Weekend market update

Both the US and Australian stock markets experienced their worst week for six months on the back of increasing COVID-19 cases in Europe and the US, and fears of a contested Presidential election. The S&P500 lost another 1.2% on Friday to take the week's losses to a hefty 5.6%, pushed down by NASDAQ stocks as the index retreated a further 2.4%. Australia was down 3.9% for the week giving back most but not all the gains made in the past month.

***

There is a popular belief that retail investors do not even achieve index returns due to poor timing of investing and selling decisions. The theory is that they buy after markets rise as confidence grows, then sell in panic when markets fall, and miss the recovery. This 'buy high sell low' tendency loses the advantages of long-term investing and riding out the selloffs.

The recent evidence for this is far from convincing. For example, Morningstar in the US produces a 'Mind the Gap' report, and the 2020 version concluded:

"Overall, the gap between investor returns and reported total returns has shown notable improvement. As a whole, the returns that investors experienced were only slightly lower (by about 5 basis points per year) than reported total returns over the trailing 10-year period."

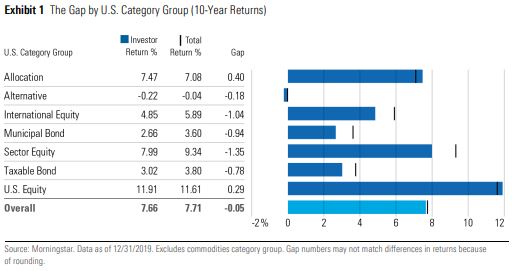

As Exhibit 1 shows, average investor returns have varied between 0.4% better to 1.35% worse than the market, depending on the category over 10 years, averaging an immaterial -0.05%.

In a 2019 study of Australian data, the results were even better, with the asset-weighted return for investors delivering 0.65% more than market returns over five years, although this was a period without whipsaw price changes.

However, annual research by Dalbar called Quantitative Analysis of Investor Behavior (QAIB) shows much worse investor results, usually underperforming the market by 3% or more over 10 years. For example, Dalbar says:

"The comprehensive study highlights the 10 key periods in which investors withdrew their investments during periods of market crises, which represent the 10 most severe cases of underperformance since 1984. Of these 10 cases, the QAIB found 8 cases would have produced better returns for the Average Investor one year later if they had taken no action and held on to their investments."

While the results of such studies are often disputed, stock markets have delivered strong results over the long term, and trying to time the market can indeed lead to poor results, such as missing a recovery. We saw it in the GFC and again in March 2020. It was Charlie Munger who said:

“Investing is simple, but not easy.”

This week we have two articles on this topic. Gemma Dale looks into the trading activity of nabtrade's retail clients during COVID-19 and describes three ways they invested during the pandemic. Not so dumb after all.

Then Tanya Hoshek reports on Russell's 'Value of Advice' research which argues that advisers help clients to avoid behavioural mistakes during periods of market disruption. Perhaps the educational messages are working.

Still on risk and investing mistakes, Josh Charlson takes a quick tour of 13 risks investors should check in their portfolios, recognising that accepting some of these is inevitable.

Bruce Apted looks at the performance of small cap versus large cap companies in Australia over 20 years and more recently. He gives his views on whether the smaller company price surge in 2020 can be sustained.

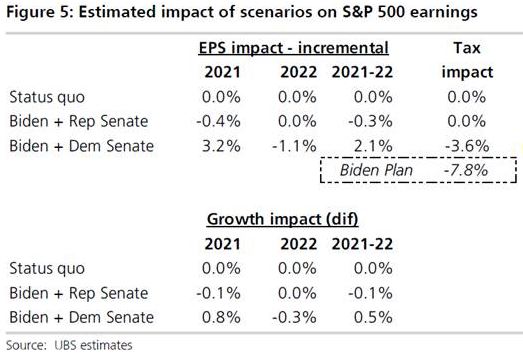

Tuesday 3 November in the US is shaping up as a momentous day, either leading down a path of four more erratic and unpredictable years under Donald Trump, or a more traditional Presidency but also filled with risks under Joe Biden. Analysts from First Sentier Investors and BNP Paribas Asset Management have short pieces on how the system works and possible consequences. UBS has provided this summary of the estimated impacts on S&P500 companies over 2021 and 2022 due to different policies.

There is a possibility that the result will take weeks to confirm, and the betting is Biden a $1.52 favourite and Trump at $2.90. My personal view is that Biden will win easily but even those who are disgusted by Trump's lies and character flaws must admit his rock-star rallies and boundless energy show impressive campaigning ability. He will be hustling on the hustings until the very end.

As more investors turn to ESG investing, Rachel White gives four reasons why this trend will continue, and we can stop thinking of sustainable or ethical investing as anything other than mainstream.

Finally, a question many SMSF trustees must ask themselves as they ponder a sea change or tree change. Elizabeth Wang explores whether you can buy a retirement home now in your SMSF.

This week's White Paper from Western Asset looks at the problems facing the airline industry and how it may recover from the pandemic. It's relevant not only to Qantas and Virgin locally but Flight Centre, Webjet and Corporate Travel among many others.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website