US consumer prices were up by 5.4% for the year ending June 2021, the largest annual increase since August 2008. As US markets feed into all others, inflation is at the centre of attention for many investors.

Our recent research suggests that simply staying invested helps outpace inflation over the long term for a wide range of asset classes. The analysis of data from 1927–2020 covers periods with double-digit US inflation as well as periods with deflation.

Inflation outpaced

Exhibit 1 shows average real returns (that is, returns net of inflation) to different asset classes in years with high (above-median) inflation from 1927 to 2020. We consider a total of 23 US assets that span bonds, stocks, industries, and equity premiums. Over this period, inflation averaged 5.5% per year in high-inflation years. While average real returns were mostly lower in years with high inflation compared to years with low inflation, the exhibit shows that all assets except one-month T-bills had positive average real returns in high-inflation years.

The analysis over 1927–2020 is useful because it covers periods with double-digit US inflation (like the 1940s and 1970s) as well as periods with deflation (like the Great Depression, 1929–32). But we find similar results over the most recent 30-year period (1991–2020), when US inflation was relatively mild and stable.

Over this period, we also expand our analysis to non-USD bonds, developed- and emerging-market equities, real estate investment trusts (REITs), and commodities. Overall, outpacing inflation over the long term has been the rule rather than the exception among the assets we study.

Exhibit 1: Keeping It Real

Average annual real returns in years with above-median US inflation, 1927–2020

See Data appendix below for more information

Inflation hedged

Despite the reassuring findings presented above, growth assets that have historically outpaced inflation may not be appropriate for everyone. For investors highly sensitive to inflation and with a low tolerance for market risk, some exposure to inflation-indexed securities might assist. However, in Australia, there is limited supply, mainly from government and infrastructure borrowers such as Sydney Airport.

While stocks from certain industries, REITs, commodities, and value stocks are sometimes considered 'inflation-sensitive' assets, the data provide little support that they are good inflation hedges.

Nominal asset prices already embed the market’s expectation of inflation. So inflation concerns are really about the negative impact of unexpected inflation on the real value of your invested wealth.

An asset is therefore most useful as an inflation hedge when its nominal returns move closely with unexpected inflation. We find mostly weak correlations between nominal returns and unexpected inflation. For the few exceptions where the correlations are reliable, such as for energy stocks and commodities over 1991–2020, the assets’ nominal returns have been around 20 times as volatile as inflation, and more than half of their nominal-return variation has been unrelated to inflation.

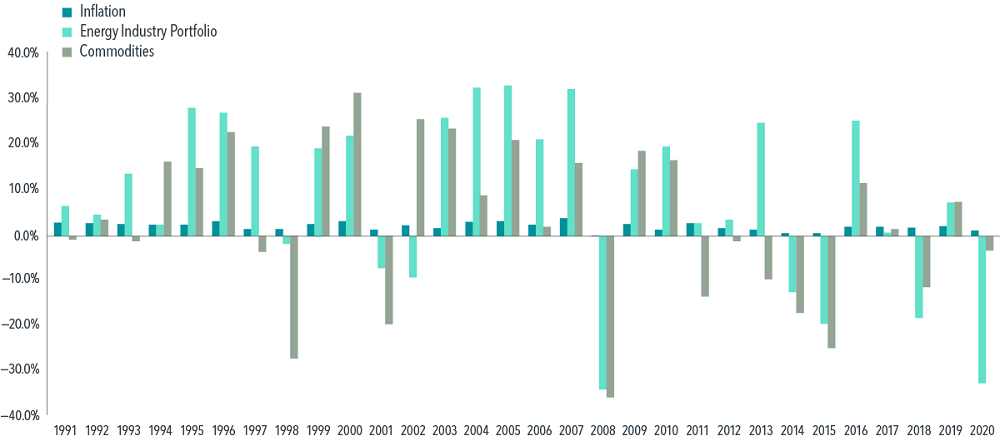

Exhibit 2 illustrates this by showing how the annual nominal returns to energy stocks and commodities differ dramatically from the annual realisations of inflation. If the goal is to reduce the variability of future purchasing power, it is questionable that hedging with something this volatile will effectively achieve that.

Exhibit 2: One of these things isn’t like the others

Annual US inflation along with nominal returns to energy stocks and commodities, 1991–2020

See Data appendix below for more information

Inflation deflated

What is the outlook for inflation? How will it compare to market expectations? Is the rise in inflation temporary or long-lived?

Nobody has a crystal ball. Fortunately, we don’t need a crystal ball to address inflation in our portfolios. The data suggest that simply staying invested helps outpace inflation over the long term.

Wei Dai, PhD is Head of Investment Research and Vice President, and Mamdouh Medhat, PhD, is a Researcher at Dimensional Fund Advisors. This material contains general information only. No account has been taken of the objectives, financial situation or needs of any particular person.

Data appendix

US inflation

The annual rate of change in the Consumer Price Index for All Urban Consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics.

US government securities and long-term corporate bonds

The returns to US government securities (one-month T-bills, five-year notes, and long-term bonds) and long-term corporate bonds are from Morningstar (previously from Ibbotson Associates).

US equity portfolios and factors

The US equity market is proxied by the Fama/French Total US Market Research Index. The US industry portfolios are the 12 Fama/French industry portfolios. The US style portfolios (small cap value and growth and large cap value and growth) are from the Fama/French six portfolios sorted on size (market cap) and book-to-market equity. The US size and value premiums are proxied by the Fama/French size and value factors. The returns to all of the above are from Ken French’s data library.

[1] Based on the US Consumer Price Index for All Urban Consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics.