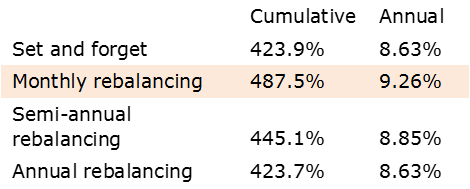

However, simply rebalancing the portfolio (albeit a very simple portfolio) monthly gives a final portfolio value of $587,000, semi-annual rebalancing gives a final portfolio of $545,000, and for this portfolio, annual rebalancing adds no value. The total returns for these portfolios are shown in the table below:

The performance difference from rebalancing is significant, particularly over a long period of time. Why? Let’s look at two of these scenarios and the weights through time to show the story.

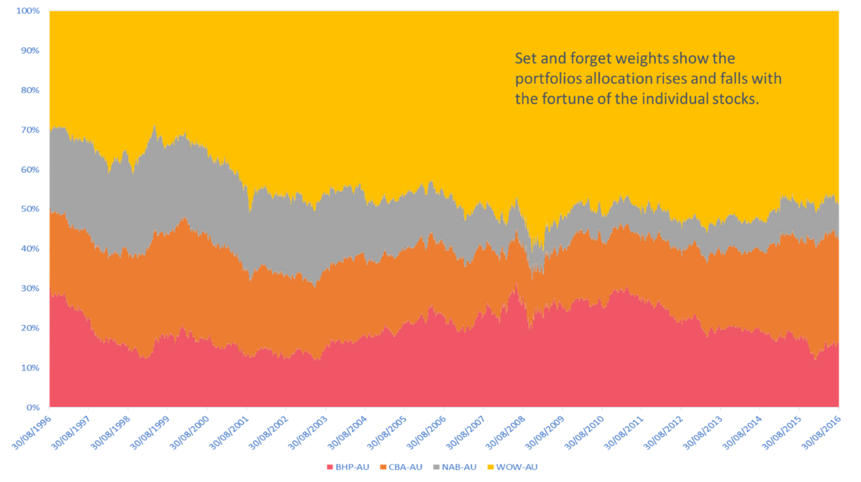

‘Set and forget’ weights through time impact performance

Source: FactSet, Owners Advisory, September 2016

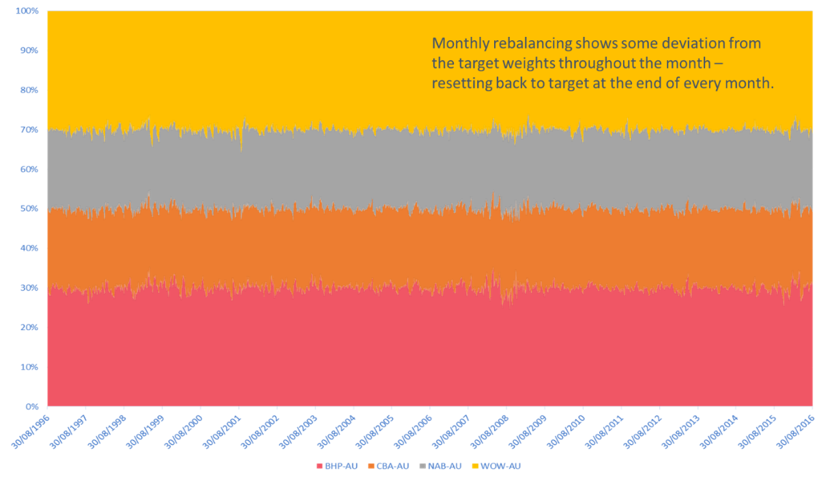

‘Monthly rebalancing’ holds our exposures largely constant through time

Source: FactSet, Owners Advisory, September 2016

Looking at the weights through time we see that, should we just set and forget, Woolworths becomes a large position in our portfolio. In fact, our dollar holding in the set and forget portfolio increases to over 50% of our portfolio.

In our monthly rebalancing, we begin to see why rebalancing performs the best for a concentrated stock portfolio. By design, we buy stocks when they have fallen below our target weight and we sell stocks when they have risen above our target weight. We are implementing the ‘trader’s catch-cry’ of buying low and selling high simply because we have held true to the weights we started with.

The second reason why rebalancing helps is it is the simplest method of portfolio risk control. Consider WOW: in the set and forget portfolio, we have let our best performers run, which is a very tempting way to manage a stock portfolio. But looking at what happens when WOW reprices reveals the other side of why a rebalancing regime helps overall portfolio performance.

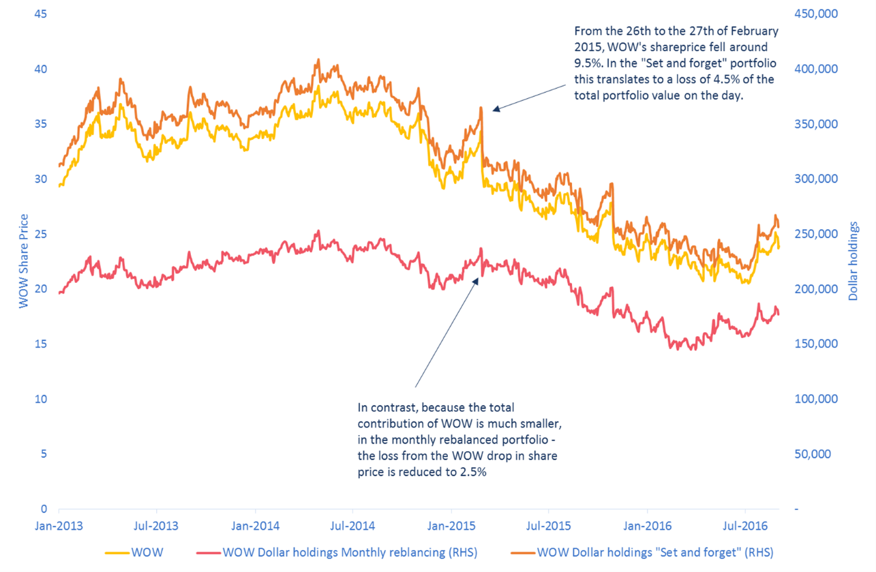

By 2015, in the ‘set and forget’ portfolio the dollar holdings in WOW has risen to approximately $400,000, as opposed to around $200,000 in the monthly rebalanced portfolio

Source: FactSet, Owners Advisory, September 2016

Woolworths fell 9.5% on 26 to 27 February 2015, costing us 4.5% in the entire portfolio on the day ($30,000 in dollar terms). However, in those portfolios where we have controlled our total exposure to a single stock, we see that while we still suffer a loss, it is only 2.5% of the portfolio’s value ($18,000 in dollar terms).

Simply having the discipline to hold shares at predetermined weights can go a long way to adding value to the total portfolio’s returns over the long term.

In the next instalment, we look at using the percentage deviation from target weights as our rebalancing trigger to see whether we can improve our overall portfolio performance by being just a little bit more sophisticated.

Leah Kelly is Portfolio Manager at Owners Advisory. This article is general information and does not consider the circumstances of any individual.