The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

Investors have a love/hate relationship with cash in their portfolios. When markets fall, it's a relief to see a bulwark hold its value. When markets run up, it looks like a poor opportunity cost. During inflationary times, the real returns turn sharply negative and cash quickly loses purchasing power.

For professional fund managers, the cash allocation is especially challenging. Fund mandates usually allow decent cash holdings to give the manager the ability to protect portfolios, but 10% in cash earning zero when the market rises 20% in a year is a 2% performance drag. It is a big loss of potential 'alpha' that can remove a performance fee and cause investors to withdraw. There is no adjustment to the reported benchmark for the cash.

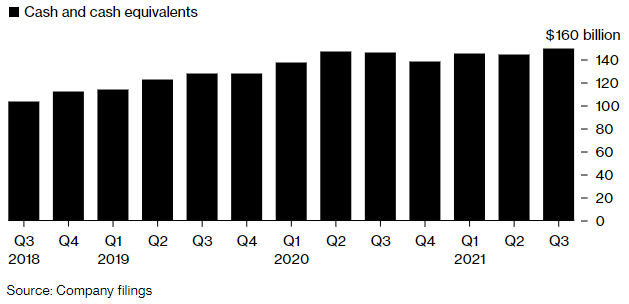

You're in good company if you held cash and missed some of the strong stockmarket rally in 2021. Warren Buffett's Berkshire Hathaway was sitting on US$144 billion in cash (actually, short-term Treasury bills) at the end of the year, or a whopping 30% of his portfolio.

Berkshire Hathaway cash holdings in US$ (source: Bloomberg)

It's not that Buffett wants to hold cash (other than to meet potential insurance liabilities), but in a heated market, he has been unable to find companies at prices he likes. He wrote recently:

“From time to time, such possibilities are both numerous and blatantly attractive. Today, though, we find little that excites us.”

He finally broke a multi-year major acquisition drought this week when Berkshire Hathaway announced it would acquire the insurance company Alleghany for US$11.6 billion, funded from within his business.

Australian fund manager presentations reveal varying attitudes to cash at the moment. For example, among Morningstar medallist funds, Magellan, Investors Mutual and Pendal manage equity funds holding around 10% cash currently, others such as Alphinity, T Rowe Price and DNR hold about 4%, while many are closer to 2%.

Cash for an individual plays a broader role than protecting capital and giving peace of mind. It may be money to live on, reducing the need to sell in a downturn. Many financial advisers set up portfolios with a minimum of cash regardless of the market outlook, such as two years of expected expenses. From 1 July 2022, at least 4% a year must be drawn from a superannuation pension. Cash also allows investors to quickly implement opportunities without selling something else.

At the start of 2022, there were signs of stronger retail allocations to cash, with Exchange-Traded Funds such as iShares Enhanced Cash ETF (ASX:ISEC) and BetaShares Australian High Interest Cash (ASX:AAA) among the most popular for inflows in January. The same happened at the start of Covid-19. But cash ETFs fell in February 2022 so the move was not sustained.

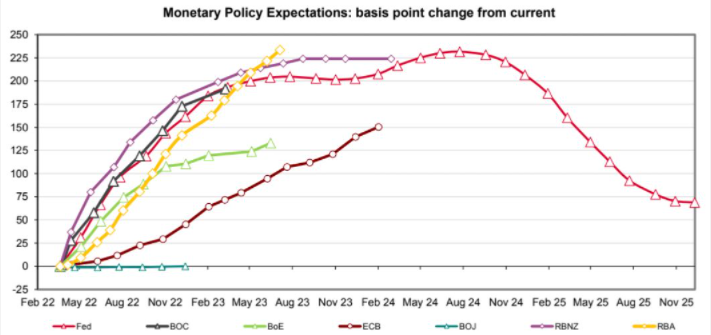

Despite rising inflation, more people might be comfortable holding cash in the next few years. The market is pricing in an increase in cash rates to over 2.25% in 2023, and while negative in real terms, it might be enough to satisfy more conservative investors. Surprisingly, markets are pricing in a bigger rise in cash rates in Australia than in comparable countries, including the high-inflation US.

Source: Westpac

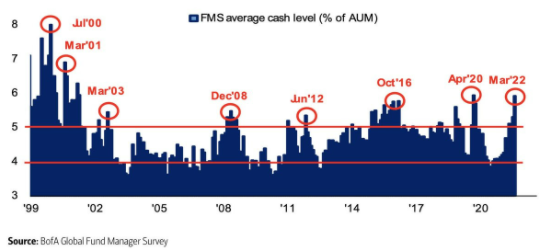

According to Bank of America's latest Global Fund Manager Survey (FMS), cash as a percentage of investment portfolios has returned to the April 2020 Covid-19 levels. Before that scare, cash allocations have not been so high since 2001, as shown below.

For individuals, the Ukraine war and threat of inflation instinctively encourage caution in allocating to riskier assets, but it's best to focus on goals and a long-term horizon. Surprisingly, as we've written before, sharemarkets usually recover quickly from wars and crises. For retail investors holding more cash than they prefer, it's comforting to know that many professionals are doing the same.

Graham Hand

***

Weekend market update

From AAP Netdesk: The Australian share market has closed at its highest level in more than two months, buoyed by gains in materials, energy and utility stocks amid soaring commodity prices. The benchmark S&P/ASX200 index ended 19 points, or 0.3% higher, at 7406 on Friday, recording an increase for the fourth straight session. The index finished nearly 1.5% higher for the week.

The gains were in line with choppy trading across Asia Pacific markets as investors eyed bargains despite the ongoing disruptions in commodity markets due to the war in Ukraine. Local investor sentiment also received a boost after US stock indices rallied overnight, with traders snapping up beaten-down tech and growth shares. Oil prices also retreated as Western allies agreed to increase military aid to Ukraine and tighten sanctions on Russia, whose invasion of its neighbour has entered a second month.

From Shane Oliver, AMP Capital: After a 13% top to bottom plunge US and global shares have rebounded cutting the fall to just 5.5% from their bull market high. Reflecting the boost from the resources sector, Australian shares have cut their losses from last year’s bull market high (with the market down 10% to its low in January) to just 2%. In fact, the Australian share market is now close to flat for the year to date and its likely to remain a relative outperformer thanks to the boost to commodity prices.

It’s possible we may have seen the lows in share markets. But uncertainty remains high around the war and inflation is still likely to get worse before it gets better keeping uncertainty high around the extent of monetary tightening and keeping upwards pressure on bond yields. And the rebound in US shares still lacks the breadth often seen coming out of market bottoms. So, while we remain of the view that share markets will be higher on a 6–12-month horizon it’s still too early to be confident we have seen the bottom.

The Australian Budget to see a 'magic pudding' of more spending and lower deficits. The Federal 2022-23 Budget on Tuesday is primarily expected to be about five things: the upcoming election; help for households dealing with 'cost of living' pressures; increased defence spending; a shift in focus to 'fiscal repair'- ie, stabilising and then reducing debt marked by spending restraint; and a budget windfall from faster growth and higher commodity prices allowing much lower budget deficit projections.

***

In this week's edition

Some major fund managers offer different vehicles for investors to access the same fund, giving opportunities to switch or invest at a lower entry cost. Check market prices and execution costs but when every extra percent compounds handsomely over time, it's worth finding the savings.

The war in Ukraine continues with no end in sight. This week, we deliver two articles on the fallout.

Much of the economic commentary on the invasion of Ukraine has been focused on the impact on oil and global energy prices. Geopolitical analyst Peter Zeihan takes a step back and writes that the Russian oil industry was in crisis before the invasion due to a lack of local expertise, global warming and geographical challenges. And then, Morningstar analysts have put together a compendium of research delivering their views on the war's impact across sectors and companies under coverage.

Private equity has steadily gained larger allocations in institutional portfolios and access is improving for retail investors. Russel Pillemer, the co-founder of Pengana, makes the case for the asset class.

What is the impact of a rising interest rate environment on the global listed real estate sector? Justin Blaess, portfolio manager at Quay Global Investors explores.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

No, you’re not dreaming. Oil rigs, mortgages and coal mines are taking centre stage as software, social media and the metaverse are escorted out the back door. Lewis Jackson looks at four sectors and seventeen stocks for the bulls and the bears on value's latest rally. And SMSF rule changes are coming in 2022 - here's what to expect, writes Anthony Fensom.

Finally, in a keynote address to a blockchain industry conference on Monday, Senator Jane Hume evoked the Victorian gold rush and the internet in the 90s in a glowing endorsement of the opportunities and benefits of the "new virtual frontier". We publish an abridged version of her speech.

This week's sponsor White Paper comes from Neuberger Berman, The inflation inflection and the new paradigm, which explores how best to structure your portfolio in an uncertain inflationary environment.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Funds Report from Cboe Australia