Imagine you are at a cocktail party in May 2012. The conversation turns to the stock market, and your friend mentions that she bought Facebook at its initial public offering that month. Then you tell everyone that you just invested in a trucking business. While your friend instantly becomes the life of the party, you spend the rest of the evening staring into your drink.

Growth is not only about tech stocks

Your friend made a good call. Facebook’s share price has risen almost sevenfold since the IPO. But your investment in XPO Logistics was also pretty exciting. Its share price performance was even with Facebook’s as recently as January 2020, and both companies delivered similarly strong revenue per share growth through the end of 2019. Since then, the pandemic has been considerably more painful for XPO’s shares than Facebook’s, so you ‘only’ made about 400% overall. But both stocks trounced the S&P500’s 200% return.

The lesson here is that great investments come in many different shapes and sizes, and they may not always seem obvious. The obvious winners in today’s environment have been the so-called FANGAM stocks – Facebook, Amazon, Netflix, Google (Alphabet), Apple, and Microsoft. One can debate their valuations, but whatever your view of these giants, there is strong evidence of truly speculative froth elsewhere.

Recent research by Verdad showed that there are 500 stocks in the US – the ‘Bubble 500’ – that are both more expensive than the FANGAM shares and have worse fundamentals. The vast majority of the Bubble 500 are found in areas such as software, fintech, biotech, and healthcare equipment. It's the virtual happy hour stocks of the present day. A few may turn out to be future giants, but it’s extremely unlikely that all 500 will work out anywhere near that well.

A check on the worst of both worlds

Taking a global view, we ran a similar analysis of our own on the FTSE World Index. We looked for stocks with the worst of both worlds:

- higher valuations than the FANGAM stocks

- weaker margins and slower revenue growth.

We found almost 100 such companies, which we call the ‘Heady Hundred’.

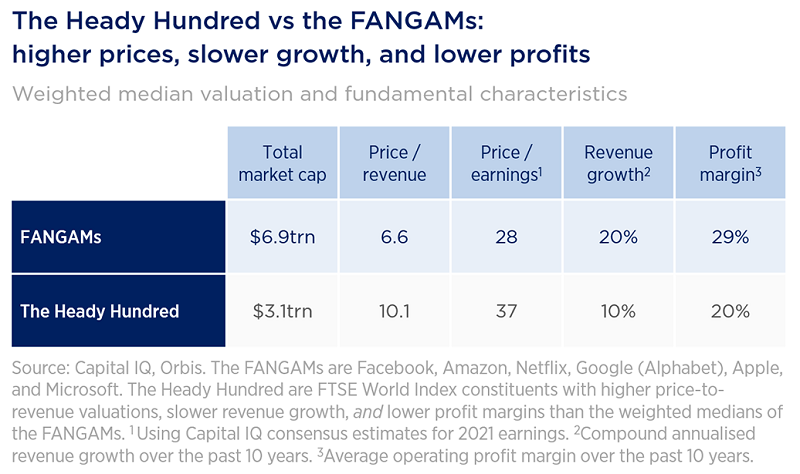

Unsurprisingly, software, biotech, and healthcare equipment stocks are well represented, as is the US. As shown in the table below, these companies are about 50% more expensive than the FANGAMs on a price-to-revenue basis and about 30% richer on price-to-earnings multiples yet have delivered only half the revenue growth and with lower profitability.

Astonishingly, this group of stocks carries a market value of more than $3 trillion. To put that in perspective, the Heady Hundred are worth nearly as much as the entire Japanese stockmarket.

A preference for boring, overlooked, hated

Of course, some of these may turn out to be great investments. Prices can often race well ahead of fundamentals for rapidly growing businesses. Amazon has never once looked attractive on traditional valuation metrics, but that hasn’t stopped its shareholders from earning spectacular returns over its 23 years as a public company (Amazon’s recent run has been painful for us to watch, having owned it but sold it far too early.)

The problem is that prices also race well ahead of fundamentals for all the other ‘exciting’ businesses that go on to falter. For those who fail to live up to their Amazonian expectations, the punishment can be swift and severe.

As contrarians, we much prefer the idea of investing in businesses that are boring, overlooked, or even hated. Not only are their fundamentals usually underappreciated, but there is far less room for disappointment since there is so much less enthusiasm reflected in the price.

Besides XPO, other examples in the Orbis Funds include US health insurers, emerging market banks and conglomerates, Japanese drugstores, and even a manufacturer of farm equipment. These ‘boring’ businesses have delivered revenue growth in excess of 10% per annum and some can even hold their own with the FANGAMs.

Most importantly, you don’t need to pay a heady premium for it.

Jason Ciccolallo is Head of Distribution for Australia at Orbis Investments, a sponsor of Firstlinks. This report contains general information only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person.

For more articles and papers from Orbis, please click here.

Summary points

- The dramatic rebound in the second quarter has left equity markets much more nuanced and with fewer obvious bargains compared to late March.

- Some “Growth” stocks appear attractive, while others have never been so expensive. On the other hand, some “Value” stocks appear unusually cheap, while others have been justifiably punished.

- In Japan, we are finding good companies at great prices and with particularly attractive dividend yields.

- Markets globally remain highly uncertain, but as always, our focus remains on avoiding the risk of permanent capital loss by being disciplined about the price we pay.