The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular articles from the week. You can check previous editions here and contributors are here.

Weekend market update

From AAP Netdesk: On Friday, investors extended an ASX record high marginally as they looked beyond the lockdowns plaguing about half of Australia's population. NSW officials say it is unlikely their lockdown will end on 30 July. Healthcare shares were best and gained 1.3% with CSL adding 1.5%. Technology shares were the next top performer and rose 1.0% while Energy shares fared worst, down 1%. For the week, the ASX added a modest 0.6%. Insurer IAG is headed for a full-year loss from COVID-19 but company leaders say there is more certainty in the economic outlook.

From Shane Oliver, AMP Capital: US and European shares looked through coronavirus concerns over the last week and rebounded helped by good US earnings and dovish guidance from the ECB. For the week US shares rose 2% to a record high and Eurozone shares rose 1.9%. Japanese shares were closed at the end of the week so missed the US rebound and fell -1.6% and Chinese shares fell -0.1%. Bond yields continued to decline. Oil and metal prices rose but the iron ore price fell. The $A fell as the $US rose further. And Bitcoin had a bounce as celebrity influencers Elon Musk, Jack Dorsey and Cathie Wood reportedly said nice things about it!

Despite their rebound over the last week, shares remain at risk of a short-term correction as coronavirus cases rise and the inflation scare continues and as we come into seasonally weaker months for shares. New coronavirus cases globally are continuing to rise again. There are now over 500,000 new cases a day making Australia at around 170 a day look like a bit of a non-event.

***

Despite the obvious successes of superannuation, the industry has failed to sell itself adequately to the public. Instead of focussing on the impressive investment returns delivered to millions of Australians, we hear more about the fights between industry funds, retail funds and senior Liberal Party officials.

The battles are on many fronts. The industry fund lobby group, Industry Super, ran the famous 'fox and henhouse' campaign to undermine retail funds. It depicted foxes surrounding a henhouse with scary music playing late at night, with a frightened child awake in a bed. A deep voice said, "The big banks want to get their hands on your super." Whereupon a man clearly representing the government opened the door of the henhouse to allow the foxes in. The Compare the Pair advertisements continue the attack.

In March this year, Superannuation Minister Jane Hume argued Industry Super was acting in its self interest in its push to increase the Superannuation Guarantee to 12% and criticising the Retirement Income Review. The Review had opened the discussion on retirees accessing home equity to fund retirement, and Industry Super ran ads with an older couple saying, "We’ve worked all our lives for this place, we’d hate to have to sell it to fund our retirement."

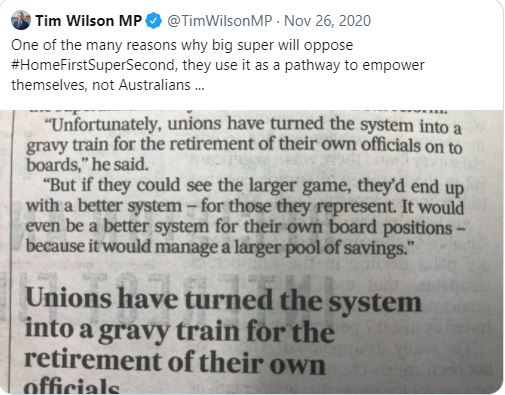

The Federal Liberal Member for Goldstein, Tim Wilson, also holds the lofty title of Chair of The Standing Committee on Economics. This gives him incredible power to raise issues, as it is:

"The most senior Committee of the House of Representatives in the Parliament of Australia, and has oversight of the Reserve Bank of Australia, the Australian Securities and Investments Commission, the Australian Competition and Consumer Commission and the Australian Prudential Regulation Authority."

Wow, talk about friends in high places. He can review almost anything financial, so when he pushes a #homefirstsupersecond campaign, it's no surprise that the industry funds object, even writing to Treasurer Josh Frydenberg warning Wilson is using his role for personal political campaigning purposes and "undermining confidence".

It's part of a larger Coalition v Labor political stoush with members caught in the crossfire.

The retail funds did little to promote their cause at the Financial Services Royal Commission, rolling over easily when criticised for charging fees to dead people and fees for no service.

Ian Silk, retiring soon after 15 impressive years running AustralianSuper and turning it into the biggest super fund in Australia, conceded on Radio National that funds could have done more to educate members. After host Geraldine Doogue had called superannuation a 'gravy train' for collecting over $30 billion in fees every year, she continued:

"I don't know that the industry has accepted the responsibility sufficiently of making people more aware of their super. It's the sort of thing you don't think about until five years before you retire. This is put on the government to do more on communication and education but what responsibility does the industry itself hold?"

Ian Silk replied:

"Yes, you're right, the industry itself does have a responsibility, and we probably have not discharged that responsibility as well as we might have. Most funds, especially the better-performing funds, are promoting their relative performance. Ultimately, it's for every individual to realise that their superannuation savings, next to their house, are probably going to be their second-most valuable asset in their life."

All this infighting in a $3.2 trillion industry disguises the great Australian success story in delivering retirement savings. It's not only that the median growth fund posted 18% returns for FY21, with many funds over 20%. More important, the 10-year annual return from several funds is almost 10%. Compound $100,000 upfront and $1,000 a month for 10 years at 10% gives over $450,000.

These are not personal SMSF returns or the results of a few top-performing fund managers. These funds hold the savings of 'mum and dad' investors who work in nursing, retailing, construction and hospitality who don't know one end of an SMSF from another. I wish my SMSF had done so well last year. So hats off to the best over 12 months - Qantas Super Growth, BT Panorama Balanced, Hostplus Balanced, CFS FC Multi-Index Balanced and MLC Balanced. And over 10 years - AustralianSuper, Hostplus, Cbus, Unisuper and CareSuper.

This lack of appreciation for superannuation probably contributed to three million people withdrawing $38 billion under the COVID early release scheme, with David Bell estimating that a 30-year-old taking $20,000 will become $50,000 less in retirement. Members have already missed out on the great results in their funds, losing $4,000 in a year at 20% on $20,000.

It would be better for members if superannuation funds concentrated more on selling the benefits of long-term saving without a perpetual slanging match protecting their turf and criticising others.

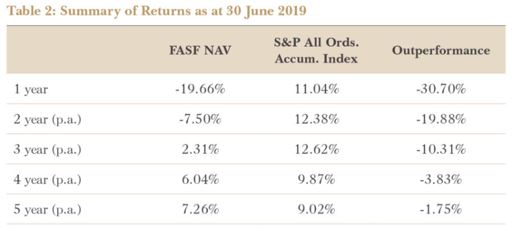

Still on performance, there was a stark illustration in FY21 of the perils of judging a fund on past performance, as the Your Future, Your Super framework does. Steve Johnson's Forager had faced a torrid few years as his stock picks failed to deliver, but to his credit, he hung in there with minor changes to his process. The first table below shows Forager's results to 30 June 2019, a worrying 10% pa behind the index over three years.

Here are the latest results in the Morningstar database, with a one-year total return of 91%, or 55% above the index. How many people gave up in 2020 based on past performance?

And don't start me on all the FY21 performance tables showing geared funds at the top, with photographs of fund managers proudly plumping out their feathers. Come on, they are geared at 60% and the Australian index was up 28%. Of course geared funds did well, as explained here.

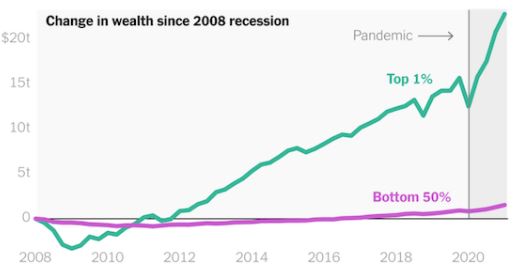

Ian Silk said another benefit of Australian superannuation is ensuring more people participate in the capitalist system and its ability to generate wealth. In Australia. The table below is from a The New York Times article on how the US central bank is supporting the wealthy. In 2021, the richest 1% of Americans held 32% of US wealth, the highest since 1989, while the bottom 50% held 2% of US wealth. As Jeff Bezos said when he returned to earth after his space flight, Amazon's staff and customers paid for that.

Of course, some people would rather use the 10% going into super for another purpose, especially buying a home, and that's legitimate. But the majority will be grateful for the nestegg built for their retirement.

We start this week with Clay Smolinski's explanation of the four guiding principles that have served Platinum since the days when Kerr Neilson set up the business. Simple guidelines but not easy to adopt.

Reece Birtles continues our series on investing in retirement, this time a more traditional approach of relying more on the long-term income from mainstream assets rather than buying insurance or protection. This approach more closely mirrors an 'allocated pension' strategy that deserves a place at the table.

A major cause of the retirement challenge is generating income without equity risk, and our interview with Andrew Lockhart looks under the covers of corporate debt funds to see how they can deliver better cash flows.

Christine Benz is a leading Morningstar writer, and as the company has a sabbatical scheme which allows employees a solid break every four years, she reflects on what she learned in a complete change of pace. Fascinating look at how she felt she was trialing her eventual retirement.

Lucy Turnbull AO is well known in business and political circles, and in this interview with BusinessThink of the business school at the University of NSW (my alma mater), she gives valuable career and leadership tips.

Suddenly, the market has become more relaxed about inflation, with long bond rates falling and concern over the economic recovery despite the latest US inflation levels over 5%. Nevertheless, Mamdouth Medhet and Wei Dai check the asset classes which are supposed to protect investors from inflation and they are not overly impressed.

In a new podcast episode, Peter Warnes discusses some of his favourite stock picks in long-term assets, how to make your portfolio last the distance, the crazy valuations on some assets and what analysts missed at Amazon. I also presented for the Australian Shareholders' Association on LIC and ETF opportunities and the full webinar with slides is included.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Emma explores why ETF investors were hit with mammoth distributions on 30 June 30 and how tax and distributions work for ETFs. Lewis Jackson looks at one way investors are using debt to enhance their returns but of course with extra leverage comes extra risk.

This week's White Paper from MFS International shows how structural changes in credit markets can deliver better returns on fixed interest bonds, which can deliver better result for investors than the low rates suggest.

The Comment of the Week goes to Kevin commenting on the 'noise' article and 'what the hell is water?':

"I nearly fell off my bike laughing at myself when the obvious suddenly dawned on me. If I'd bought Walmart when old Sam was the richest guy in the world, say 1980. Then he died, Bill Gates became the richest man in the world, what 1992? If I'd bought MSFT then. Jeff Bezos became the richest man in the world 2016? If I'd bought Amazon then, I nearly did. The light came on. All the noise put me off. Then it dawned on me. He is doing the right thing, all profit goes back into the company to build it up. When the next richest man or woman in the world is decided, the shares will be expensive, and probably worth buying."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Funds Report from Chi-X

Plus updates and announcements on the Sponsor Noticeboard on our website