Weekend market update: Following last Thursday when the NASDAQ was down 5% on the day and S&P500 down 3.5%, further falls on Friday of 1.3% and 0.8% respectively delivered the biggest pullback since June. However, both markets closed well above their lows on better-than-expected US employment data. With the tech sector now accounting for a third of the S&P500, where big tech goes, so does the market. The ASX200 started the week at 6,079 but finished at 5,925 as Australia followed Wall Street down with a 3% fall on Friday.

***

It was an historic sign of the times last week when the company with the longest record in the Dow Jones Industrial Average (DJIA) index, ExxonMobil, was evicted and replaced by a software company, Salesforce. Amazingly, as recently as 2013, ExxonMobil was the largest company in the world. The DJIA has great significance as the first stock market index, introduced in 1896. Charles Dow chose the 12 most influential companies of the day, added up their stock prices and divided by 12. The index increased to 30 stocks in 1928 where it remains today, still carrying strong influence.

Only one company, General Electric, in the original stocks in the index even exists today, and it is no longer in the DJIA. How many of the current 30 DJIA companies listed below will drop out or cease to exist in coming decades? We think of them as a permanent part of the industrial landscape.

The DJIA currently comprises: Salesforce, Procter & Gamble, DowDuPont, Amgen, 3M, IBM, Merck, American Express, McDonald's, Boeing, Coca-Cola, Caterpillar, JPMorgan Chase, Walt Disney, Johnson & Johnson, Walmart, Home Depot, Intel, Microsoft, Honeywell, Verizon, Chevron, Cisco Systems, Travelers Cos, UnitedHealth Group, Goldman Sachs, Nike, Visa, Apple, Walgreens Boots.

Many companies decline or disappear over time, and 'set-and-forget' investing is more problematic than ever.

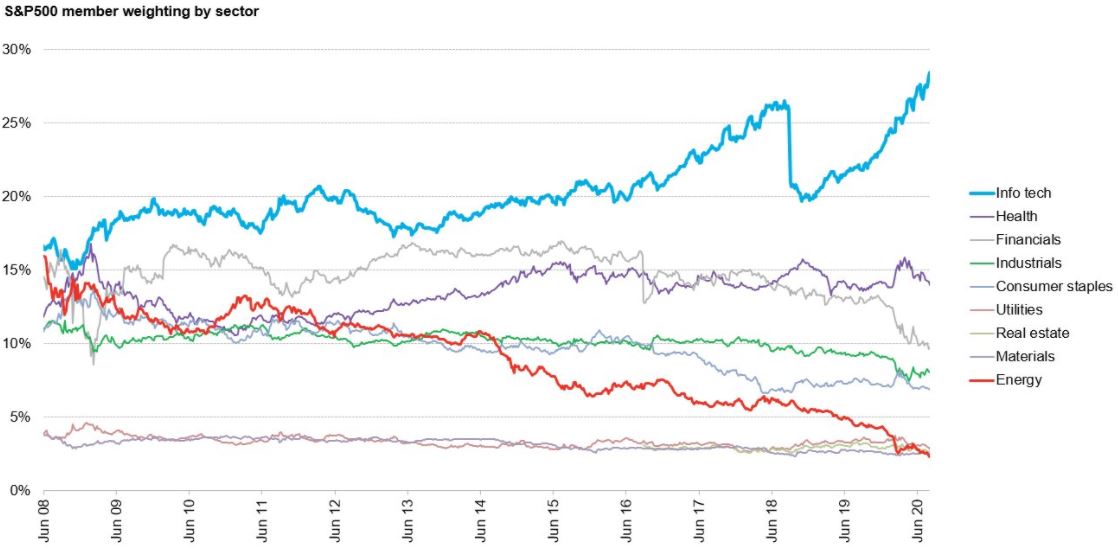

A better representation of the broad US economy and now more-frequently quoted is the S&P500 index, and the sector weightings below confirm this rapid change of fortunes. Technology is the big winner and energy is the big loser. Any fund manager on the wrong side of that trade should no longer have a job.

Two substantial changes this week by central banks show how they can support the economy without lowering interest rates. Australia's Reserve Bank increased the size of the Term Funding Facility (TFF) used as a low cost funding source by banks, supposedly to finance business loans. Total funds available at a fixed rate of 0.25% for three years are now $200 billion, currently drawn to $52 billion. With bank coffers already full from retail term deposits (the savings rate rose from 6% to 20% in this week's National Accounts), we can safely expect no funding problems for our banks for many years.

In the US, the Fed signalled rates close to zero for many years as it relaxed its inflation target. It forces investors into other asset classes to achieve decent returns and will further support the incredible run in tech stocks.

The fires of the superannuation debate continue to burn as we covered two weeks ago. Paul Keating turned up the gas this week by claiming the Liberal Party wants to end compulsory super:

“Not take a chink out of it, but to actually destroy it. They intend to do this in two ways. That is, they want to drain money out of the bottom of the system, and stop money coming into the top of the system ... This malarky they talk of, ‘if they take it in super, they won’t get it in wages’, there’s been no wages growth for eight years and there’s not going to be."

As another Labor ex-PM, Kevin Rudd, also weighed in, Senator Jane Hume took to the airwaves, referring to Labor opening a crypt (clearly a reference to dead bodies) to bring out former leaders to support the super system. The arguments have a long way to play out.

In a hectic week, we also saw the final vestiges of the once-dominant bank position in wealth management sold off when NAB disposed of MLC to IOOF, and the capital raising from retail investors (a subject we have covered here and here) had the usual twist. In raising $1 billion overall, IOOF would double its capital base at $3.50 a share, a discount of over 20% to the $4.51 price at the time of the issue. IOOF is only looking for $50 million in the retail SPP, but as the shares closed on Wednesday at $3.53, smaller investors are not missing much this time.

Then the new chair of AMP, Debra Hazelton, wasted no time putting her stamp on the business by announcing a complete portfolio review "to ensure we appropriately assess all options to maximise shareholder value in a considered and disciplined manner.” Everything for sale at a price.

Here's a personal footnote. About 35 years ago, when I was running New Issues at Commonwealth Bank, many of our bond counterparties were Japanese, and we decided we should hire someone who could speak Japanese to assist in negotiations. We advertised widely and a school teacher who taught Japanese applied. She had no financial markets experience but was clearly smart and she worked with me in Sydney for a couple of years.

Then the bank transferred her to the Tokyo office, where a few years later, she became Treasurer of the local office. I visited her there on business, and she kindly showed me around the bars and karaoke rooms. Later, she returned to Sydney to head the office of Mizuho Bank.

As the new chair of AMP, Debra replaces David Murray who was CEO at Commonwealth Bank when we hired her. Best wishes to my former colleague in her challenging new role.

Back to investing basics ...

This week's edition includes a couple of articles which experienced investors can share with those who may be at an earlier stage in their investing journey.

Thomas Philips was asked by a friend to draw on his many years of investing and provide a simple guide based on what he had learned. Such was the enthusiastic reaction that we felt it warranted a larger audience. Likewise, Robin Bowerman looks at inexperienced investors entering the stock market for the first time and warns about their speculating.

Emma Rapaport delves into a new report on investing by SMSF trustees during the pandemic, summarising changes in five key charts. Then Peter Moussa offers his strategies for the uncertain markets we are facing, with some ideas more suitable for a sophisticated investor.

The combination of market and legislative changes, early super withdrawals, people working longer and contribution levels is having a profound impact on retirement savings. Erinn Cullinane and Nick Callil create specific examples to show how much longer people may need to work if super balances do not meet retirement needs.

A change of pace to Michael Collins on the nature of US-China relations and the extent to which a new 'cold war' may eventuate, then Mark Mitchell says the role that fixed interest played in portfolios has completely changed. How much can it protect falls in stock markets?

This week's White Paper from Vanguard looks at whether active equity managers can be cloned using inexpensive factors that drive stock market returns. If returns can be mimicked by simple factor strategies, often available using ETFs, investors may lower costs and demand more from their managers.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website