Recently, I got this email from a subscriber, Pete:

“Wondering if you might provide readers with another update on the current state of LICs [listed investment companies].

Andrew Mitchell and Steven Ng's article, “The catalyst for a LICs rebound”, published in June last year, was very insightful and I feel it’s time for a follow-up.

As a long-term AFIC and Argo shareholder, I’ve watched the slow car crash of LIC discounts widening to NTA.... now at some of their widest levels ever... and for many of us, dividends can only go so far, and at some point we need to sell holdings to fund living expenses. LICs rarely receive much coverage these days, with most of the conversation shifting to ETFs (understandably), aside from the occasional presence of WAM.

An update on the challenges and prospects for LICs would be greatly appreciated by investors like myself who continue to hold them through thick and thin.”

I feel Pete’s frustration and he’s certainly not the only despairing LICs holder.

It’s no secret that ETFs are continuing to take market share from LICs and other investment products. In August, there were 388 ETF products and they had a market capitalization of $299 billion, a rise of 36% year-on-year.

The size of the ETF industry still pales besides managed funds, which are worth close to $5 trillion, $4.1 trillion of which come from superannuation funds.

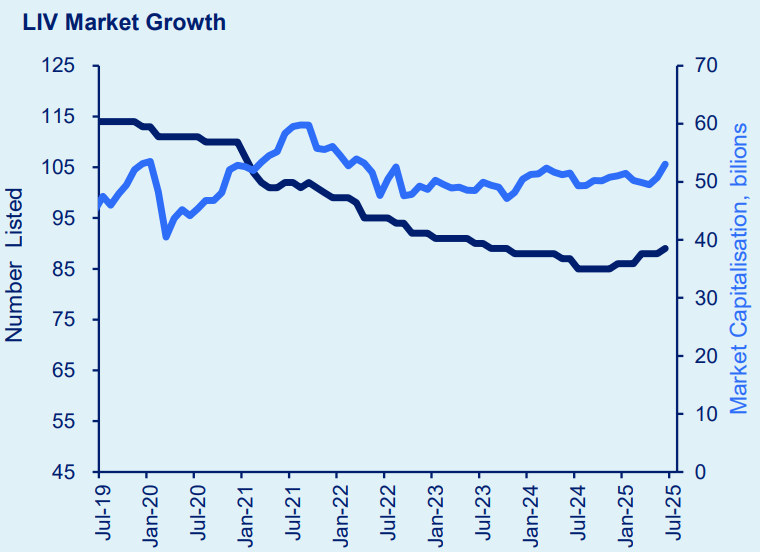

LICs and LITs (collectively known as listed investment vehicles or LIVs) are much smaller by comparison. There are 89 of them listed on the exchange, and they have a market cap of $55 billion, about 20% that of ETFs.

Source: ASX

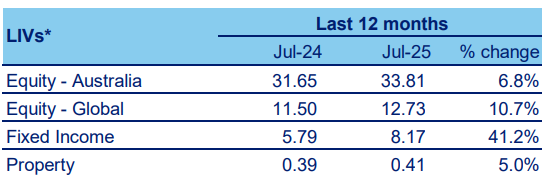

The good news is that the number of LIVs increased from 85 to 89 over the past year, and the market cap also jumped by 12% over that period. The money flowed principally into fixed income and global equities.

Source: ASX

The bad news is that the number of LIVs is still well down from the peak of 115 in 2019 and the market cap growth still badly lagged that of ETFs.

The loved and unloved

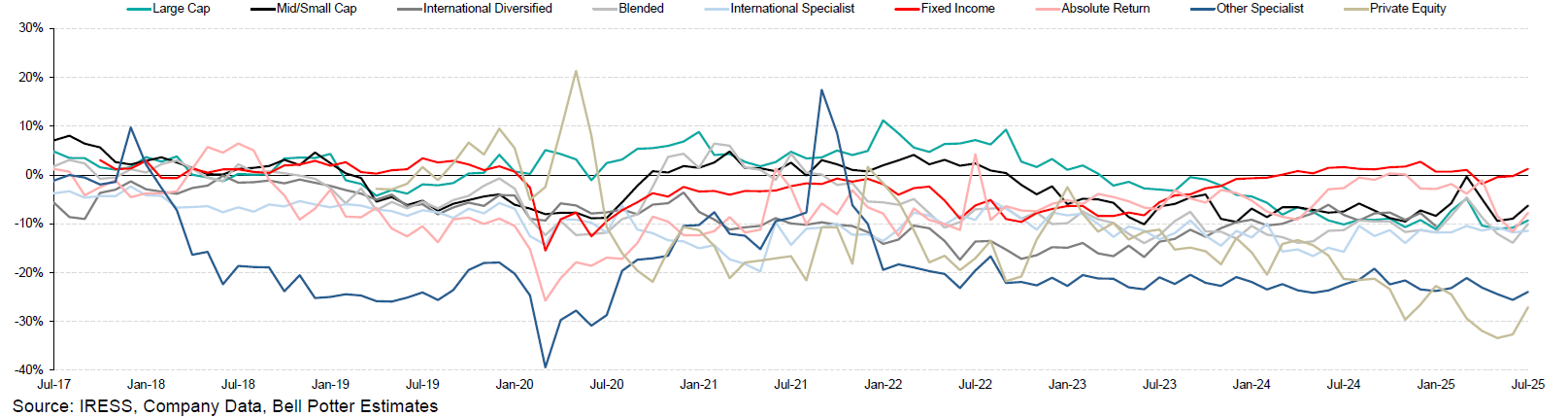

According to Bell Potter, LICs trade close to their widest discounts to net tangible assets (NTA) in history.

Interestingly, fixed income LICs now trade at a small premium to NTA, a big turnaround from much of the previous five years.

In equities, mid and small LICs have the widest discounts to NTA. Meanwhile, private equity LICs are the most unloved of all investment categories.

Premium/discount by investment mandate (market cap weighted)

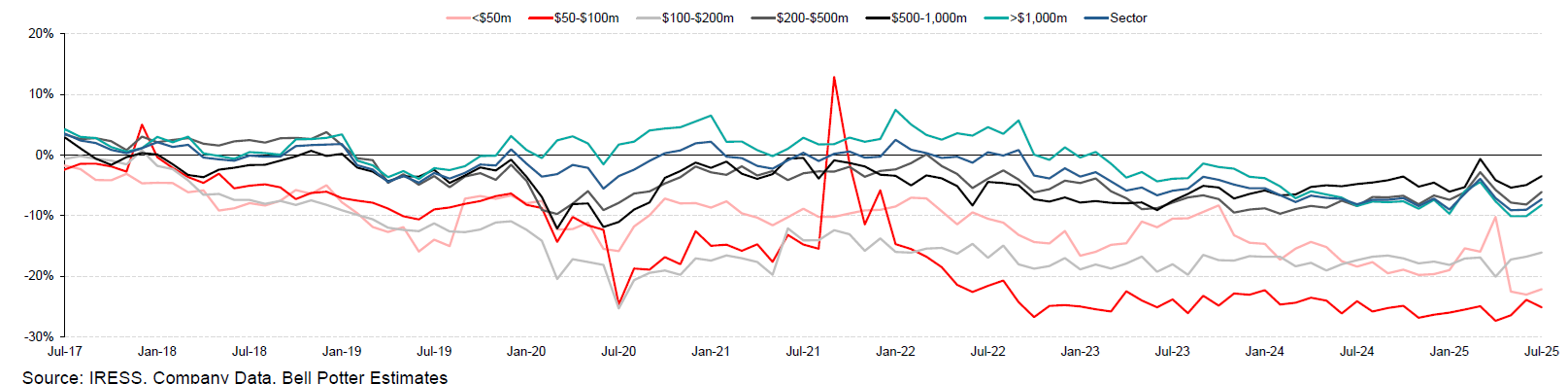

Broken down by size, smaller LICs have the widest discounts to NTA.

Premium/discount by market cap band (market cap weighted)

One thing to note about the above charts is that there has been a narrowing of NTA discounts in many categories in recent months. Does this offer hope? Perhaps.

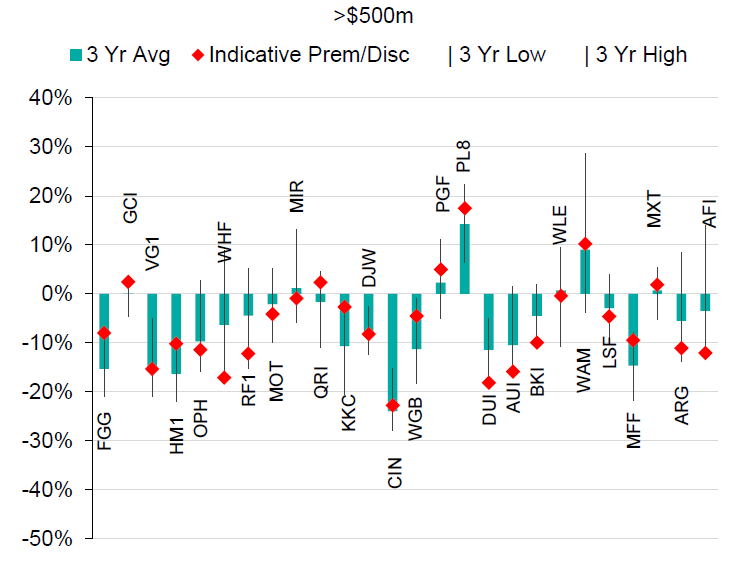

Looking at individual LICs, the two largest ones, Australian Foundation Investment Company (AFIC) and Argo stand out, with NTA discounts near three-year highs. Both have been hindered by below benchmark performance over one, five, and 10 years.

Investors have instead clamoured for equity income LICs. The Plato Income Maximiser (ASX: PL8) now trades at an 18% premium to NTA. Newer equity income products have also hit the market, including WAM Income Maximser (ASX: WMX) and Whitefield Income (ASX: WHI).

Some of the other Wilson funds have also proven popular with the premium driven by a strong reputation for delivering income and an ongoing commitment to marketing.

Premium/discount for individual LICs and LITs

Source: Bell Potter

Why LICs are struggling with large discounts

The big question is: why are LICs on average continuing to trade at large discounts to NTA? And related to that: why aren’t investors stepping up to buy these discounts, with the prospect of paying 90 cents, 80 cents, or even 70 cents for every dollar of assets?

As subscriber Pete mentioned, Ophir’s Andrew Mitchell and Steven Ng did a great article examining this last year.

They went through several of the reasons given by investors for LIC/LIT premiums and discounts, including:

- Supply and demand

- Size of the LIC or LIT

- Liquidity of the fund

- Investor sentiment

- Market direction

- Investment performance

They suggested that none of these factors explained AFIC’s widening discount to NTA at that time (and it’s widened further since).

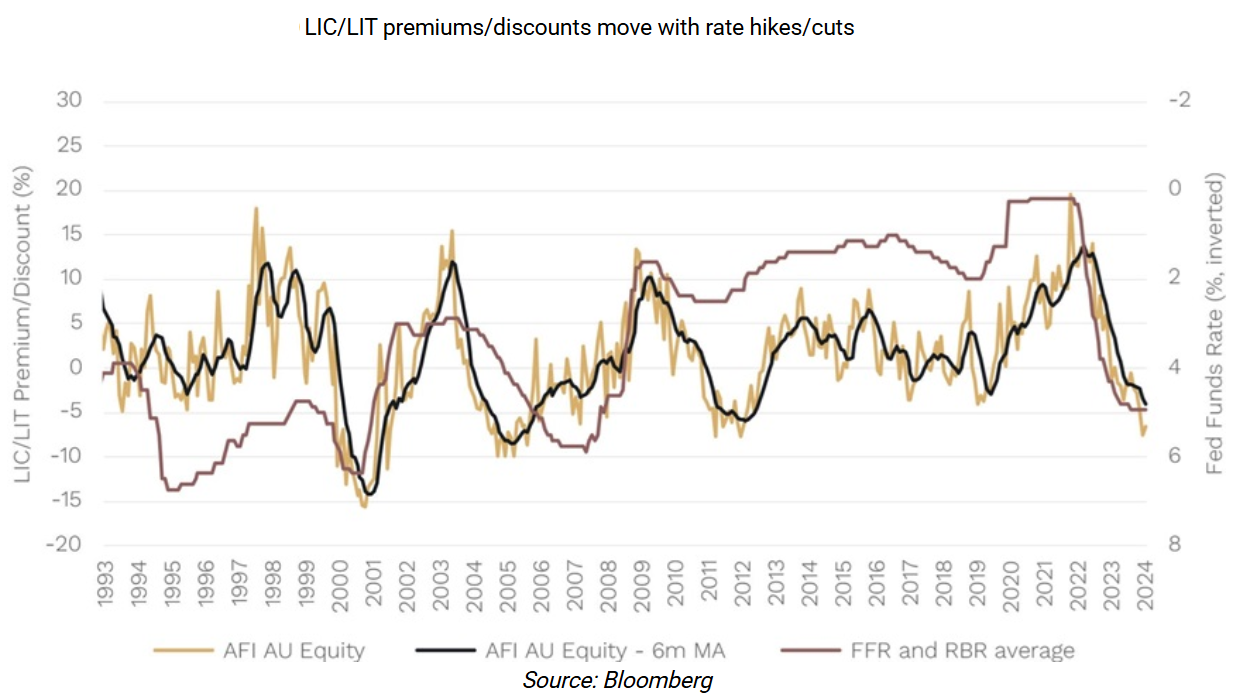

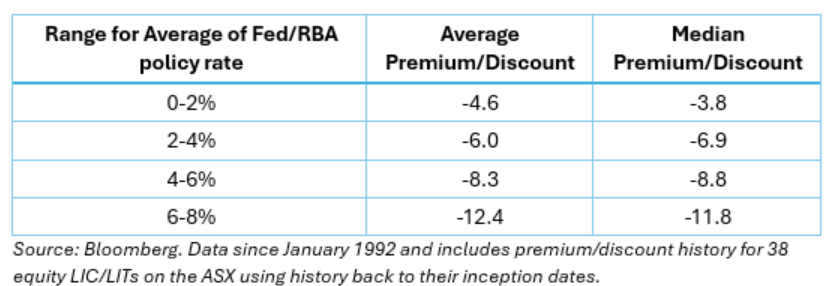

They theorized that another factor was far more important: interest rates. In AFICs case, lower interest rates have been associated with higher premiums to NTA and higher interest rates have been associated with higher discounts to NTA.

And what was true for AFIC was also true for other LICs.

What’s the connection between rates and LIC NTA premiums and discounts? As Mitchell and Ng explained:

“Basically, we have shifted from an interest rate world of 0% during COVID in 2020 and 2021 where the ‘TINA’ (There Is No Alternative to equities) moniker was in play and many saw shares as the only investment choice to “TIARA” (There Is A Reasonable Alternative) where fixed income and even cash investments have become more attractive again.”

My two cents

It’s intriguing that since they wrote the article in June last year, money did flow into fixed income as rates rose.

And the narrowing of NTA discounts in recent months coincides with RBA cuts to interest rates and seems to lend credence to Mitchell and Ng’s views.

My view is that while interest rates are an important driver, the other factors they mentioned, especially size, liquidity and investment performance, also play crucial roles. On the latter, you only need to look at AFIC and Argo.

The bullish picture presented by the authors will also be challenged by the waning in structural demand for LICs.

When I try to picture the future for investment products, I look at younger generations and what they’re buying. What I see is they’re purchasing things that are easy and convenient and can be done by phone. It’s why they’re buying ETFs and automated savings and investing options such as Raiz. While LICs are easy to buy and sell, assessing their structure, the premiums or discounts, the performance, the managers and so on, requires a lot more work. Work that the young aren’t inclined to do.

So while LIC discounts may narrow as interest rates fall over the next 6 months, the sector is likely to face a challenging future.

That said, there will always be room for high-performing LICs and a number of these now can be bought at large NTA discounts and should be on the radars of savvy investors. Ophir’s own High Conviction Fund (ASX: OPH) is one of them.

And there’ll also be room for new products that meet the needs of investors, as recent listings of equity income LICs show.

* Disclosure: Ophir is a Firstlinks' sponsor.

James Gruber is Editor at Firstlinks.