Better than as good as it gets

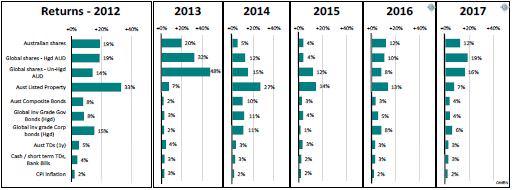

2017 goes down in history as the 6th consecutive year of positive real total returns from all major asset classes for Australian investors – Australian shares, global shares, Australian and global bonds, listed and unlisted commercial property, housing and bank deposits. Six straight years when everything went up has never happened before in history.

Click chart to enlarge

The next longest period was four positive years in 1925-28 during the great post-war housing and government spending boom. No prizes for what happened next: the 1929 crash, 1930s depression and defaults by NSW and Commonwealth governments.

Periods of negative real returns from the major asset classes together are relatively rare and short-lived. There were only four individual years where major asset classes posted negative returns together:

- 1912 –War build-up in Europe, US dismantling the Money Trusts, Titanic sinking

- 1941 – Hitler invading Russia, Pearl Harbour bombing, Japanese army storming down through Asia.

- 1948 – Industrial unrest, communist agitators, Australian bank nationalisation crisis, Soviet blockade of Berlin

- 1973 – Australian monetary tightening, severe credit squeeze, Britain entering ECM, USD devaluation, Yom Kippur oil crisis

What is the common thread that runs through all of these positive and negative return periods? Inflation.

Each of the periods of across-the-board negative real returns had high inflation. Conversely, each of the periods of across-the-board positive real returns had low inflation, including the current six-year rally.

Will markets remain positive for another year to make it seven years in a row? All types of assets everywhere are expensive, but shares, property and bonds tend to do well when inflation and interest rates are low. The good news is that inflation and interest rates are still very low in Australia and around the world and are likely to remain that way for some time yet.

Portfolios and lessons

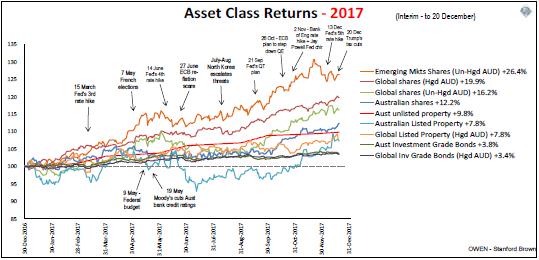

With each of the main asset classes posting positive returns in 2017 it was difficult to lose money.

Click chart to enlarge

The active positions that paid off for investors in 2017 include:

- In Australian shares – bias toward small/medium versus large companies paid off as the big banks dragged on the market

- In global shares – over-weighting ‘emerging markets’ shares paid off as Chinese tech stocks in particular were very strong

- In global shares – bias toward hedged versus unhedged as the AUD rose

- Within fixed rate bonds – bias toward corporate versus government bonds paid off as credit spreads contracted but no benefits from running floating versus fixed rate bonds.

As far as regrets go, it is easy to look back with the benefit of hindsight and say (for example), “We should have had more global shares”. However, it was hard to argue for an overweighting to global shares when they were so expensive at the start of the year and with the Brexit vote and Trump election so fresh in the minds of our investors.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.