The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

We’ve received hundreds of responses to our Reader Survey, but to give as large a sample as possible, we’ll leave it open for a few more days.

We read every one of the comments received. It’s nice to hear so many of you look forward to receiving our newsletter. Your feedback will help to improve our content, and it should take only a few minutes. The survey can be accessed via this link.

So far, your responses have been both insightful and surprising.

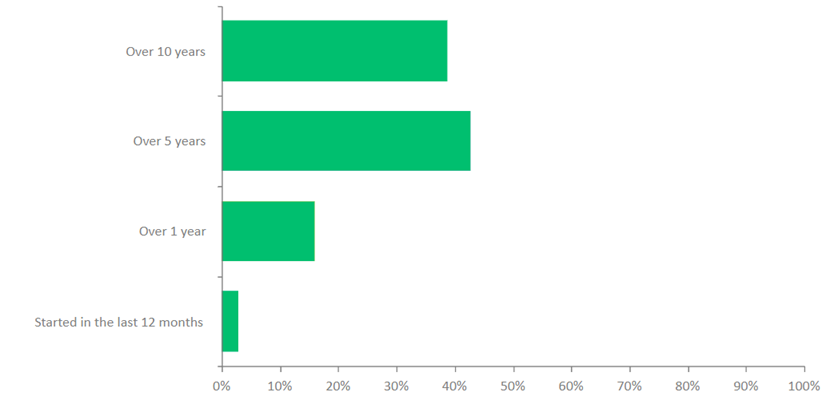

Many of you have been readers of Firstlinks for a long time. It’s gratifying that we have so many subscribers who’ve stuck with us.

How long have you been a Firstlinks reader?

We’re always looking for ways to bring new readers on board. We don’t advertise and our primary method for obtaining new subscribers is word of mouth/referrals. So, if you like our newsletter, we’d love you to pass it on to family, friends and colleagues.

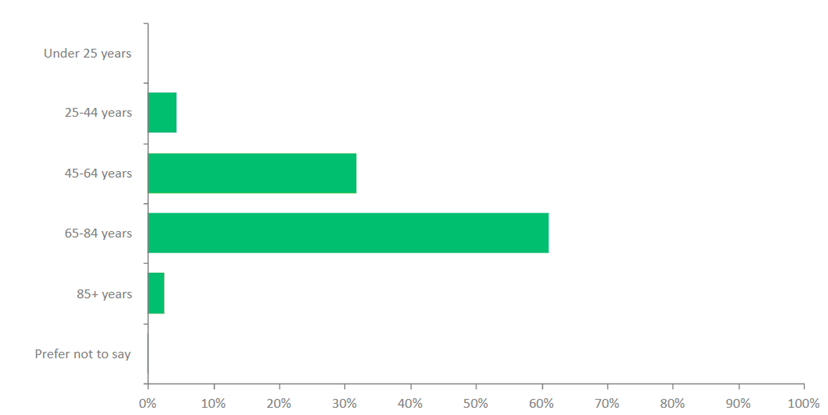

Unsurprisingly, many of our readers are older. About 65% are aged 65 years or older. That’s more than we anticipated, though I suspect it’s partly down to sample bias – younger cohorts may not have the time or inclination to fill out the survey.

Which age bracket applies to you?

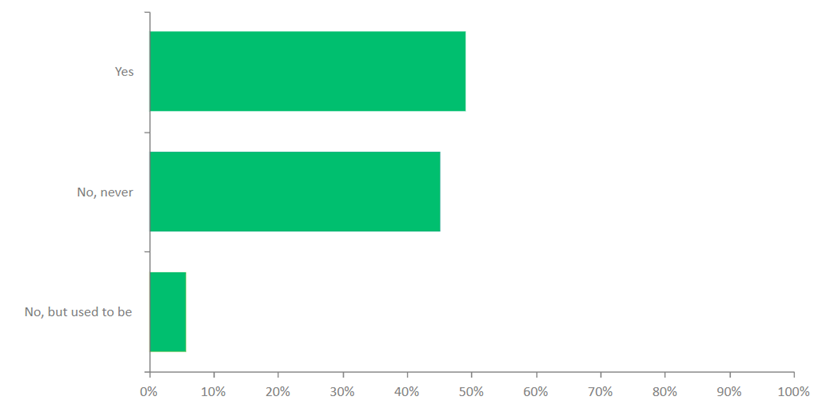

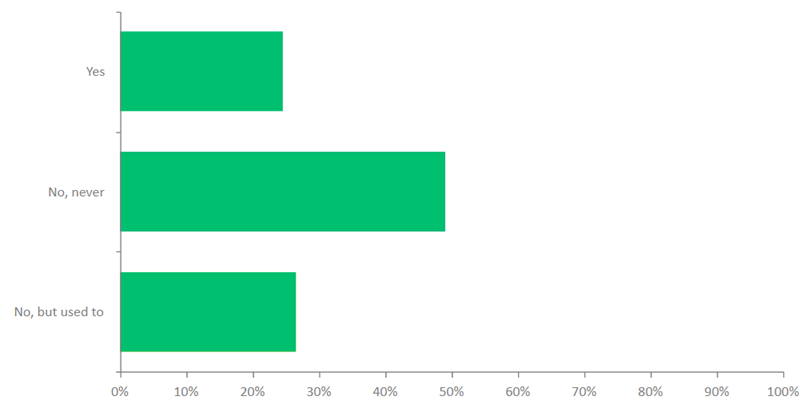

Almost half of our subscribers have an SMSF. That’s largely in line with surveys of previous years and shows that many of our readers are sophisticated, self-directed investors.

Are you a member of a self-managed super fund (SMSF)?

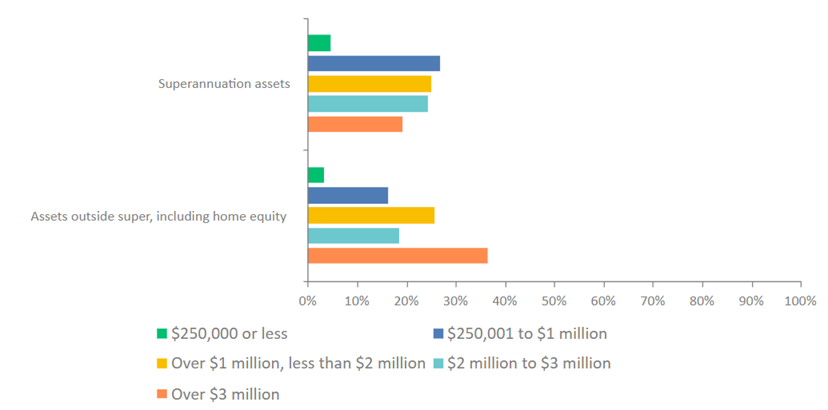

Most of our readers also have substantial assets. Around 70% have more than $1 million in super, and ~20% have over $3 million.

80% have more than $1 million in assets outside of super, with 37% having more than $3 million. Most of these assets are likely in the family home.

How much do you have in and out of superannuation?

Around a quarter of our readers are receiving financial advice, which is far above average, though it shows advice still has plenty of room to try to attract new clientele.

Do you use professional financial advice services?

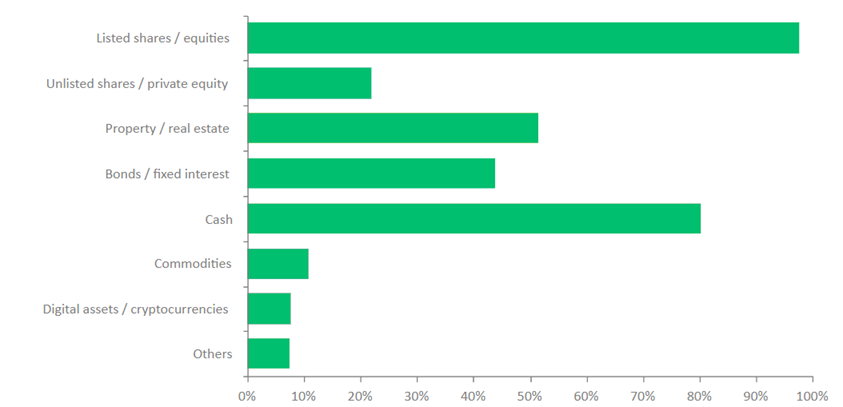

As to which assets our subscribers are currently holding, equities and real estate are the two standouts, while private assets are gathering momentum, and bonds are on the nose.

Which assets are you currently invested in?

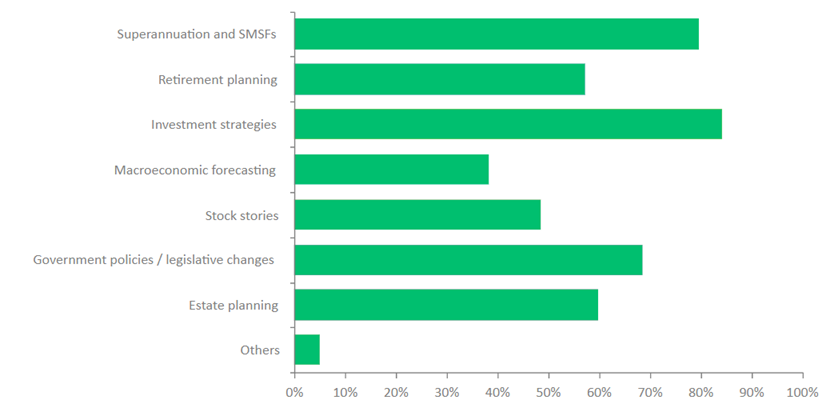

The topics of most interest to you include investment strategies, super/SMSFs, government/legislative changes, and retirement and estate planning.

Which investment topics most interest you?

We’ve received hundreds of suggestions about what readers like and don’t like about Firstlinks. Most are positive while others offer constructive criticism and there are plenty of ideas for future articles.

Here is a small sample of the comments thus far, leaning more into constructive ideas for future newsletters:

“As a 32yr old reader I am mostly curious in learning about finance to make smarter decisions early in life so they compound significantly over next 3 decades.”

“Enjoy your variety of articles as they stand. Advice on when to sell shares. Up to date SMSF tax changes or govt threats to SMSFs; advice for those in the $3M -10M super bracket and how to manage in view of recent tax changes. Cover emerging themes on the ASX and what to look out for. Love your work.”

“From my perspective:

1. Keep it short and factual

2. ‘Foolproof’ investment strategy…these are a good read….try for 1 per rack weekly issue

3. More coverage on Super Covenant status and best ones ( ie income generators post work pay packets).”

“The articles I find most useful seem to be authored by a subject knowledge expert with a high level of passion, great communications ability and a (usually quite narrow) focus on a subject of developing and/or significant interest which has relevance to my investment portfolio, future wealth, personal health and happiness. What is nice is that you seem to deliver a burst of such articles about every 2-3 weeks with a less demanding breather in between which is very welcome.”

“Would be nice to learn more about super drawdown strategies especially for non-SMSF holders and for those people who will likely exceed the TBC in accumulation once they retire.”

“I am not very financially literate. Some of the articles on topics that I would normally be very interested in, are aimed too high for me with acronyms and jargon that I constantly need to look up. I would appreciate having some articles aimed at those who don't have a financial background.”

“HOUSING! For God's sake and mine … GIVE IT A REST !

Publish Noel Whittaker and Michele Bullock, and give the others the flick! So much useless pining and whining !! So many solutions and ideas AND NONE OF THEM useful!”

“I would really love to see the podcast back. Even if it's just a snapshot of the best articles of the month.”

“Reader comments are a plus; even though some of the readers are barely articulate, this is outweighed by other highly articulate readers.”

“As a long retired economist and investments manager , I continue to learn more through Firstlinks.”

“I quite enjoy not just the articles, but the commentary from other readers sometimes! A good mix. Some of the articles can be a bit too technical for me, but I'm sure others' find value.”

“FirstLinks provides a range of articles which supplement other sources of info which together help me manage my SMSF and personal investments. Don't agree with all articles BUT all provide food for thought.”

“The problem with many of your contributors from financial industry is that they needlessly make the topics complex. Secondly there seems to be under current to encourage people to speculate instead of saving / investment for long term.”

“I would think that more focus on estate planning and taxation. Maybe a little complex for your target audience though but immense value is on offer here if people get this bit right.

Imagine the comments monitoring requires a bit of work but it really significantly adds to the experience.”

“Believe you offer very balanced information. I’m a great fan of Noel Whittaker who spells out financial information in a manner everyone can comprehend. My major concern is, how do we get young people financially literate earlier??”

“In addition to filling in gaps in my knowledge, I like to read items that challenge my in-built biases, including readers' comments. To some extent (and understandably), there is a bias in readers towards well-off rather than other groups in the community.”

“I enjoy reading some of the articles. Views of others are important. I would enjoy reading some contrary views on issues - more like a debate.”

Love the feedback; keep it coming.

****

In my article this week, I look at how a lot of froth across many assets heightens the risk of a larger correction, and where the best places may be to hide if trouble is brewing.

James Gruber

Also in this week's edition...

We have a big focus on dividends and income this week.

First, Jen Nurick and Josh Veltman delve into behavioural psychology and how investors often fall prey to ‘amygdala hijacks,’ letting emotion override reason. They think focusing more attention on company dividends rather than stock prices is a useful hack to prevent emotions getting the better of you.

Second, Daniel Pennell says CBA has been a laggard this year, especially compared to global banks, which are up 32% year-to-date. He suggests the global banks trade at lower P/Es with diversified earnings and rising dividends, offering Aussie investors both income potential and long-term value beyond the local market.

Third, Capital Group report on global dividends, which rose 6% year-on-year in the recent quarter, with more expected to come. However, Australia was a notable weak spot, with dividends down 7%, thanks largely to our miners.

In other articles, Firstlinks has had the pleasure in recent years of featuring Tim Congdon, one of the very few who predicted not only the sharp rise in US inflation but it's subsequent fall. He's kindly shared a snippet of his latest thoughts to clients with us about what happens with inflation next. It's a must read.

Superannuation has been a fabulous system but it's become such a leviathan that it may be giving Australia "Dutch Disease", according to Clime's Paul Zwi. That is, super could be creating structural market distortions that leave our economy dangerously specialized and vulnerable to financial market corrections.

You devote years of your life working, saving and investing, striving to build a legacy that will outlive you. Before any wealth moves to the next generation, Bruce Kluk thinks there are six questions every parent should ask themselves.

The Liberal Party has released an energy policy that favours the economy over emissions reduction targets, and Tony Dillon says it's a good start, though more can more done to ensure a pro-economy, ‘no Australian left poorer’ energy policy.

A recent study confirms that even experts often get their predictions wildly wrong. Joe Wiggins looks at the implications for investors and what they should do about it.

Two extra articles from Morningstar this weekend. Malik Ahmed Khan reports on Gemini's AI momentum and what it means for Alphabet, aka Google, while Shane Ponraj thinks the market is overly pessmistic on shares of Ramsay Health Care.

Lastly, in this week's whitepaper, Neuberger Berman outlines how banks and private markets are redefining credit.

***

Weekend market update

From AAP:

Australia's share market broke a four-week losing streak despite a flat final session on Friday, notching its best weekly performance since May.

Trading volumes sunk as a US bank holiday provided the backdrop for the quiet session, after hopes of an interest rate cut from the Federal Reserve buoyed global equities during the week.

Eight of 11 local sectors ended the day higher, led by consumer staples, IT stocks and utilities, while financials, real estate plays and the communications segment fell behind.

Woolworths led staples higher with a 3.2% rally on the back of an upgrade from JP Morgan, while Endeavour surged almost 2%.

A 0.7% drop in financials came as all big four banks traded lower, but the broader sector still managed to snap a two-week losing run with a 0.2% push since Monday.

Raw materials stocks surged more than 5% over the week, but were mixed on Friday as concerns about China's property sector weighed on iron ore futures.

BHP and Rio Tinto traded slightly lower on Friday but were up more than 3% each over the five sessions.

Gold stocks were broadly higher on the back of higher US rate cut expectations, as the spot price climbed, lifting VanEck's Goldminers ETF more than 10% since Monday to five-week highs.

Energy stocks edged slightly lower over the five sessions as investors weighed oil oversupply concerns and a potential Ukraine-Russia peace plan against a re-escalation of conflict in the Middle East.

The tech sector was the week's best performer, soaring more than 6% to snap a four-week losing streak, with dip buyers scooping up IT stocks in unison with a lift in Wall Street's tech-heavy Nasdaq.

From Shane Oliver, AMP:

Global shares rose over the last week as the US share market rebounded on the back of increased confidence that the Fed will cut rates next month after Fed speakers turned more dovish amidst some softer US economic data. For the week US shares gained 3.7%, leaving them up 0.1% in November, Eurozone shares rose 2.8%, Japanese shares rose 3.3% and Chinese shares rose 1.6%. The positive global lead also pulled up Australian shares although they were constrained by a further rise in local inflation leading to talk that the next move by the RBA may be a rate hike later next year. The ASX 200 rose 2.3% for the week with gains led by IT, material, health and industrial shares. This still left it down 3% for November. Bond yields fell in the US and Europe but rose in Japan on increased expectations for another Bank of Japan rate hike next month and in Australia on the back of higher inflation and expectations that the next move by the RBA may be a rate hike.

More bad news Australian inflation is now leading to talk of rate hikes next year. The bad news came in the form of the new full coverage monthly CPI (well at least 87% of items are now surveyed monthly) showing another lift in inflation in October to 3.8%yoy. What’s worse is that the all-important trimmed mean underlying inflation rate rose to 3.3%yoy. So both are now back above the target range.

And the rise was broad based with goods inflation well up from its lows, services inflation remaining elevated and there are now more CPI items again with inflation above 3%yoy than items below 2%yoy.

This was higher than expected and disappointing as we thought that the September quarter bounce in inflation was largely temporary and so would start to settle down again this quarter. With this not happening so far it will add even more to RBA caution and concern that we are bumping up against capacity constraints and has led to speculation that we will now see rate hikes next year – with some economists now forecasting that and the money market seeing a 20% chance of a hike by August next year and 41% by year end. This may be reinforced by September quarter GDP data to be released in the week ahead which is expected to show growth above RBA forecasts.

We think another RBA rate cut next year is still possible but will require a run of softer inflation numbers back below target and higher unemployment. Given the recent run of data, we are not particularly confident! But given the still early stage of the economic recovery would see next year as too early to expect the RBA to start raising rates again. That’s more likely a 2027 story.

Macro prudential regulation to cool the property market is ramping up again in Australia. As had been widely flagged APRA announced it will cap the proportion of each bank’s housing lending that goes to borrowers with a debt-to-income ratio of six times or more at 20% from 1st February. This will be applied separately to each lender’s owner occupier and investor lending. It’s likely to impact investors (who tend to have higher DTI ratios) more than owner occupiers but could impact some first home buyers seeking to take advantage of the 5% deposit scheme. This follows a surge in investor lending and concerns that the property market may get too speculative. While the aggregate ratio is well below the 20% cap at present (see the next chart) and so may not really have much impact initially (except for some smaller banks) its clearly a pre-emptive move designed to cool investor activity before it gets too hot. If it doesn’t work (and some borrowers may try to get in ahead of the cap become binding so it could actually boost lending in the near term) APRA is likely to do more like putting a cap on investor credit growth like it did in 2014. For 2026 as a whole though the move to ramp up macro prudential controls and the chance of more to come along with the outlook for less rate cuts will constrain home price growth. We are lowering our 2026 national home price growth forecast to 5%, from 8-10% a few months ago.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website