With yields on cash-like assets barely above zero, it begs the question of whether cash has any role in a portfolio apart from for liquidity purposes. Shouldn’t cash be held at minimal levels given the lack of any meaningful return? Not so quick!

Cash offers a unique feature – capital protection. If you invest $1 in cash, you can expect to get your $1 back plus (a little) interest. Other assets do not offer this feature because their prices fluctuate. This positions cash as the asset that might help defend the portfolio if all other assets fall in price for some reason.

Here is a framework for thinking about cash and a plausible scenario under which a ubiquitous bear market in all assets would see cash provide a safe haven.

More complex than just getting your dollar back

Of course, the nominal value of capital is not all that matters. ‘Real’ (inflation-adjusted) purchasing power also needs to be considered. Real purchasing power will be eroded if cash rates run at less than the inflation rate but will be protected if cash rates match or exceed inflation.

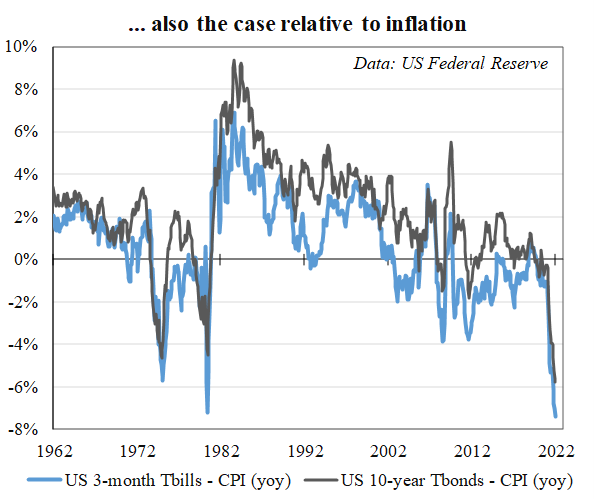

Real cash rates are currently negative, with cash-like assets that yield much over 0.25% not to be found without taking some capital (i.e. credit) risk. Meanwhile, the latest CPI readings are running at 3.5% in Australia and 7.5% in the US over a year ago.

An important point is that cash rates continually reset. This means that the future path of rates (and inflation) are more important than where both stand today. If cash rates rise in response to inflation so that real rates remain positive over time, then cash will protect the real value of capital and provide an effective inflation hedge. If cash rates do not keep pace with inflation, then real capital will be eroded, although this tends occur as ‘capital death by a thousand cuts’ rather than large one-off losses. How central banks conduct monetary policy is pivotal.

Breaking down the drivers of asset prices

My framework is one where asset prices are determined as the present value of future expected cash flows by applying a discount rate that reflects the return required by the market. Under this framework, asset prices can fall for two reasons.

First is a decrease in expected cash flows. A stock suffering a sell-off after the market revises down its earnings is a classic example.

Second is an increase in the discount rate. The latter amounts to the asset repricing down to offer a higher return going forward.

Cash is unique in that it carries no meaningful cash flow or discount rate risk (assuming no default risk). It is a promise to give back your invested capital plus any interest. As a consequence, cash will be most valuable in circumstances where broad-based reductions in cash flows or increases in discount rates occur that hit all other assets. Meanwhile, cash carries reinvestment risk because its rate of return continually resets.

Broad-based decreases in cash flows across assets could occur in, say, a global recession. However, under such circumstances there are usually some assets that provide reliable cash flows that may help protect the portfolio.

Government bonds have traditionally played this diversifying role, often more effectively than cash as discount rates also tend to fall during recessions. At least they have over the last 30 years or so.

Where cash can really come into its own is during an across-the-board rise in discount rates that hits the prices of all assets. This is where the danger seems to lie today.

A scenario where all markets reprice

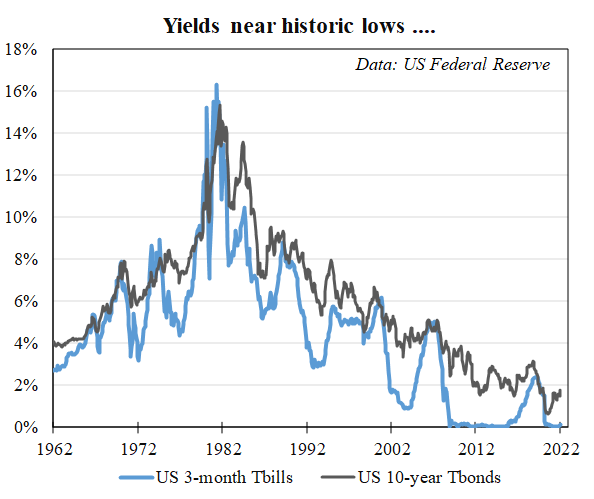

Yields near record lows (see charts) and many assets trading on high multiples are signs that discount rates are currently low. The risk is that this may not be sustainable. Higher inflation and tightening by central banks mean that discount rates could be going up, possibly considerably. This would be tantamount to markets going from being broadly priced for low returns repricing downwards so that they offer higher returns.

It is possible to imagine a scenario where central banks take cash rates to 3%-5%, government bond yields return to above 3%, multiples on equity-like assets shift to lower levels, property cap rates move to higher levels, and the housing market needs to adjust to mortgage rates back at 5%-6%.

You get the picture. Nearly everything reprices down as discount rates rise. Equities, bonds, property, etc. all get hit. Meanwhile, cash holds its value.

This may not matter so much if cash flows were increasing at the same time. Here consideration needs to be given to the influence of inflation, and central banks that seem to have placed themselves behind the curve. Monetary tightening to rein in inflation involves restraining growth – that is the point, in part. But there is a chance that the result is more than a slowing in growth. This could occur either because inflation proves so intransient that aggressive tightening is required, or central banks miscalculate.

Of course, a combination of rising discount rates without an offset from rising cash flows is just one possible scenario. But it seems a scenario that is not too far-fetched given current circumstances. Holding some cash can help protect the portfolio if such a scenario eventuates and diversification fails.

Two other things to consider

What happens to cash rates and inflation will determine the degree of capital protection provided. Will cash rates be returned to above inflation as central banks tighten, so that real capital is protected? Or will cash rates be maintained below inflation so that cash continues to erode real purchasing power thus diluting the benefit of the hedge?

It is a moot point how much tightening is required to rein in inflation, and how far central banks are willing to go once the impacts on the markets and economies begin to appear. In any event, focus should be on the future trajectory of cash rates relative to inflation, rather than where rates and inflation stand today.

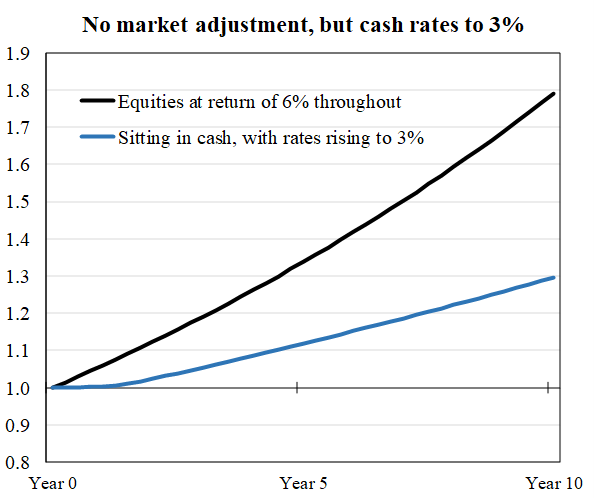

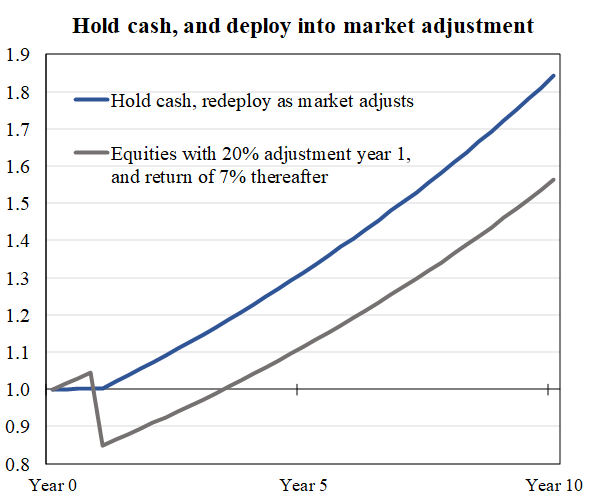

Another issue is grappling with the market dynamics. The charts below illustrate what could happen if the market continues on while you sit in cash, versus the scenario where cash is redeployed back into a market adjustment at a higher rate of return. But market timing is far from easy. If you shift to cash too early, and the market continues onwards only to correct from higher levels, there might be no net benefit.

Further, redeploying excess cash back into the markets once the adjustment occurs is tricky to execute. The benefit of the hedge would be much diluted, or even nullified, if cash is redeployed either too early and markets continue to fall, or too late so you miss the recovery. For some investors, staying the course but bracing for a possible hit might be a sensible approach.

In summary, cash is a defensive asset with unique attributes

My key message is that cash should be seen as a defensive asset with unique attributes that are valuable in certain situations, specifically when discount rates rise and prices fall across all assets. It at least protects the (nominal) value of capital and could also protect the real value of capital if central banks manage towards positive real rates in due course (no guarantees here).

Cash is better considered from this perspective and not treated as trash simply because cash rates are currently extremely low.

Geoff Warren is an Associate Professor at the Australian National University. He has also had an investment career spanning asset consulting, portfolio management, investment strategy and equity research; and currently sits on a number of investment-related advisory boards.