In more than 20 years in financial markets, we have never seen an asset class divide opinion quite like gold does. Some investors think it’s the ultimate form of money and safe-haven asset, while others see it as a barbarous relic of a bygone era.

Irrespective of how one personally views gold, there should be no doubt that the recent rally beyond US$1,400 per ounce and A$2,000 per ounce has reignited interest in gold.

This article touches on the reasons behind the latest move in the yellow metal, as well as its characteristics as an investment and the key benefits it can bring to a portfolio.

Why the recent rally?

The gold price has risen by over US$100 per ounce and A$200 per ounce since late April 2019, driven by a number of factors which include:

- A plunge in global bond yields, with the market value of debt trading with a negative yield currently sitting at approximately US$12 trillion.

- Expectations of monetary easing by the US Federal Reserve, possibly as early as July 2019.

- Escalating geopolitical tensions in the Middle East.

- Continued concerns regarding a US-China trade-war.

Australian dollar investors have also received a boost from the declining local currency, with the cash rate now down to an unprecedented 1% after two recent rate cuts.

Gold as an investment

To help understand gold and look at the role it can play in your portfolio, it first helps to characterise what kind of investment it is.

To that end, we broadly agree with the comment from John Pearce of UniSuper, who was quoted recently in Cuffelinks, saying he thought “of gold as a currency”.

What are the characteristics of this currency?

- It is highly liquid: Turnover in the gold market is typically in excess of US$100 billion per day.

- It is easily accessible: Gold can be bought from as little as $50 per investment through The Perth Mint depository, while listed products, such as our ASX-listed PMGOLD, allow investors to buy and sell gold via their stockbroking account.

- Central banks still use it: Central banks own more than 30,000 tonnes of gold as part of their foreign exchange reserves. In 2018, they added over 600 tonnes to their holdings, the fastest pace of gold accumulation since the late 1960s.

- It has no credit risk: Unlike most investments, there is no liability attached to gold. Gold is purely an asset.

- Gold can be volatile: Like equities, the price of gold can be volatile on a short-term basis.

- It has delivered strong-long term returns: Despite the lack of income, the price of gold has risen by approximately 9% per annum over the last 48 years.

Key benefits for investors

Consider two benefits gold can bring to a self-directed investor’s portfolio.

First, gold tends to be the best-performing asset class in years when real cash interest rates, which factor in inflation, are low. This is highly relevant today, not only because markets expect that the RBA will cut the cash rate to just 0.75% in the next year, but also because Australian 10-year government bonds currently yield just 1.30%.

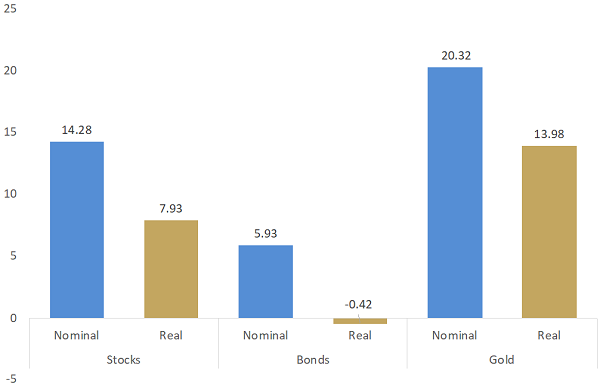

The chart below covers 1971 to 2019 inclusive and shows the average nominal and real return for Australian stocks, Australians bonds and gold during years where real cash interest rates were below 2%.

Australian asset class returns when real cash interest rates were below 2%

Source: The Perth Mint, Australian Bureau of Statistics

Gold performs well during periods when real cash interest rates are low for two key reasons:

1. Low or even negative real cash interest rates are typically only implemented as a form of monetary stimulus when the economy is weak or softening. In such environments, it’s natural that investors adopt a more defensive approach by seeking out safe haven assets such as gold.

2. If the real interest rate from cash or short-term bonds is low, or even negative, then the opportunity cost of investing in gold is significantly reduced.

Second, gold can be a hedge against severe declines in equity markets.

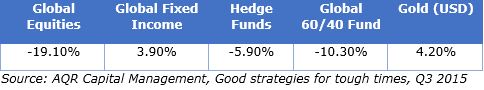

This was made clear in a 2015 paper titled “Good Strategies for Tough Times”, published by AQR. The paper looked at the 10 worst calendar quarters for global equity markets, with the results for various asset classes and strategies seen in the table below.

Asset class returns when global equities suffer their largest quarterly falls

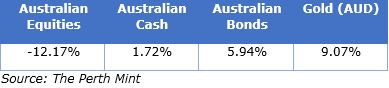

The table below looks at the same 10 calendar quarters AQR studied, and shows the average returns for Australian equities, Australian bonds and gold priced in Australian dollars.

Australian asset class returns when global equities suffer their largest quarterly falls

In the five worst calendar years for Australian equities since the early 1970s, the gold price recorded an average annual increase of almost 40%.

Gold on the radar

The key takeaway is that while gold is not guaranteed to rise in price every time markets fall, since the 1970s, no other single asset class has outperformed gold during the most significant equity market declines.

Given the current economic, monetary and market environment, we think these attributes should put gold on the radar for investors focused on wealth preservation.

Jordan Eliseo is a Senior Investment Manager at The Perth Mint, a sponsor of Firstlinks. The information in this article is for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.