The irony of the focus on longevity and the retiree fear of money running out is that most people leave more assets to their estate than they held when they entered retirement. If it's possible to look down from beyond the grave, it must be frustrating for anyone who worked hard and saved, then lived a frugal retirement, only to see the following generations fritter the money away.

New research from Perpetual based on 3,000 Australian families shows that while 58% of people hope their children will invest for their future, an estimated 70% of families will lose their wealth by the second generation, and 90% by the third. It's a frightening prospect when $3.5 trillion will be transferred from Boomers in the next 20 years. Financial education for following generations is essential (try subscribing them to Firstlinks as a start!). Andrew Baker, General Manager of Private Clients at Perpetual Private, says:

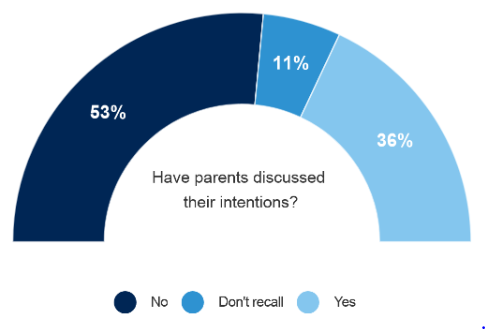

"We tend to shy away from discussing money amongst our families and friends. However, as we approach the largest intergenerational wealth transfer in history with more than half of Australians expecting to inherit, why have only just over a third discussed their wishes with their children?”

The coming holiday season might be a good time to talk about money with the family, and here's some more context. Ross Fox reports on the investing priorities of millennials, including where they like to invest, whether they have the resources and who they trust with their money.

Most of our readers are not directly affected by the funds reported in APRA's new 'heatmap' of rankings for MySuper products, but many have children who are. These funds are the 'defaults' offered by industry and retail funds on behalf of employers, so it's worth checking the list to see how your family's fund is performing and the fees it is charging. Everyone has a choice.

The release caused a flurry of activity in large super funds, especially by nervous trustees and fund managers. Peak representative groups warned of the narrow scope of APRA's work and short time period used in the results. We report on the major insights while Phil Graham checks the numbers and asks why APRA needed to go public.

The strong equity markets of 2019 have surprised everyone, especially when forecasts done in December 2018 were made in a climate of a poor quarter and expectations of Fed tightening. It continues an excellent decade, as Ashley Owen breaks down the asset class performance.

And it's also been another good year for Exchange Traded Funds (ETFs), and Ilan Israelstam updates research showing the increasing acceptance of this investment vehicle.

One subject in our articles that is more complex than the superannuation rules is the various aged care living choices. Annika Bradley looks at retirement villages and points to where to find help.

Jeff Song checks the latest rules on a common use for SMSFs, to buy 'business real property', such as a dental surgery or office premises, from a member and lease it back.

This week's White Paper from Channel Capital's RWC examines some of the fastest-growing countries in the world in emerging and frontier markets. It's a mix of risk and opportunity.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.

Sat 14 Dec: two articles added, for the updated PDF, click here.