The growth versus value dichotomy lies in plain sight, as broad market indices such as the S&P 500 have outperformed the tech-heavy NASDAQ in recent months. These gains are in contrast to movements in calendar 2020 where tech ran strongly ahead. Investors of both persuasions are wondering whether the price of growth companies has largely been captured with value companies yet to fully reflect the 're-opening trade' as vaccinations increase, borders reopen selectively and airline bookings pick up.

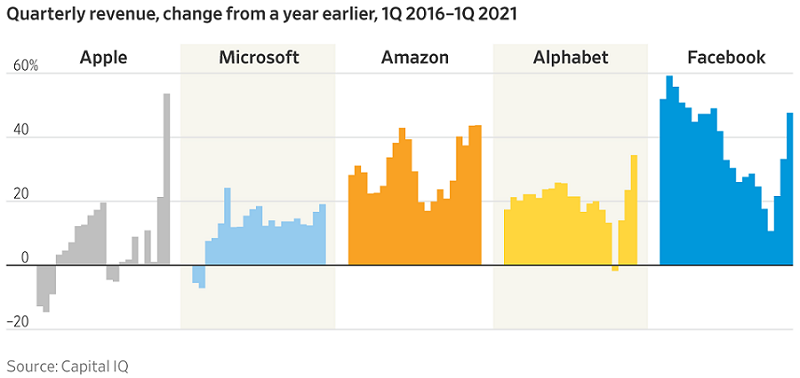

We think not. Earlier this month, the Wall Street Journal published the following chart with accompanying commentary, of the quite mind-bending revenue growth numbers produced by the disruption giants in the March 2021 quarter, relative to the same period last year. These numbers show a pattern of growth accelerating coming out of the COVID year.

Remember, this group picked up steam even as COVID hit. A fall in revenue growth could have been expected as the world began the slow climb to recovery.

Doing well, even in a pandemic

These companies are recording (for the most part) their strongest quarterly revenue growth in five years. Microsoft chief Satya Nadella, on the most recent earnings conference call, said:

"Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning. We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform.”

But the share prices of these stocks did not rise following these blow-out numbers - indeed a couple fell. In truth, they mostly rose in the weeks leading up to the results, so perhaps no further lift on the result was to be expected.

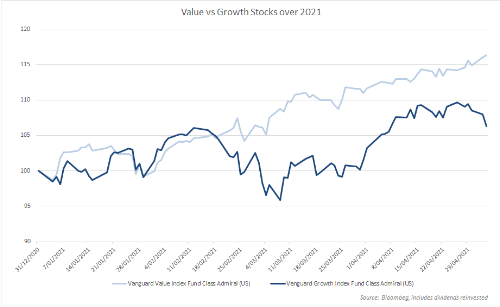

Meanwhile, there is no doubt that some of the beaten-down value players are enjoying their period in the sun, as the chart below on growth versus value shows.

Our caveat is that this value resurgence should be regarded with some circumspection. Take for instance the European car makers. On the one hand, Volkswagen, the largest car producer in the world with production of over 10 million vehicles annually, has fully embraced the electric vehicle, committing to the virtual phase-out of internal combustion engines entirely within a decade. It has been reported that VW's admittedly smaller rival, BMW, has not committed to the electric switch, with the BMW board against it because the margins are lower than for the ICE cars. Frustrated innovative, creative, and smart engineers left BMW, partly founding their own battery electric vehicle startups in China or the United States, it has been widely reported.

Traditional valuation methods do not apply to strong growth stocks

In our view, there are value (lowly-priced) stocks, and there are value companies which have a plan for the future, and they are different. Disney is in the latter group, moving from a model in which it relies on cable companies to sell its programming in favour of a streaming service like Netflix.

Kodak is an example of a value company which failed to adapt, and so never realised its value promise.

The key is a systematic approach to valuation. We apply a multi-year discounted cashflow valuation process, designed to capture shifts in business strategy (positive or negative). We do not use single period measurement tools such as P/E or EV/EBITDA but consider the likely cashflows looking out over a number of years. This allows us to understand the prospects of the giants mentioned in the Wall Street Journal article as well as many other companies that we expect to be household names in the future.

For example, we have held Xilinx, Nvidia and Qualcomm for over three years as our expectation of the companies' valuation has emerged and the share prices rocketed. The earnings power of these companies cannot be assessed using single period measures.

The process is also useful in assessing the valuation of companies which are moving from loss to profit. We hold a small number of these companies because we consider that their growth potential is significant (meaning global). Netflix was only barely profitable when we initially opened the position yet this quarter announced a US$5 billion buyback of stock.

There are some years to go before Netflix reaches our future valuation of the company. Similarly, with the other FAANG companies (Facebook, Amazon, Apple, Google) we see multi-year growth paths for these companies.

It also helps us to screen out companies which have deep-seated problems which are not being properly addressed by management, notwithstanding how good their earnings may be in any given period.

Alex Pollak is Chief Investment Officer and Co-Founder of Loftus Peak. This article is for general information only and does not consider the circumstances of any individual.