Two recent events give valuable insights into what is happening in technology, especially the risks and rewards of social media.

First, each year since 1959, the ABC has produced a series called the Boyer Lectures. In 2017, Professor Genevieve Bell’s series is called Fast, Smart and Connected: What is it to be Human, and Australian, in a Digital World? In particular, Episode 4 asks how Australia should build its digital future and “a world that is not about our worst impulses but our best”. Genevieve Bell pioneered futuristic research at Intel in Silicon Valley, and she focusses on the role of technology in our lives.

The second event is the recent release of simplified Terms and Conditions, based on those issued by social media giants, by the Children’s Commissioner for England (the ‘Commissioner’, established under the Children’s Act 2004).

Facebook has two billion users, but it’s doubtful whether more than a tiny minority has read the Terms and Conditions everyone agrees to. The T&Cs connect to another 10 documents on specific policies, with thousands of words of legal undertakings. Users give away the right to privacy and the ownership of material shared online, while agreeing that Facebook can make money from the content without paying the user.

It’s the same with all the social media giants. The Commissioner for England reports that in the UK, Instagram is used by 56% of 12- to 15-year-olds and an amazing 43% of 8- to 11-year-olds, and their T&Cs run to 17 pages and over 5,000 words. These children and their parents do not realise they are being tracked even when the app is not in use. They have given away their personal data including its commercialisation and even agreed that Instagram has the right to read direct messages. Snapchat can publicly display or sell any content put on Live Snapchat, including a person’s face or voice.

Simplifying the rules for all to understand

The Commissioner has issued simplified T&Cs and guides to give children, teachers and adults more power and information, aimed primarily at UK schools but available for all. She says of the social media giants, highlighting Facebook, YouTube, Snapchat, WhatsApp and Instagram:

“Their terms and conditions are impenetrable, even to most adults. Children have absolutely no idea that they are giving away the right to privacy or the ownership of their data or the material they post online.”

In January 2017, the Commissioner published a year-long study called ‘Growing Up Digital’ to help prepare children for their digital lives. She says the companies should be doing more to counter the negative social impact of cyber-bullying, grooming, control over content, the impact on mental health, the effect on body image, anxiety and depression.

In conjunction with Tes (a teacher's resource site which has an Australian section here) and legal firm Schillings, the Commissioner has produced teaching packs relevant to citizens around the world, including simplified T&Cs for five social media sites. The packs can be downloaded for free. Here is a short extract from the simplified version of Facebook’s rights.

Facebook’s rights

1. We use technology that can track information about you automatically as soon as you go onto Facebook.

2. Facebook can collect information about you, including:

- Everything you tell us when you set up your account

- The pages you view, how long you spend and who you talk to

- What device you’re using, what browser and network, and your IP address

- Details about what you post or ‘like’

- Anything anyone else shares about you or tags you in

- What and who is in your address book, if it’s synced to Facebook

- Your card details, address and what you’ve bought, if you buy things on Facebook

- Your battery and signal strength

- Where you are

- If you go onto another company’s website or app

3. We can use your name, profile pictures, information about what you ‘like’ and anything you post to make money and we don’t have to pay you for that.

4. Facebook owns other companies, including Instagram and WhatsApp who can share information about you with Facebook. If someone buys Facebook, the sale will include your information.

5. Facebook uses your information to suggest adverts, photos you should be tagged in, or places you should check in. We don’t have to make it obvious whether something is an advert or not.”

The Facebook terms and conditions have been edited for educational purposes and are not a replacement for the original version, which can be found at bit.ly/TCsFacebook.

What can be done?

Facebook acknowledges that its users also have rights, and these are outlined in the teaching packs. Probably most important is this interpretation:

“Some companies will share information about you with us and we will share information about you with them. We won’t share your name or email address, but we can share your age, location, gender and interests with advertisers all over the world, or people doing research. You have the right to tell us not to and we won’t.”

Therefore, users have the right to control and limit some of the details that Facebook may share.

Therefore, users have the right to control and limit some of the details that Facebook may share.

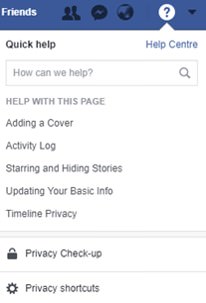

I’m not an expert on Facebook, but in the top right of the home page, the Help Center is under the question mark, and it contains the tabs to set the privacy settings, including an advertising and preferences tool. It’s worth exploring your preferences.

It’s doubtful whether many people would freely give away their rights to privacy and ownership of their image and voice, and allow personal details to be shared with advertisers without making it obvious they are being marketed to. The Boyer Lectures give some warnings on where we are headed. People should consider what rights they are prepared to relinquish, especially when protecting vulnerable young people who do not know what is happening.

Graham Hand is Managing Editor of Cuffelinks. Other than on the Boyer Lectures, the material for this article is sourced primarily from the website of Children’s Commissioner for England, and this should be checked for more details and context to confirm the accuracy of this interpretation.