Retirement should be a time to relax and reward yourself after decades of hard work. Yet, for many Australians, our golden years are filled with confusion, uncertainty, and a fear of running out of money. With 700 Australians retiring every day, and over 255,000 a year, it is crucial we provide older Australians with the tools and insight needed to confidently navigate this new stage of life.

Here's five charts every Australian needs to see when thinking about retirement.

1. Understand your retirement goals

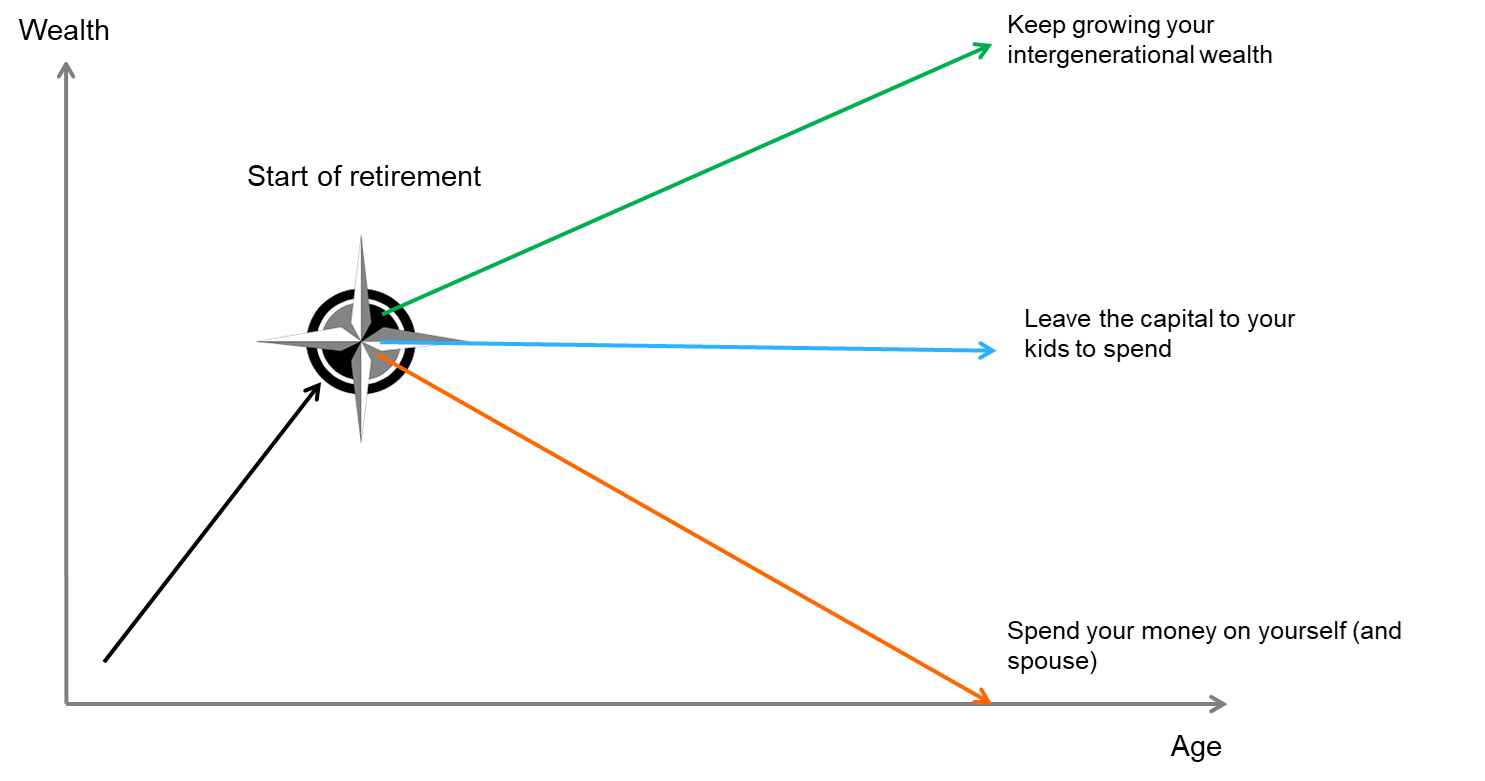

For many retirees there are competing priorities and only a finite amount of money. Nobody has a crystal ball for the future and shifting from a regular pay cheque to a lump sum super balance can be a hard transition.

One of the most important considerations is how much to spend on your lifestyle verses leaving an inheritance for your loved ones. Understanding this overarching goal can help you plan for other expenses over time.

While the goal for super is to help fund a comfortable retirement, some retirees may want to leave a nest egg for future generations. To manage these individual goals, it can be worth considering separate investments. For example, investing in a guaranteed retirement income solution, can help you confidently spend on lifestyle expenses throughout retirement while a separate investment can focus on the inheritance for the next generation.

Chart 1: Retirement goals lead to different consumption paths

Source: Challenger Ltd

2. Understand longevity challenges

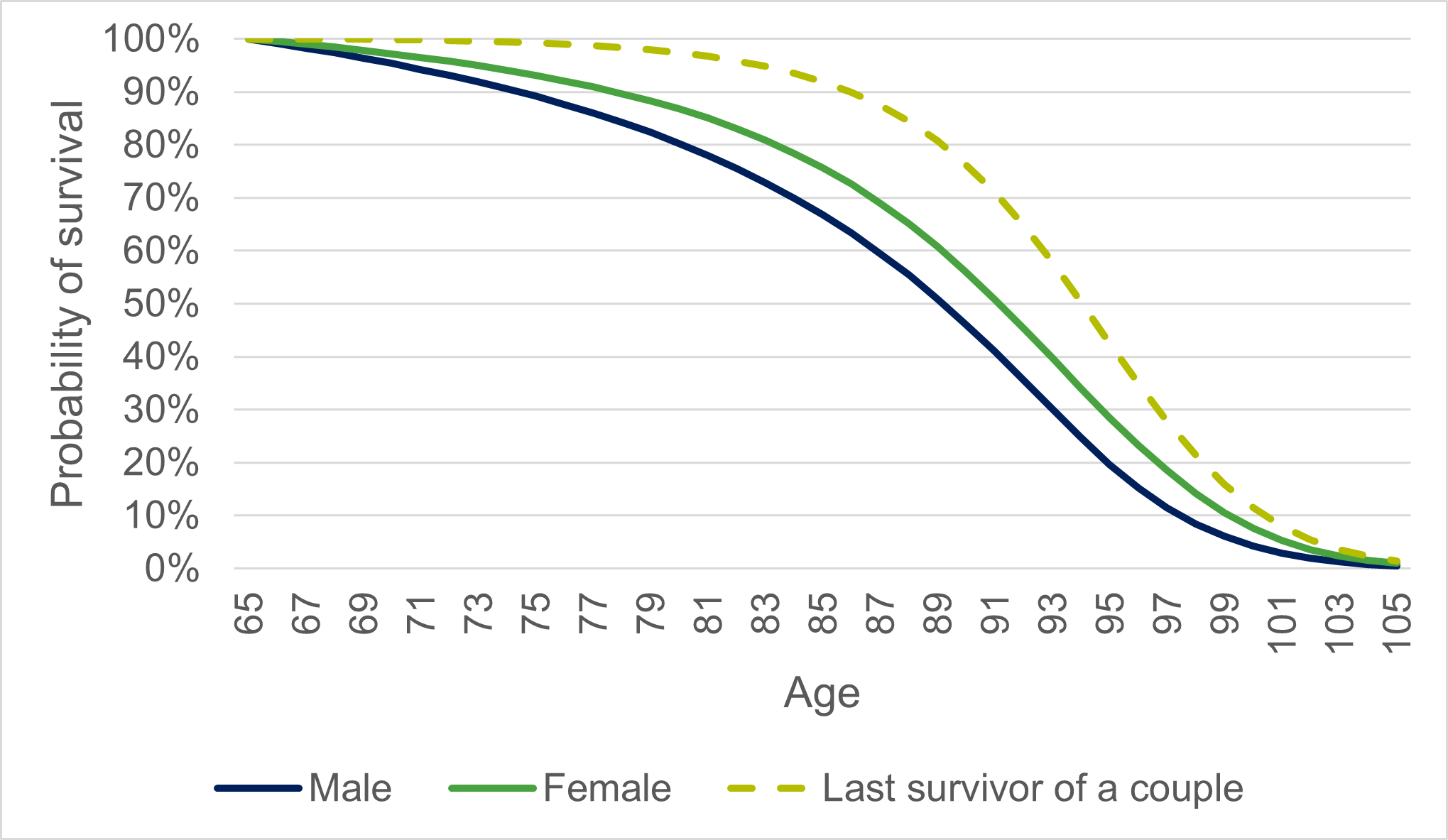

Australians are living longer, and the average Australian will spend 20 to 30 years in retirement. Yet, none of us know exactly how long our retirement will last. This gives rise to longevity risk.

The chart below plots the probability of survival for a 65-year-old in 2025. The solid lines represent the proportion of 65-year-olds that will survive to each age, while the dotted line provides an estimate for the surviving member of a couple.

It is important to have financial mechanisms in place to ensure your income will last, particularly for women who generally live longer. This can help alleviate a lot of anxiety in our older years.

Chart 2: Probability of survival for a 65-year-old

Source: Based on Australian Life tables 2020-22 with mortality improvements from AGA for 25-year factors.

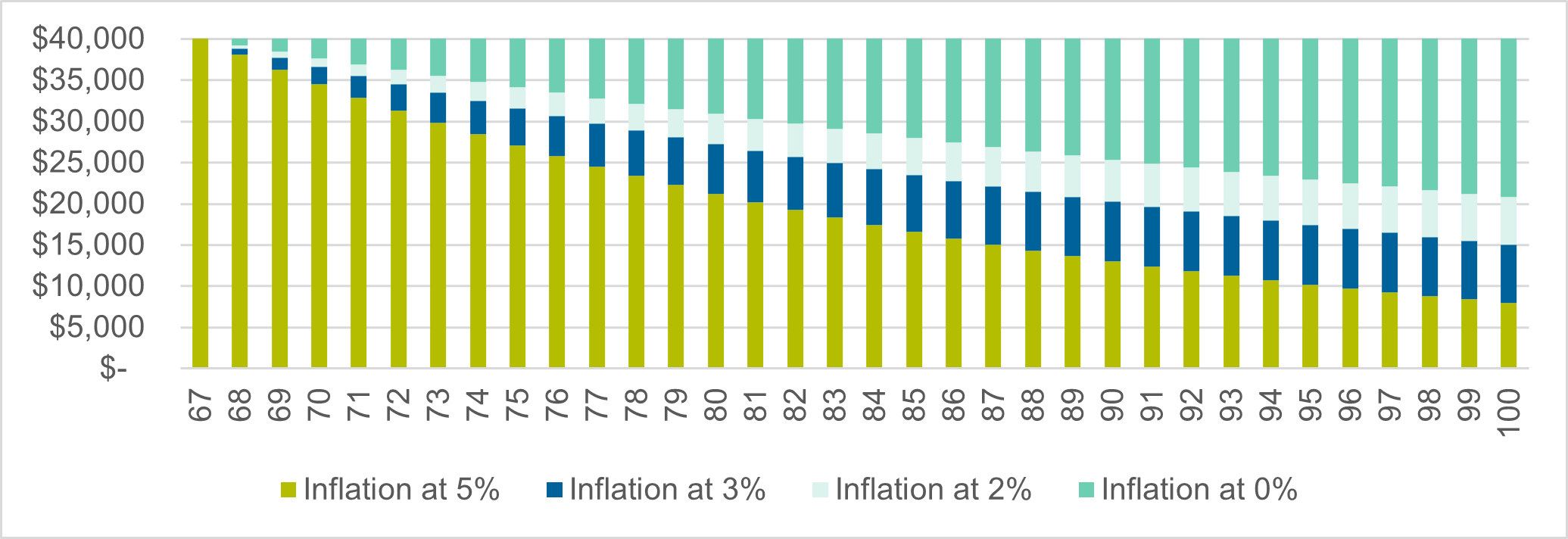

3. Understand the impact of inflation

Rising cost-of-living can be problematic for retirees. Research by YouGov, commissioned by Challenger, found that 2 in 3 Australians over 60 said cost-of-living impacted their confidence they would have enough money for retirement.

The below chart highlights how a retiree’s lifestyle can be diminished due to the impact of ongoing inflation. A spike in inflation, like we saw in 2023, can also wreak havoc, and retirees need to ensure they have some protection in place. A CPI-linked income stream can help overcome cost-of-living concerns.

Chart 3: Inflation erodes the value of your income over time

Source: Challenger Ltd

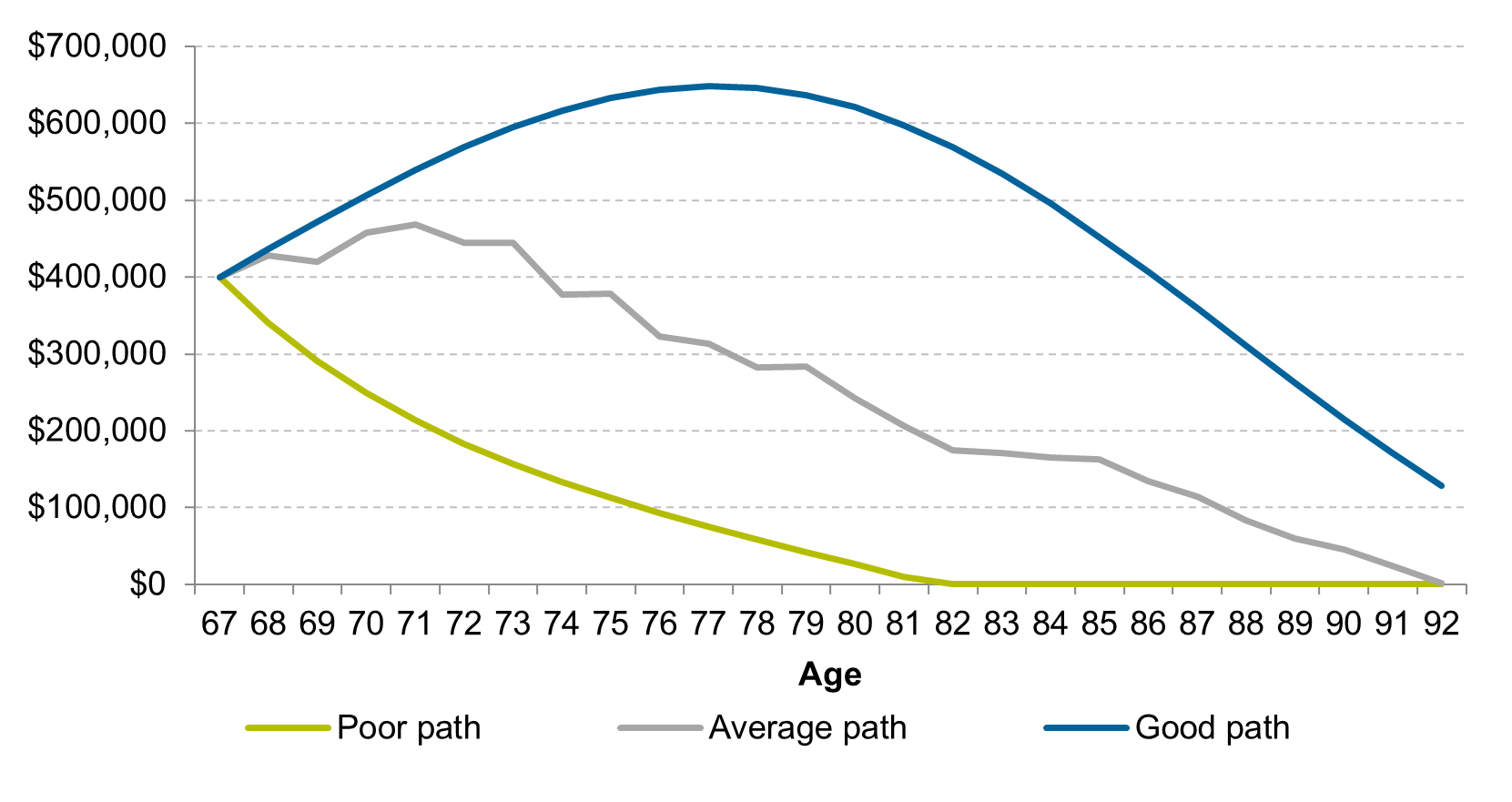

4. Understand market risk in retirement (AKA sequencing risk)

A commonly held perception is that the best way to account for inflation and make money last in retirement is through maintaining exposure to equity markets. While, historically, markets have delivered over the long-term and proven valuable in accumulating wealth, it is a different story in and approaching retirement. The impact of poor market performance is not just the length of time it takes to recover the real capital value, but the income that is lost over that period.

The order of investment returns matters in retirement as you are drawing an income from investments. In many cases, the path of returns is more important than the rate of return.

The chart below shows how long your savings might last through retirement. All three paths have the same rate of return – but the returns are in a different order. If returns follow the average path, savings can be drawdown for approximately 25 years. If they follow a good path, there may be excess savings at the end, which could be left as an inheritance.

The good path delivers higher returns early in retirement, while the poor path has weak returns at the start. This means when income in drawn there is less capital invested when the market eventually recovers. The result is that savings can be depleted early.

Chart 4: The impact of the path of returns in retirement

Source: Challenger Ltd

5. Understand the components of retirement income

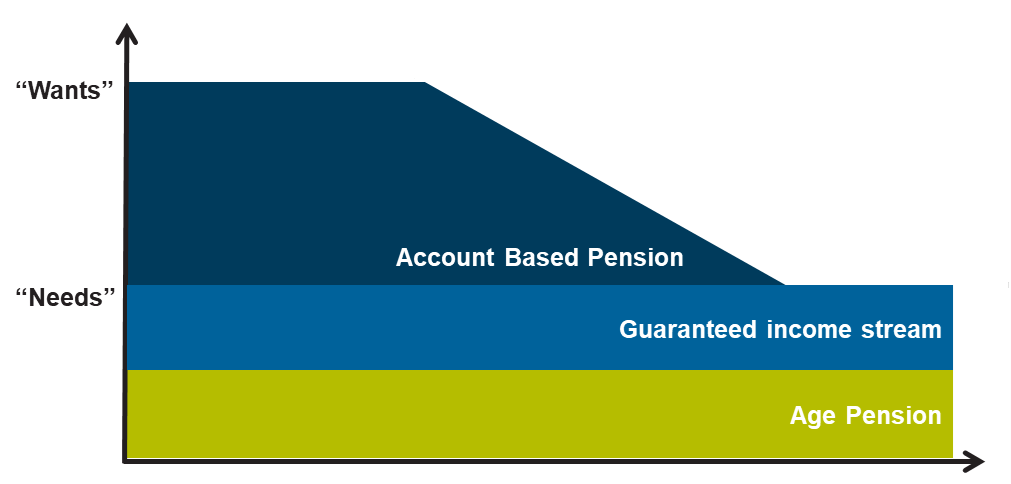

Research from Challenger and National Seniors Australia revealed 90% of Australians over 50 don’t believe the Age Pension is sufficient to fund their lifestyle in retirement. In fact, half of those surveyed believed they would need an additional $10,000 (singles) and $15,000 (couples) more than the Age Pension per annum to meet their needs.

This is where a partial allocation to a lifetime income stream can help with a retiree’s peace of mind. There is a common misconception that retirees should invest everything into a lifetime income stream. In reality, a partial allocation can be sufficient to look after long-term needs, while maintaining a pool of capital. It can also give retirees the confidence to spend more on their lifestyle in early retirement, while they have the health and energy to really enjoy it.

Chart 5: Income layers to help meet your needs and wants in retirement

Source: Challenger Ltd

Retirement can be an emotional time. Arming yourself with knowledge, seeking out a trusted support system, which may include professional advice, and setting up the right financial structure at the outset can help alleviate the stress and ensure you enjoy the hard-earned lifestyle you deserve.

Aaron Minney is Head of Retirement Income Research at Challenger Limited. This article is for general educational purposes and does not consider the specific circumstances of any individual.