If ‘SMSF’ were a corporate brand, its marketing department would be the most successful in superannuation history. Barely a day goes by without some media mention of the extraordinary success of SMSFs. A massive industry of advisers, accountants and technology providers has flourished, leaving the big fund managers with relatively minor roles. Among the barrage of statistics, where billions and trillions are more common than mere millions, is a startling fact. The big retail players always had a strong response to SMSFs in their kit bag. They just didn’t explain it to enough customers.

It’s called the ‘super wrap’, and if promoted strongly, it could have saved at least $100 billion from drifting away from major fund managers into SMSFs, and in many cases, be a better investment platform for the client.

Super wraps are administrative platforms that give the control, potential lower cost and choice of an SMSF without the burden of becoming a trustee, setting up accounts and producing separate tax returns each year. They are available through most large retail funds, and industry funds such as AustralianSuper. In all these wraps, investors have access to ASX-listed securities, including the hybrids much-loved by retirees, a wide range of term deposits, good cash facilities and the widest array of managed funds anyone is ever likely to want. In some cases, close to a thousand funds. The only major asset class not available on a wrap is direct residential and commercial property. However, only about 15% of SMSF assets are in direct property, so this is not a limitation for most investors. In fact, a large, illiquid, undiversified asset such as property is probably not the best way to finance a retirement where regular drawdowns are needed in the pension phase.

At the end of each financial year, the investor receives one statement from the super wrap provider, and all the paperwork, corporate actions, tax treatments and cash flows have been covered. All investment management is carried out by clients and their advisers, while the super wrap handles custody and trustee obligations.

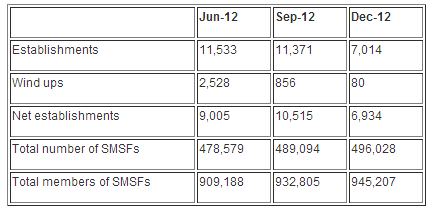

Despite the widespread availability of this product, the SMSF momentum shows no sign of easing, as the recently released ATO statistical report demonstrates. Sometime this year, the one millionth person will become a trustee of an SMSF, signing up at the rate of over 100 a day.

Equally impressive is the asset growth, now almost one-third of all superannuation and recently reaching $500 billion, growing far quicker than APRA-regulated funds. Industry consultant, Tria Investment Partners, estimates that 50,000 members of large funds depart for SMSFs each year, taking $17 billion with them in 2012. That’s about 30% of large fund net inflows.

The missed opportunity for super wraps is emphasised by considering the natural progression for many people through superannuation. At one extreme are millions of disengaged investors who find superannuation jargon as confusing, and interesting, as molecular physics. The ANZ Bank Survey of Adult Financial Literacy for December 2011 found that only 69% of people even look at their superannuation statements, and one-third said they found them difficult to understand. Their super goes into default options with industry funds or multi manager options with retail funds, and they get on with their lives.

Three decades later, the other extreme kicks in. These once disengaged investors are now at the end of their careers, and their mates around the barbeque keep talking about self managed super. It has become as ubiquitous as German prestige cars and private school educations for those with medium to high incomes. Their accountant already handles the business and personal accounts, and he’ll do an SMSF for a few thousand dollars a year more.

It’s an extraordinary shift in responsibility that comes with an 80 page trust deed of obligations and the threat of severe penalties if they make a mistake. Members are trustees who must design an investment strategy and choose investments from an infinite array, often based on their cursory understanding of market fundamentals. They have to manage an administrative system, and take personal responsibility for understanding the rapidly changing rules of superannuation. At the stage in life when they were anticipating the prospect of a relaxing retirement, they are thrust into the world of non-concessionals, recontributions and TTRs. What on earth are they?

According to a 2011 ATO survey of SMSF trustees, the most common causes of difficulties managing an SMSF are that the laws and regulations keep changing, and there is so much to know and understand. The required skills can take years to acquire, if ever. The ATO, in its role as the regulator of self managed super, is taking an increasing tougher stance against funds that fail to meet their compliance obligations. The regulator regularly removes complying status from SMSFs due to breaches of laws and failing to lodge tax returns, and a non-complying fund is taxed at the highest marginal tax rate. The penalty taxes can be severe.

This is where the third way, super wraps, should have bolstered the retail and industry super funds’ positions. They should have identified their vulnerable clients and warned them that SMSFs are not for all, and sold super wraps as a stepping stone, a learning path, to becoming a trustee and taking full responsibility for managing one’s super. The most commonly cited reason for establishing an SMSF is to give control over investments, and for the majority, a super wrap does that. It’s self managed super without a separate trust.

In fact, super wraps are often mistaken for SMSFs. When AustralianSuper launched its Member Direct wrap, the 2 February 2012 edition of Investment Magazine ran the headline, “AustralianSuper provides SMSF services to members.” If large institutions marketed it properly, it’s not a super wrap, it’s a ‘Self Managed Super Account’. It’s the self managed super when a customer does not want the responsibility, administration burden and cost of becoming a trustee.

What’s the evidence that a decent proportion of SMSFs would consider a super wrap? At the 2012 ASFA Conference, consultants from Tria presented a session titled, “The Empire Strikes Back: can retail and industry funds provide a viable alternative to SMSFs?” After being asked why they had left a major fund and set up an SMSF, members were then asked, “If we had offered you a competitive SMSF solution, would you have stayed?” Nearly half the members said they were either ‘likely’ or ‘very likely’ to have stayed. Tria estimated retention could have been “perhaps a third or more of SMSF destined outflows.” And internal polling by a major stockbroker with a large SMSF client base showed about a quarter of existing SMSFs would not have set them up if they had known about the features of a super wrap.

Furthermore, 11% of SMSFs hold less than $100,000 in assets, and 22% less than $200,000. At these balances, the fixed costs of annual accountancy and administration expenses plus ASIC fees are a high percentage. It is on larger balances where SMSFs better justify their costs, because super wraps often have an administrative fee based on asset size.

Does the SMSF money find its way back to the major retail managers anyway? No. The ATO asset allocation statistics for December 2012 show the major classes are:

- listed trusts 4.1%

- unlisted trusts 9.1%

- other managed investments 4.8%

- cash and term deposits 28.6%

- listed shares 31.6%

- unlisted shares 1.1%

- non-residential real property 11.4%

- residential real property 3.5%

About 14% is invested in traditional managed funds. The big winners are the stockbrokers, the funding departments of banks and the real estate agents.

Obviously, a super wrap solution is not for everyone, as many can benefit from the complete investment flexibility of a genuine SMSF. But we are talking about a million SMSF trustees here - the majority hold blue chip shares, cash and term deposits in their SMSF, which could be done in a super wrap, often at a competitive cost and without the trustee and administrative burden. According to the ATO survey of SMSF trustees, the average amount of time per week spent managing an SMSF is 3.7 hours, or 4.2 hours in pension phase. That's a decent round of golf, or a morning relaxing on the beach.

Which would you prefer, and what's your time worth?