Before 2007, few people had a clue what a Collateralised Debt Obligation (CDO) was. When cash funds that held CDOs froze redemptions as the market collapsed, the loss of confidence drove what became the GFC. Suddenly, not only was mainstream media explaining CDOs, but so did bestselling books and Hollywood movies, the highlight being Michael Lewis's excellent The Big Short.

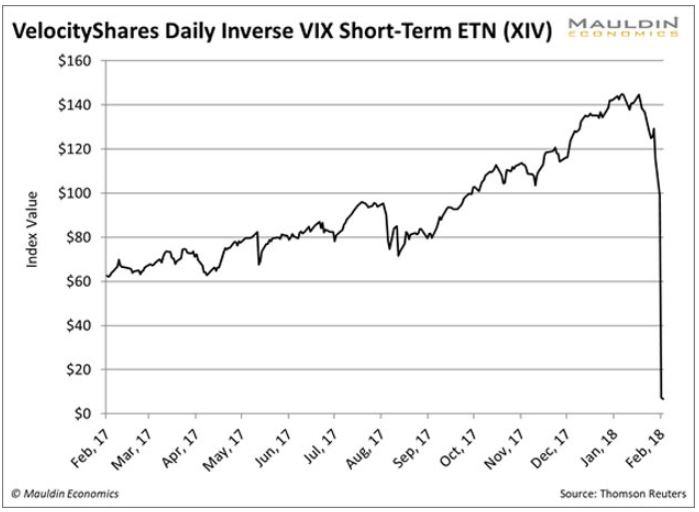

There's a scramble now to explain XIV. Bring on Lewis's next book. One day after the CBOE Volatility Index (VIX) had its largest-ever one day rise of 116%, Credit Suisse announced it would close its inverse VIX note. This VelocityShares Daily Inverse VIX Short Term ETN (NASDAQ code XIV) lost 96% of its value on one day. It's arcane to most Australian investors, but this was a $2.5 billion listed note that many local traders enjoyed as it returned 150% per annum for the previous two years.

What happened? In brief, until the start of 2018, equity markets had enjoyed years of falling volatility. Traders used products based on the value of the VIX (the VIX is an index and cannot be directly bought or sold) to sell at say 20, and buy back at say 12 as volatility fell. The inverse note, XIV, traded on the market just like a share, and as the VIX fell, XIV increased in price. Where there's demand, Wall Street creates a product.

But many traders had forgotten about risk. As volatility returned to the market, VIX rose dramatically, and the inverse note, the leveraged XIV, collapsed.

This 'shorting volatility' strategy paid for many a Porsche out of trader bonuses. Discussion website Reddit has a 'Trade XIV' group with 1,800 members, which carried posts like: "How I made $356K on XIV in two years". Now it includes this post:

"I've lost $4 million, 3 years of work, and other people's money. I started with 50k from my time in the army and a small inheritance, grew it to 4 mill in 3 years of which 1.5 mill was capital I raised from investors who believed in me. The amount of money I was making was ludicrous, could take out my folks and even extended family to nice dinners and stuff. Was planning to get a nice apartment and car or take my parents on a holiday, but now it's all gone."

Many of the investors were friends and family. I have not attached the relevant link to Reddit because much of the language is crude.

I'll leave it to Michael Lewis to write the XIV book and explain backwardation, gamma and contango, given he will have about 300 pages. Then go watch the movie.

It's not investing. Volatility trading and the need to cover leveraged risk on XIV and other products probably accelerated the overall market decline. This activity infiltrates mainstream stocks and induces investors to panic in response to headlines and fear. Forces such as these and high frequency trading (where computers automatically issue orders and now comprise about 60% of US equity trading) can have a pervasive impact on everyone's portfolio. The consequences appear to have been contained this time, and despite the screaming headlines, the US share market is ahead in 2018 to date.

Graham Hand is Managing Editor of Cuffelinks.