A year or so ago, views formed that the US cash rate would likely rise above Australia’s during 2018. Many forecasters predicted the Aussie dollar would plunge when this happened.

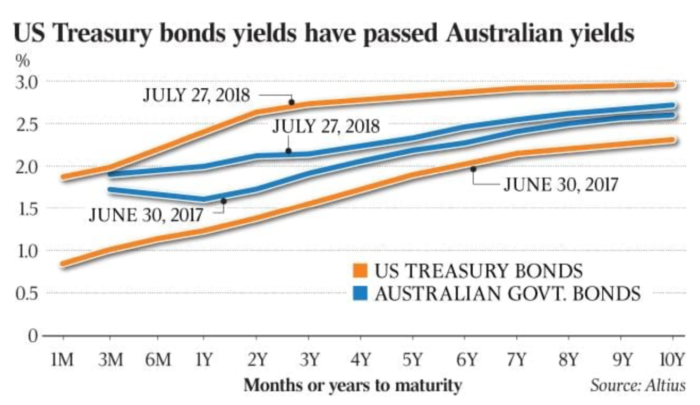

The US cash rate is now a half percentage point above the cash rate here, with widespread expectations of the gap widening further. Moreover, and as the chart below shows, the whole of our yield curve is now below the US curve. Although the local dollar is lower than it was a year ago, it certainly has not crashed.

Forecasting exchange rates is a fraught and challenging activity. A wide range of ‘fundamental’ influences has to be considered, and sometimes their pecking order changes at short notice. Also, exchange rates often tend to overshoot their new level. For example, in the late 1990s, the Australian dollar fell ‘too much’ on views we were an ‘old economy’ and in 2011 our currency soared ‘too high’ on our apparent ‘complementarity’ to the buoyant Chinese economy.

Often, exchange rates do unexpected things. Moreover, wide swings in sentiment towards the Australian dollar must be allowed for.

In the next year or so, we’re likely to hear occasional but shrill forecasts for a sharp weakening in the Aussie dollar as US/Australia interest rate spreads widen. Nonetheless, as in 2016, the Aussie dollar may not trend down as much as suggested in the recurring gloom. Here’s why.

Looking ahead for the Aussie dollar

1. Commodity prices

With commodities contributing three quarters of our exports of goods and services, our dollar is often seen as a ‘commodity-based currency’. Thanks to the strengthening, and synchronised, economic growth across the global economy, the index of our commodity prices has increased by 10% in the past year, and helped support the Aussie dollar as interest rates in the US rose.

The pace of economic growth in China is the dominant influence on our commodity prices, especially the prices of the bulk commodities we export. Any marked weakening in Chinese growth - real or imagined - will likely drive the Aussie dollar lower.

In my view, economic growth in China is likely to slow, but to a still-respectable rate of 5%-5.5% over the next couple of years. Bad debts are hurting property developers, some regional governments and the shadow banks. But China is managing its restructuring away from heavy industry towards services and consumption reasonably well. And economic management is always easier in countries with big reserves of foreign exchange. Indeed, China seems to be beginning another round of policy easing.

At times, market sentiment towards the Australian dollar will overplay the negatives in China’s economic prospects. In particular, further escalation in the trade war will also cause concerns, at times exaggerated, of both a global currency war and an early recession in China. Financial markets experience more fake crises than real crises.

Of course, the US economic cycle in the US also affects the global cycle in commodity prices. The US is now in the ninth year of its cyclical upswing, which has been running at an unusually slow pace, and is now receiving a late-cycle boost from tax changes and, soon, from the larger budget deficit, equivalent to 5% of US GDP.

2. Interest rates

A year ago, the US cash rate was 1.25% and our cash rate was 1.5%. Now, the US cash rate is 2% while ours has stayed at 1.5%.

Market expectations are that the US cash rate will be raised by three, four or five times over the coming 18 months, as inflation moves above the Fed’s target of 2% and as the Fed moves further to ‘normalise’ its policy settings. In my view, expectations for the number of changes in the US cash rate are more likely to be scaled down over the coming year than be stepped up.

With our economy having more slack and our inflation more quiescent, Australia’s cash rate is expected to stay where it is until mid-2019 and then move gradually higher.

Any widening of the gap in cash rates between the US and Australia will attract a lot of attention in financial markets and at times likely lead to widespread views that the Australian dollar will move down sharply.

3. Other important influences

From time to time, two other big influences affect the Australian dollar.

The Aussie dollar generally weakens against the US dollar when the latter strengthens against the euro and the yen. And our currency usually gains against the US dollar when the it falls in value against the euro and the yen. Currently, the general expectation in the market is the US dollar will trend higher against the other major currencies over the next year or two, causing some further slippage in the A$/US$ rate.

Secondly, since the global financial crisis, some hedge funds have expected Australia to experience a severe slump in house prices and massive write-downs in banks’ loan books, causing, among other things, the Aussie dollar to crash.

In my view, these fears are exaggerated, particularly while the Australian government retains its AAA credit status and stays on course to return its budget to balance over the next couple of years.

Don Stammer has been involved with investing since 1962, variously as an academic, central banker, investment banker, fund manager, and company director. He writes a weekly column on investments for The Australian. This article is general information and does not consider the circumstances of any individual.