Financial advisors tend to be valued by those who use them, while the financially unadvised don’t see the need to pay.

KPMG research carried out last year at the height of the original COVID-19 pandemic found most people saw financial advice as a discretionary spend, while those who took financial advice saw it as essential and 70% of customers (a higher proportion than for insurers or super funds) were pleased with the service.

Compliance is pushing up costs

With this backdrop, it is important that any unnecessary costs facing financial advisers are reduced as much as possible, to increase the likelihood of more people taking advice. But the cost of complying with rising regulatory and professional requirements has driven the cost of advice production up over the last few years.

The Financial Services Council asked KPMG to assess the impact of proposed FSC reforms on the advice process, including hours, time, and cost per step of the process. These reforms were initially part of an FSC green paper and now a White Paper published ahead of the stated intention of the Federal Government to conduct a review into Financial Advice.

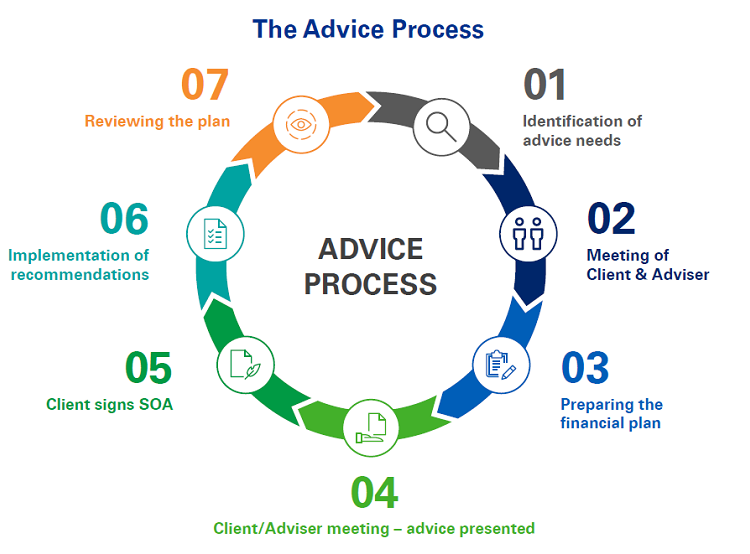

There are seven steps to the advice process:

- Identification of advice needs

- Meeting of advisor and client

- Preparing the financial plan

- Second meeting where the advice is presented

- Client signs the Statement of Advice

- Implementation of recommendations

- Review of the plan

Many advice firms cannot cover their costs

Our research found that it currently costs financial advisers more to produce advice than is charged as an up-front fee to consumers.

The FSC’s proposed reforms include abolishing lengthy, complex, Statements of Advice for a simpler, consumer-faced ‘Letter of Advice’. They also suggested adopting a new legislated financial advice model, clarifying and removing the currently complex labels for different types of ‘advice’. It is recommended advice would be billed as, simple; complex; or specialised. General information would be in a separate category.

It also included removing the best interest duty ‘safe harbour’ steps from the Corporations Act, while retaining the best interest duty obligations and enhancing the professional code of conduct. We do not believe this will reduce consumer protection but will save costs as the research indicates.

Statement of Advice costs $5,300

Our analysis found that these proposals had the potential to reduce the cost of advice by up to 39% and cut down the time spent on creation of a Statement of Advice by up to a third. The average cost of producing a statement of work, we found, could fall from over $5,300 to less than $3,700, a possible saving of 37%.

We also found the proposed reforms could free an adviser’s time to enable them to see more clients (up to 44 more a year) or use this time for other business critical activities such as training and business development.

We also looked at how technology could be used better, over time, to reduce costs. While there is no single advice solution which will unilaterally solve the advice challenge, we believe leveraging technology may further aid a provider to reduce the cost of advice, aiding affordability and also facilitate better, more efficient interactions between the client and adviser – aiding accessibility.

We are seeing providers seeking to harness a broad range of technology capabilities to drive enhanced customer experience, back-office efficiencies, and compliance. More could be done.

KPMG welcomes the opportunity to be part of the discussion on reforms which seeks to make advice more affordable and accessible to more Australians.

Click here to read the full report.

Cecilia Storniolo is Partner, Superannuation Advisory, Actuarial & Financial Risk at KPMG. This article is general information and does not consider the circumstances of any investor.