As fund managers globally scramble to diversify and future-proof their client base, more attention is now being paid to the financial needs of millennials, a demographic born between 1981 and 1996, which investment firms have struggled to appeal to.

However, a recent Calastone study of 3,000 people aged between 22 and 34 across the UK, France, Germany, US, Hong Kong and Australia sheds light on some of the lifestyle habits, ambitions and general trends among millennials in what could help fund managers better target younger investors in the Australian market.

Property priority top, ability to invest bottom

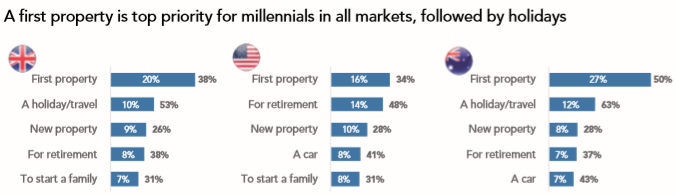

Investing does not elicit much interest from millennials globally, and young people in Australia do not buck this trend. The study found that while millennials in Australia may not be assiduously saving on a monthly basis, 71% do have some sort of saving, ranking the country higher than every market bar Hong Kong. Respondents in Australia said their primary motivation for saving was to fund their first property, a higher proportion in Australia than any other country in the study.

Blue bar is ranked 1st choice, other number is ranked in top 5 choices.

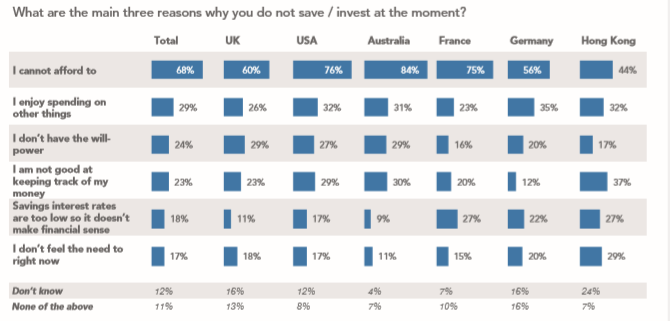

However, as shown below, a disproportionate number of Australians (84%) said their main reason for not saving was because they were unable to afford to, well above the global average of 68%. Calastone also found most Australians (71%) felt they were unlikely to receive a high-value inheritance in the next 20 years, although this is aligned with the global average.

Millennials and money management

Although the majority of millennials globally keep their money in a savings or current bank account, there are some regional divergences in terms of how young people invest. The study found 10% of Australians invest in funds – putting it ahead of the UK and France, but a long way behind the US and Hong Kong. Most Australians said they were investing to achieve long-term capital accumulation and returns, something which is presently unavailable from many savings accounts due to the low interest rates.

Looking ahead, Australia could be quite attractive for fund managers with 76% of all millennial respondents in the local market saying they planned to invest in the future, well exceeding that of France (54%), Germany (56%) and the UK (64%), but falling short of Hong Kong (81%) and the US (77%). However, if the funds industry is to attract these assets from millennial investors in the Australian market, it needs to better understand how this generation currently purchases its goods and services.

Attracting millennials into investment funds

Technology is clearly important to millennials, with local respondents confirming they organise their personal lives online and use apps wherever possible.

According to the study, 57% of Australians will buy services and products either online or via a mobile app, putting the country on a parity with the global average. Australian millennials appear to be more technically astute when it comes to banking with 64% saying that having online access to their account information was critical, compared to the global average of 56%. Furthermore, 52% confirmed they wanted access to their bank account information through an app, which was far higher than anywhere else, particularly in Germany where only 27% said the same.

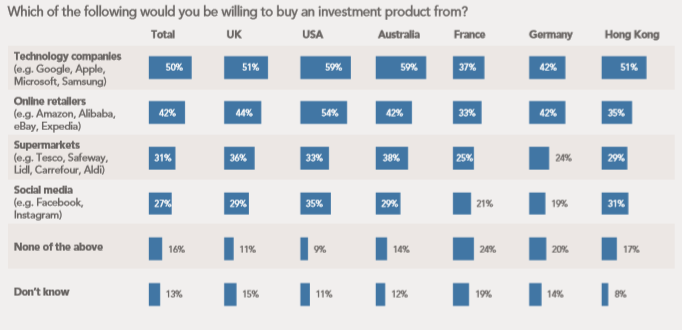

A large proportion of Australian millennials (59%) – along with those in the US (also 59%) – told Calastone’s survey they would willingly purchase investment products from technology companies such as Google or Apple in contrast to investors in Europe and Hong Kong who appear to be more sceptical about the idea. Among those Australians who already invest, 73% said they would buy an investment product through a technology company, well above the global average of 63%. Furthermore, 48% of Australians said they would trust a computer algorithm to invest their money, which is broadly in line with other countries.

Australia's millennials have a strong savings culture, and while Australian respondents have yet to fully embrace investment products, many young people are keen to invest in the future. However, embracing digitalisation will be crucial for asset managers if they are to win mandates in the tech-savvy local market. A failure to digitalise could impede asset managers’ efforts to raise funds from millennials.

Ross Fox is Managing Director and Head of Australia and New Zealand at Calastone.